Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto markets head into what could be a regime-setting macro week as “this week could reshape everything for the Fed and markets,” warned the @_Investinq account in a weekend thread that laid out a dense sequence of US macro catalysts landing between Tuesday and Friday.

While the posts weren’t about crypto per se, the chain of events they describe—labor‐market revisions, wholesale and consumer inflation, jobless claims, energy inventories, and consumer expectations—map almost one-for-one onto the key drivers of the US dollar and Treasury yields. Those, in turn, are the two macro levers that most reliably move digital assets, with bitcoin historically trading inversely to both the dollar and real yields.

Crypto Volatility Alert: Fed’s Make-Or-Break Data Week Is Here

The week opens with an unusually consequential Tuesday: at 10:00 a.m. ET on September 9, the US Bureau of Labor Statistics will publish its preliminary benchmark revision to March 2025 payrolls alongside the QCEW. This is the annual “fact check” of the establishment survey that anchors jobs data to unemployment-insurance tax records covering more than 95% of payroll jobs.

BLS has already flagged the timing; outside research shops have spent weeks priming markets for a significant down-adjustment. Goldman Sachs estimates a reduction on the order of 550,000 to 950,000 jobs for the twelve months through March 2025—potentially the largest 12-month markdown since 2010—an expectation echoed across several market digests and news outlets.

Related Reading

The context matters: last year’s preliminary benchmark for March 2024 carved 818,000 jobs off previously reported totals, the biggest hit since the Great Financial Crisis, and it drove a reassessment of labor momentum into the fall. @_Investinq framed it this way: “Think of it as a yearly ‘fact check’ on job growth.”

For crypto, a sizable downward revision would validate the “growth-is-slowing” narrative now feeding rate-cut bets into the September FOMC, a backdrop that has historically coincided with softer USD and more supportive cross-asset liquidity.

Wednesday morning brings the wholesale inflation check. July’s Producer Price Index re-accelerated to +0.9% m/m and +3.3% y/y, with “final demand” goods up 0.7% and services up 1.1%; the BLS singled out a near 39% jump in fresh and dry vegetable prices and noted that financial services, lodging, and airfares contributed to the services surge.

Under the hoods, “core PPI” ex-food and energy rose 0.9% m/m and 3.7% y/y, while the broader trimmed core (excluding food, energy and trade services) advanced 0.6% m/m and 2.8% y/y. @_Investinq cautioned: “Both goods and services are running hot, making it harder for the Fed to dismiss inflation.”

Another firm print for August PPI would stiffen the dollar, push up yields, and typically pressure rate-sensitive risk assets—including high-beta crypto. Conversely, a cool-down would ease those headwinds. The August PPI is due Wednesday, Sept. 10 at 8:30 a.m. ET.

Energy is the second macro input mid-week. The EIA Weekly Petroleum Status Report hits Wednesday at 10:30 a.m. ET. Draws in crude stocks tend to push oil higher at the margin; higher energy costs feed directly into headline inflation and indirectly into core via transport and production costs. That’s not a crypto-specific datapoint, but it shapes inflation expectations and, by extension, real-yield dynamics that crypto trades against.

All Eyes On The CPI

The main event is Thursday’s Consumer Price Index, the last inflation read before the Fed’s September 16–17 meeting. In July, headline CPI rose +0.2% m/m and +2.7% y/y, while core CPI ticked up to 3.1% y/y from 2.9%, with sticky categories including shelter, healthcare, recreation, and auto insurance offsetting cheaper energy.

“This CPI is the final inflation report before the September Fed meeting,” @_Investinq reminded followers. The August CPI lands Thursday, Sept. 11 at 8:30 a.m. ET. A softer-than-expected print would strengthen the case for a larger policy move, while a surprise re-acceleration—particularly in services—could cap a dovish reaction even if the Fed still cuts. For digital assets, the sign of the surprise matters: cool CPI tends to mean a weaker dollar and flatter real yields, both historically constructive for Bitcoin and the entire crypto market; hot CPI often does the opposite and usually hits altcoins hardest.

Also Thursday at 8:30 a.m. ET, weekly jobless claims arrive—a high-frequency pulse on labor slack. “Low claims = strong labor = hawkish Fed. Rising claims = cracks in labor = dovish tilt,” as the @_Investinq thread put it. Markets increasingly treat this series as a tie-breaker when inflation is ambiguous. Officially, the Labor Department’s unemployment-insurance release hits every Thursday morning at 8:30.

Friday closes with the University of Michigan preliminary September sentiment and inflation expectations at 10:00 a.m. ET. August sentiment fell to 58.2 (final) from 61.7, while 1-year inflation expectations rose to 4.8%, up from 4.5% in July—what the @_Investinq thread labeled a “toxic combo” of weaker mood and firmer expectations.

Related Reading

The Fed watches expectations closely because they tend to shape wage/price behavior; for crypto, higher expected inflation can be a double-edged sword: if it lifts yields and the dollar it’s a near-term drag, but in more extreme risk-off episodes it has also coincided with flows into “anti-debasement” narratives around BTC and gold.

FOMC Looms Over Crypto

All of this lands in a Fed blackout window ahead of the September decision. The FOMC calendar confirms a September 16–17 meeting, and after Friday’s soft jobs report (nonfarm payrolls +22,000, unemployment 4.3%), several banks moved to price in a cut, with some houses openly debating 25 vs 50 basis points depending on the CPI/PPI path this week.

That debate is exactly why “a small decimal swing here could shift trillions,” as @_Investinq put it. From a crypto-specific lens, the distinction matters: a standard 25 bps cut with benign inflation likely weakens the dollar modestly and supports Bitcoin and crypto on the margin; a surprise-large 50 bps cut on the heels of large jobs revisions would underscore growth risk and could flatten the entire curve.

The immediate setup therefore looks binary for crypto assets. If Tuesday’s benchmark revision is large and Thursday’s CPI cools, the “USD down / yields down” impulse that crypto likes could reassert into the FOMC, potentially reinforcing a swing back to net inflows into crypto asset funds after episodic outflows in late August.

If, however, PPI and CPI print hot, expect the dollar bid to harden, real yields to back up, and the pressure to fall disproportionately on high-beta altcoins while bitcoin’s relative strength—and spot ETF demand—acts as a cushion.

As @_Investinq summarized, “This week isn’t just data, it’s the Fed’s last look before September… and markets will trade every decimal.” For crypto, that translation is straightforward: every tenth of a percentage point in PPI/CPI and every hundred thousand jobs in the benchmark revision will be read through the dollar–yields prism and priced first into BTC liquidity, then into altcoin beta. The calendar is set; the pivots will be macro.

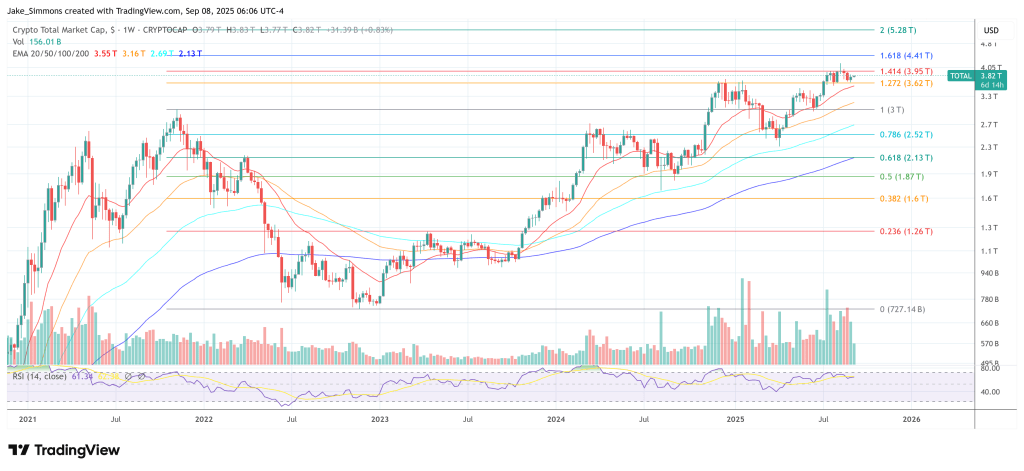

At press time, the total crypto market cap stood at $3.82 trillion.

Featured image created with DALL.E, chart from TradingView.com