Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

JPMorgan’s US trading desk is cautioning clients that a widely expected Federal Reserve rate cut on September 17 could mark a near-term peak for risk assets rather than a new leg higher—an outcome that would not spare crypto.

In a note flagged by desk head Andrew Tyler, the bank writes: “We have concerns that the September 17 Fed meeting which delivers a 25bp cut could turn into a ‘Sell the News’ event as investors pullback to consider macro data, Fed’s reaction function, potentially stretched positioning, a weaker corporate buyback bid, and waning participation from the Retail investor.”

The timing matters. The Fed’s next policy meeting runs September 16–17, with a statement and press conference scheduled for Wednesday, September 17. That calendar alone has become a catalyst as traders position around both the size of the cut and the tone of the guidance.

Related Reading

Standard Chartered, pointing to a labor market that has cooled far faster than anticipated, now expects the Fed to deliver a 50-basis-point move. “August labor market data has paved the way for a ‘catch-up’ 50 basis point rate cut at the September FOMC meeting, similar to what occurred at this time last year,” the bank said, after US nonfarm payrolls rose by just 22,000 in August and the unemployment rate ticked up to 4.3%.

Steve Englander, global head of G10FX research at Standard Chartered, discusses the need for the Federal Reserve to cut rates by 50 basis points at the September meeting and why he would consider anything less to be a policy error https://t.co/TJQBGIytIm pic.twitter.com/VP2rVusiA5

— Bloomberg TV (@BloombergTV) September 8, 2025

JPMorgan’s desk is not abandoning its “lower-conviction Tactical Bullish” stance, but it is urging investors to carry insurance into the event. In addition to recommending that equity investors “consider” adding or increasing gold exposure as cut expectations sap the dollar, Tyler’s team spelled out more explicit hedges for a volatility shock: “we like VIX call spreads or VXX longs as a hedge, as well as parts of Defensives.”

The macro backdrop has indeed turned more complicated. August payrolls barely grew and prior data were revised down, while the unemployment rate rose to a near four-year high, developments that have hardened expectations for policy easing but also raised the specter of a growth scare.

Meanwhile, gold has been screaming higher—printing successive record highs above $3,600/oz—as investors price both easier policy and broader political-economic risk. Those concurrent signals—weakening labor, stronger bullion—frame why a rate cut may not automatically equal “risk-on” for beta.

Crypto Faces Volatility Test

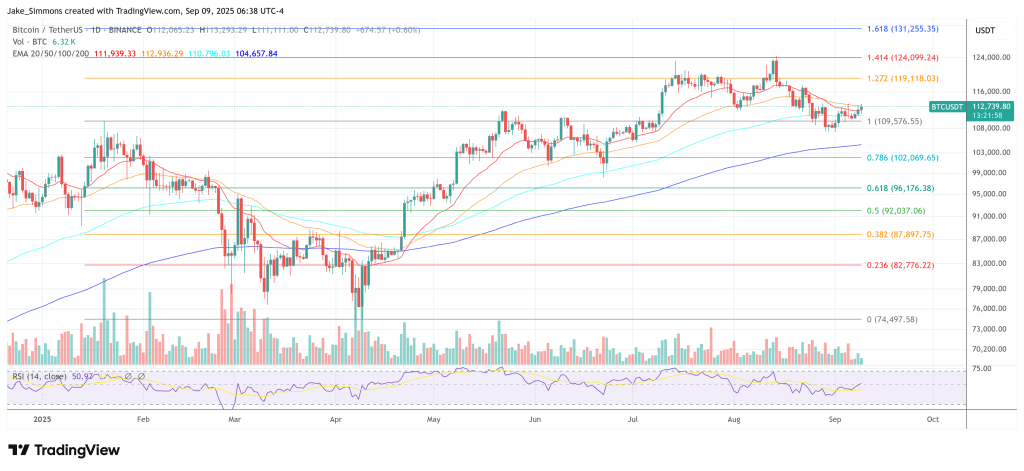

For crypto, the read-through is two-sided and highly path dependent. On one hand, the same jobs-driven repricing that has juiced gold has also supported bitcoin in recent sessions as traders lean into the idea of easier money and a softer dollar—classic tailwinds for risk assets and for store-of-value narratives alike.

Related Reading

On the other hand, a mechanical “equities down, vol up” impulse around the decision would likely transmit into crypto assets, where cross-asset de-risking and margin unwinds have historically amplified intraday swings. That tension is visible in current coverage: bitcoin has bounced back toward the $112k area alongside rate-cut bets, yet several market observers warn that a run-of-the-mill 25bp move—especially if framed as a “hawkish cut”—may fail to spark a sustained crypto rally.

Notably, a “catch-up” 50bp cut, as Standard Chartered projects, would accelerate the compression in real yields and could weaken the dollar at the margin—conditions that have tended to support bitcoin and liquidity-sensitive altcoins when the move is not seen as recessionary triage.

Conversely, a smaller or caveated cut could deliver precisely the “sell the news” pattern JPMorgan warns about, with equities and high-beta assets like crypto marking lower first before reassessing the glide path. History is no lodestar—post-cut outcomes have ranged from strong rallies in mid-cycle adjustments to drawdowns when cuts presaged recession—but it does argue for elevated realized volatility around the first step.

At press time, Bitcoin traded at $112,739.

Featured image created with DALL.E, chart from TradingView.com