Key Points

- The House has passed a sweeping bill that restructures federal student loan borrowing and repayment, while also creating new education-focused savings accounts and modifying Pell Grant eligibility.

- The bill introduces fixed loan caps for graduate and Parent PLUS borrowers, eliminates several repayment plans, and institutes a “Do No Harm” earnings rule for colleges.

- A new “Trump Account” program launches with $1,000 seed contributions to help families begin saving for college, a first home, or small business expenses.

The House of Representatives on Thursday, July 3, has passed a landmark education and tax bill that reshapes how Americans will save for college, pay for higher education, and repay federal student loans. The changes, embedded in the final version of the One Big Beautiful Bill, are some of the most significant overhauls in decades.

The One Big Beautiful Bill touches nearly all aspects of American life, but for students, borrowers, and parents, the education provisions will bring the most immediate impact.

From new limits on how much families can borrow for college, to a new class of education savings accounts (Trump Accounts), the bill will massively overhaul how higher education is both saved for and paid for.

Would you like to save this?

New Caps On Student Loan Borrowing

The bill eliminates Grad PLUS loans and caps Parent PLUS loans, reversing years of nearly unrestricted federal student loan access. Starting in July 2026:

- Parent PLUS loans will be capped at $20,000 per year and $65,000 total per student.

- Graduate students will face a $20,500 yearly cap, and a $100,000 total cap.

- Professional students can borrow up to $50,000 per year, and $200,000 total.

Undergraduate loan limits remain unchanged (and have remained unchanged since 2008). These new rules include a three-year grace period for current Grad PLUS or Parent PLUS borrowers, who can continue borrowing under old terms through the 2028-29 academic year. However, repayment plan options do change, and future borrowing for Parent PLUS loans could cause havoc.

The bill also lets colleges impose lower limits on borrowing within programs, and all loan limits must be prorated for part-time students.

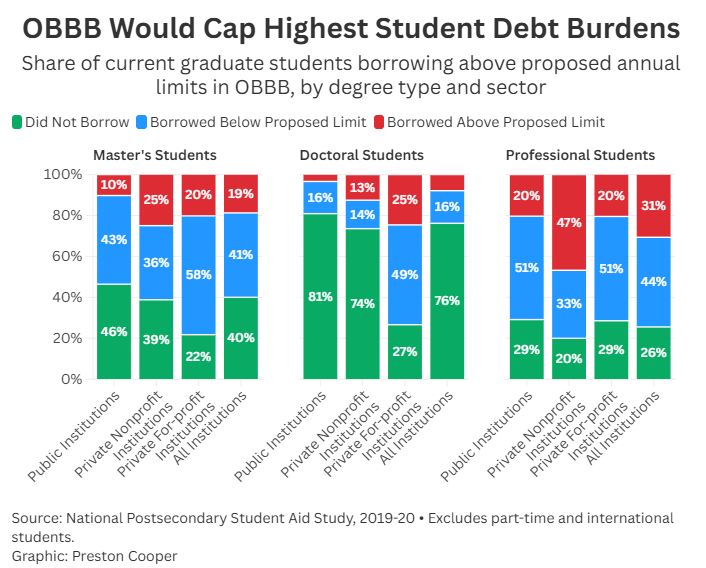

While critics have argued the the new caps will limit the ability of low-income families to attend college, proponents argue that it can help constrain costs. Furthermore, recent studies have shown the majority of borrowers won't be impacted:

Massive Student Loan Repayment Plan Changes

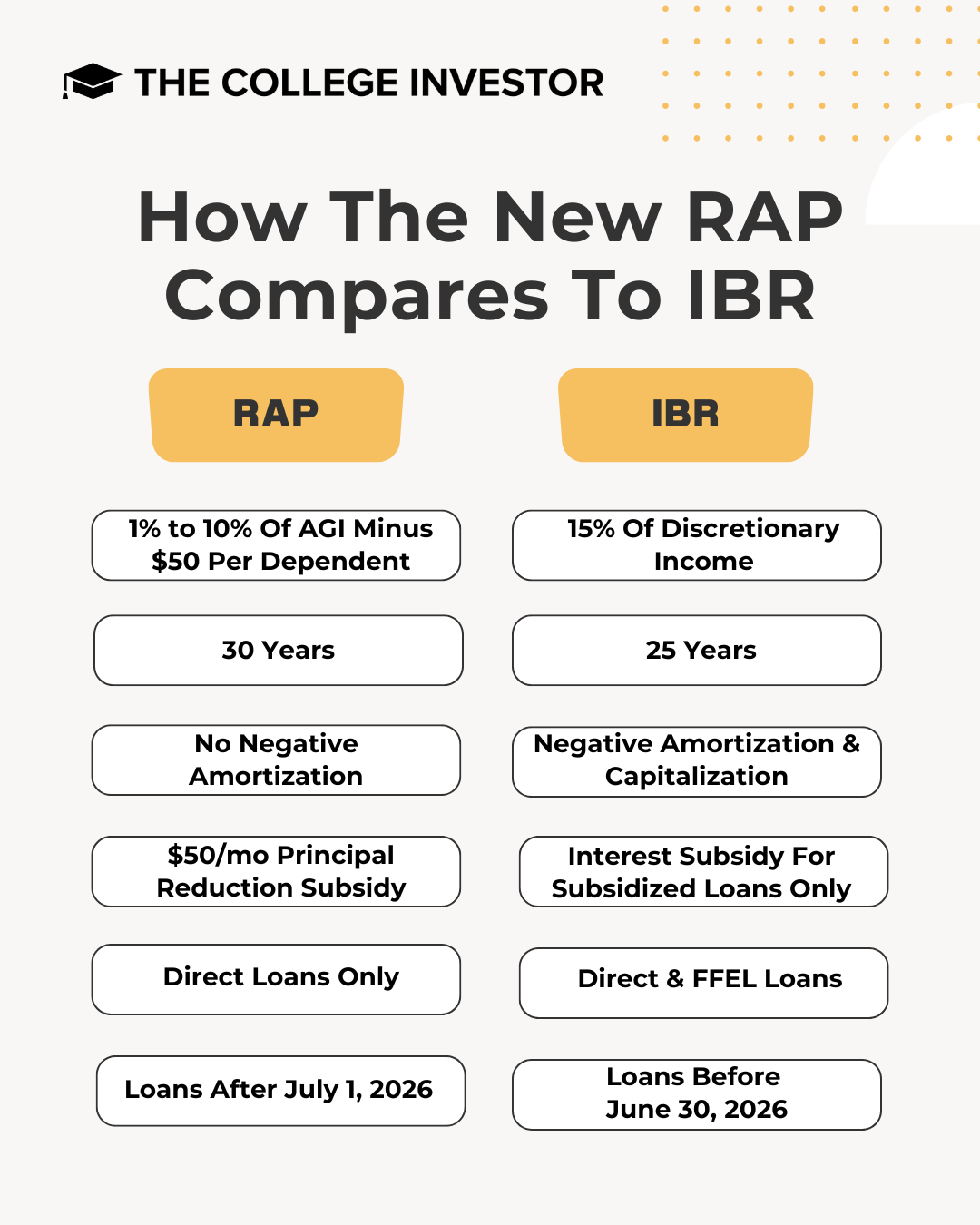

The bill also restructures student loan repayment for new borrowers into two options: a fixed-payment standard plan and a new Repayment Assistance Plan (RAP). Borrowers who take out new loans on or after July 1, 2026, will default into the standard plan unless they opt into RAP.

RAP payments are based on a borrower’s adjusted gross income, ranging from 1% to 10%, and include a monthly forgiveness credit. Forgiveness occurs after 30 years.

Current borrowers will need to transition to either RAP or a revised version of Income-Based Repayment (IBR) by July 2028. The law repeals the SAVE, PAYE, and ICR plans, with IBR serving as the only remaining alternative for existing loans.

Parent PLUS loans and consolidated loans that include Parent PLUS debt are excluded from RAP. They must use the standard plan and are no longer eligible for income-driven repayment or PSLF going forward after July 1, 2026. There are some options for existing Parent PLUS Borrowers, but the path is narrow and there are strict timelines.

Pell Grant And FAFSA Changes To Pay For College

Pell Grants will now exclude families with a Student Aid Index more than double the maximum grant from eligibility. Foreign income must now be included when calculating aid eligibility. Students with full-ride scholarships are also excluded.

The bill expands access to Workforce Pell Grants for short-term credential programs between 150 and 599 clock hours, provided they meet job placement and earnings benchmarks.

The FAFSA will no longer count the value of family farms or family businesses as assets. This change may increase eligibility for some middle-income families.

New Trump Accounts For Education And A Baby Bonus

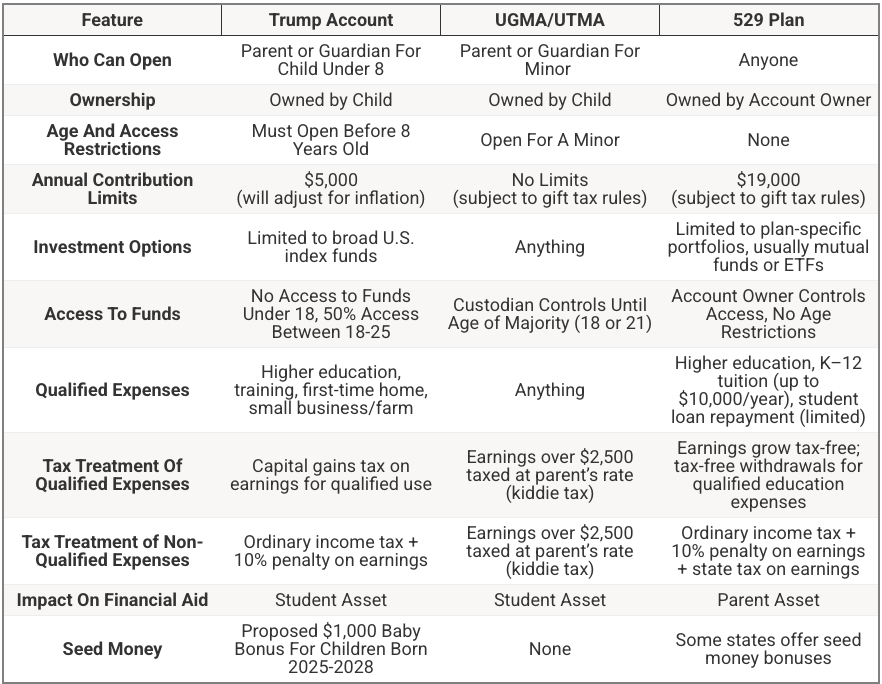

The bill creates a new type of tax-advantaged savings account called a Trump Account, available to children under age 8 (these were previously called the MAGA account in an earlier version of the bill).

Contributions are capped at $5,000 annually and limited to U.S. equity index funds. Earnings grow tax-free, and distributions for education, small business expenses, or a first home are taxed as capital gains.

Between 2025 and 2029, the federal government will deposit $1,000 into a Trump Account for each qualifying newborn. Treasury will open these accounts automatically.

Distributions before age 18 are prohibited. Between ages 18 and 25, only 50% of account value may be withdrawn, with exceptions for qualified purposes. Improper use triggers tax and penalty consequences.

Compared to 529 plans, Trump Accounts lack state tax benefits and are less flexible. However, they offer broader uses and are automatically created for qualifying children.

Other Changes To Student Loans

The bill eliminates economic hardship and unemployment deferments. Borrowers will instead be directed to income-based repayment plans.

Discretionary forbearance will be limited to 9 months in any 24-month window. Loan rehabilitation becomes available twice instead of once, but requires a higher $10 minimum monthly payment.

And the student loan tax bomb returns. Most of the tax-free student loan forgiveness provisions expire on December 31, 2025, with the exception of Death and Disability Discharge, as well as Public Service Loan Forgiveness. All other types of student loan forgiveness, including borrower defense to repayment and income driven payment plan related, may now be taxable.

What Happens Next?

Now that the House and Senate have passed the bill, it goes to the President's desk, who is expected to sign the bill tonight or tomorrow. After that, preparations will begin to implement these changes.

Borrowers, students, and families should prepare for major changes in the way higher education is financed, starting with new loan rules in July 2026 and revised repayment rules over the next two years.

Don't Miss These Other Stories:

Editor: Colin Graves

The post Congress Passes Massive Changes For Student Loans appeared first on The College Investor.