Key Points

- Cryptocurrencies can deliver large gains quickly, but their volatility and lack of long-term data make them riskier than traditional stocks.

- Stocks, especially through index funds, have a proven history of building wealth over decades, but returns are generally steadier and slower.

- For borrowers or investors with limited savings, balancing risk between the two markets is essential to avoid setbacks.

Bitcoin, Ethereum, and other cryptocurrencies have captured the attention of younger investors, especially those who came of age during years of low interest rates and soaring tech stocks. Crypto’s allure lies in the potential for outsized returns in short timeframes (sometimes measured in weeks or months rather than years). This potential comes with dramatic price swings. A token can rise 30% in a day, only to lose half its value by the end of the month.

For many investors, the volatility is part of the appeal. The 24/7 nature of crypto markets and the relatively low barrier to entry (often just a smartphone exchange and a small deposit) make it feel more accessible than the stock market. But that same accessibility can encourage speculative behavior that undermines long-term financial goals.

So, if you're starting to invest, should you consider stocks or crypto?

Would you like to save this?

Stocks Offer More Stable Returns

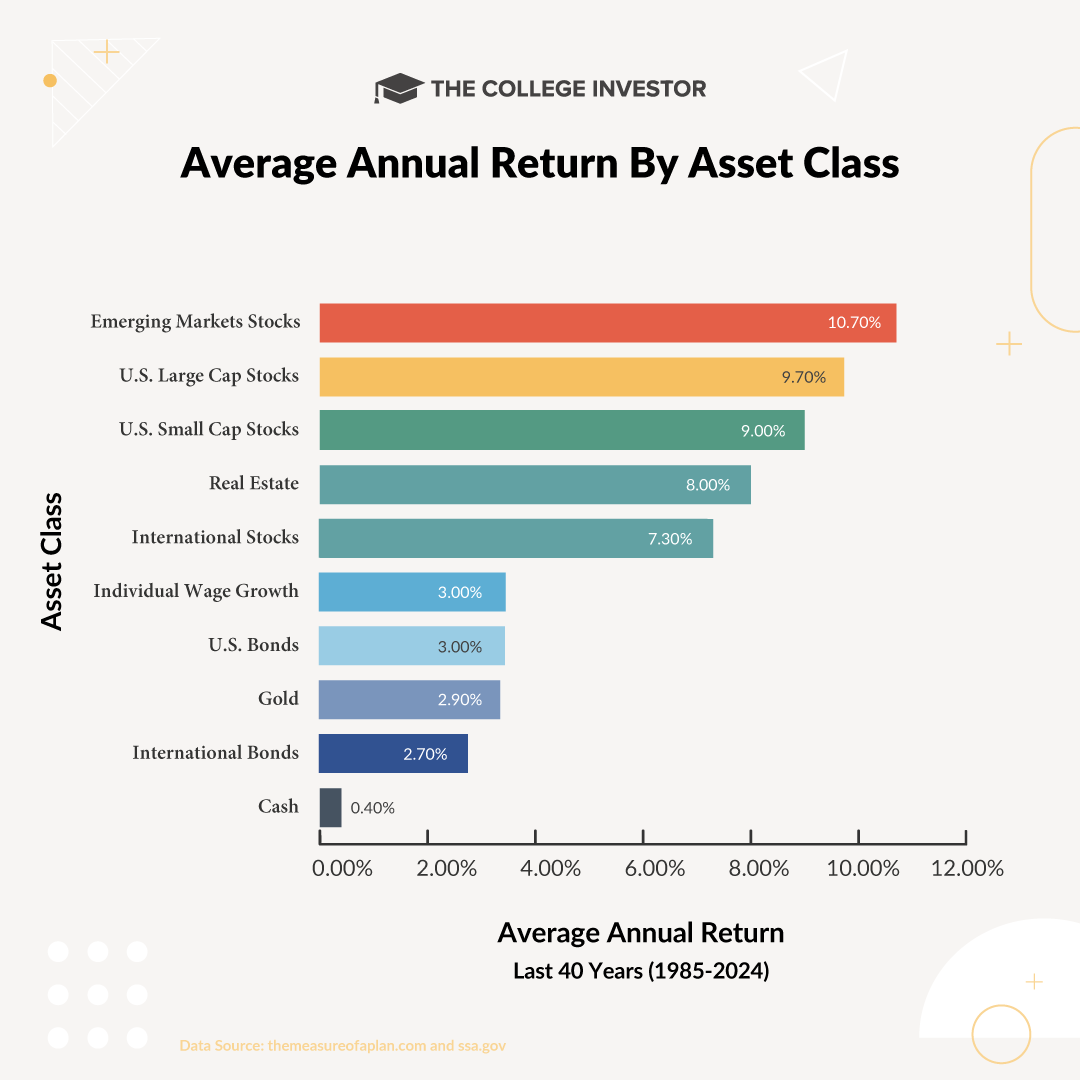

Stocks have a track record that spans more than a century. The S&P 500 has historically returned about 10% annually before inflation. While there are market downturns, such as the 2008 financial crisis or the sharp 2020 pandemic sell-off, stocks tend to recover and grow over the long term.

Stocks can serve as the foundation of a stable investment plan, particularly when accessed through index funds or exchange-traded funds (ETFs). These vehicles spread risk across hundreds of companies, reducing the impact of any single stock’s poor performance.

While gains are typically slower than crypto’s peaks, the steadier growth may align better with long-term goals like retirement, homeownership, or paying off student loans.

Risk And Time

Deciding between crypto and stocks often comes down to risk tolerance and investment time horizon. Crypto’s volatility makes it better suited for investors who can handle large short-term losses without jeopardizing their financial stability.

For example, even though Bitcoin is near an all-time high, seeing price drops of 25% or more happen with some frequency. It dropped by 25% in early 2025. It dropped by over 50% in 2021 and 2022.

In contrast, stocks reward patience, and investors who can stay invested through downturns tend to see more predictable results.

For borrowers or those with limited emergency savings, allocating too much to crypto can magnify financial vulnerability. A sudden market downturn could force a sale at a loss if cash is needed urgently. Stocks, while not immune to downturns, are less likely to experience 50% losses in a matter of weeks.

Some investors choose a hybrid approach: allocating a small percentage of their portfolio (perhaps 1% to 5%) to cryptocurrencies, with the majority in stocks or other traditional assets. This strategy allows participation in potential crypto gains without exposing the entire portfolio to extreme volatility. The rest of the portfolio benefits from the stability and dividends often provided by stocks.

Bottom Line

Whether you choose crypto, stocks, or a mix, effective planning requires modeling how investments might perform over time.

While AI-based tools are popular, there are reliable non-AI platforms that can help:

- Boldin – Offers in-depth cash flow and retirement planning scenarios.

- ProjectionLab – Lets you visualize different financial outcomes and compare strategies.

These tools allow you to map out how various allocations between crypto and stocks might impact your goals, without relying solely on AI-generated advice.

Crypto offers excitement and the chance for outsized gains, but the risks are real and can be amplified for those still building financial security. Stocks remain a more stable long-term vehicle, with a proven history of compounding wealth.

For most investors (especially those paying off debt) a thoughtful balance that protects long-term goals while leaving room for calculated risk is the safest path.

Don't Miss These Other Stories:

Editor: Colin Graves

The post Crypto vs. Stocks: Which Risk Is Worth Taking? appeared first on The College Investor.