(Bloomberg) — The Warren Buffett effect is proving true once again, spurring UnitedHealth Group Inc.’s reversal this month and giving the Dow Jones Industrial Average a push toward its first closing high since last year.

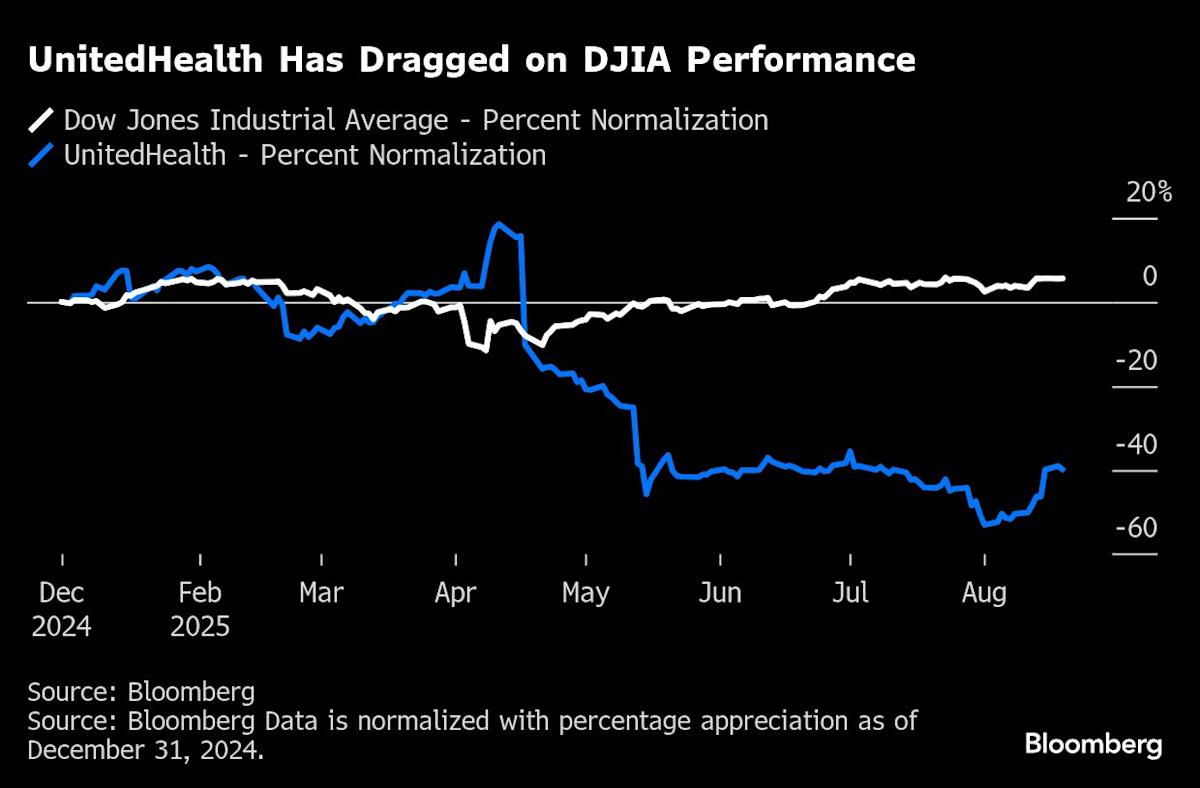

Buffett’s Berkshire Hathaway revealed last week that it bought a stake in the health insurer in the second quarter. UnitedHealth shares, which lost more than 50% from the start of 2025 through the end of July, have been on a tear this month, rising more than 20% in August alone and far outperforming any other company in the blue-chip index during that stretch.

Most Read from Bloomberg

The stock has added more than 300 points to the Dow in August, accounting for more than 40% of its monthly gain. It has been a welcome boost for the stock-price-weighted benchmark, which hit an intraday record on Tuesday but has yet to close at a new all-time high and has been trounced by other major equity indexes, like the S&P 500 and Nasdaq 100, this year.

“There wasn’t a single piece of good news basically this whole year specific to UnitedHealth,” Morningstar analyst Julie Utterback said. “So having a company like Berkshire Hathaway investing competitively in a managed firm that was attractively valued, that’s really a nice vote of confidence.”

NOTE: Aug. 15, UnitedHealth Surges After Buffett, Tepper Bet on Turnaround (2)

The “Buffett Effect” essentially refers to a stock market phenomenon where share prices rise when the legendary investor takes a stake and fall when he exits a position. In this case it’s notable because until very recently UnitedHealth was the biggest drag on the Dow this year. Then it reversed direction and quickly went from worst to first.

‘Really Tough Year’

“Investors in UnitedHealth have had a really tough year,” said Utterback, who tracks the stock’s decline to early December, when former executive Brian Thompson was fatally shot outside an investor conference in New York. The stock is still down 40% in 2025 and is trading at a little more than $300. Utterback has a buy rating and $400 price target on the shares.

Thompson’s murder, which was a targeted attack aimed at UnitedHealth’s leadership, helped send the Dow on its longest losing streak since the 1970s. At the same time, the insurer’s stock fell from the biggest weight in the 30-member index to seventh.