Key Takeaways:

-

Bitcoin rallied to $120,000 on Coinbase, led by BlackRock’s spot ETF, which now holds over 700,000 BTC, surpassing Strategy.

-

BTC Long-Term Holder NUPL remains below overheated levels, indicating minimal profit taking.

-

Daily transactions are rising without panic selling, while accumulation addresses hold a yearly high of 250,000 BTC.

Bitcoin (BTC) extended its July rally by clearing a new all-time high of $120,000 on Coinbase on July 14 at 2:47 am UTC.

The flagship crypto is now up 13% this month, leading to close its third consecutive green monthly candle.

The BTC rally has been supported by institutional inflows, led by BlackRock’s spot Bitcoin exchange-traded fund (ETF), IBIT, which hit a record $83 billion in assets under management (AUM) on Thursday.

IBIT’s AUM has tripled in just 200 trading days, a milestone that took the gold exchange-traded fund GLD over 15 years to accomplish. BlackRock’s Bitcoin ETF currently holds over 700,000 BTC, surpassing Strategy by nearly 100,000 BTC.

Bloomberg ETF analyst Eric Balchunas said,

“$IBIT blew through the $80b mark last night, fastest ETF to get there in 374 days, about 5x faster than the previous record, held by $VOO, which did it in 1,814 days. Also at $83b it's now 21st biggest ETF overall.”

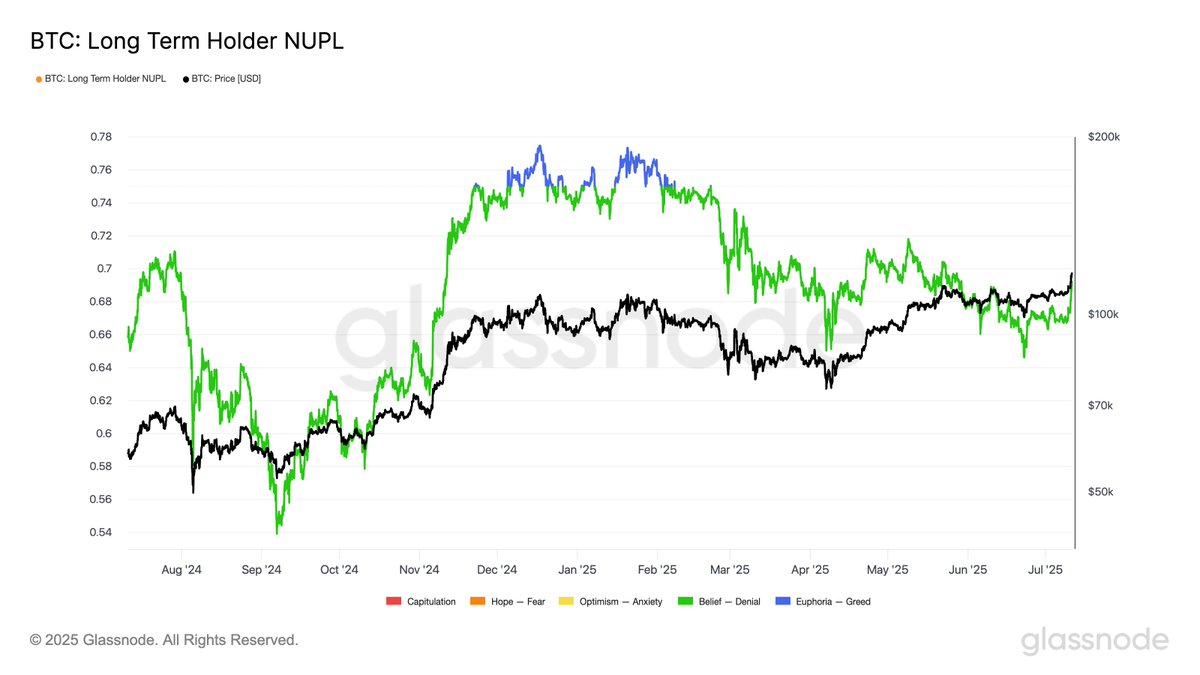

One onchain metric suggests Bitcoin hasn’t entered peak euphoria yet. The Long-Term Holder Net Unrealized Profit/Loss, a measure of whether long-term holders are sitting on major profits, remains at 0.69, below the 0.75 level historically linked with overheating markets. Compared to the last cycle, which saw 228 days above that threshold, this cycle has only spent about 30 days in that zone, hinting at higher price targets.

Related: Bitcoin, Ether ETFs clock second-biggest day of inflows on record

Steady BTC network activity adds to its bullish case

Bitcoin analyst Axel Adler Jr. said that Bitcoin’s network is gradually increasing usage without signs of profit-taking or panic. Daily average transactions climbed from 340,000 to 364,000 over the past two days, but remain below the 530,000–666,000 peaks seen during its previous market tops. Adler explained that this reflects a composed market environment and said,

“There are no signs of active coin selling in the market. This strengthens both the fundamental and technical bullish signal.”

📊MARKET UPDATE: Daily #Bitcoin transactions jumped by 24K in two days, reaching 364K. While activity is improving, it still trails far behind the 2023–2024 highs of over 530K, leaving room for further network acceleration for $BTC. 📈 pic.twitter.com/xbxD3GzRRU

— Cointelegraph Markets & Research (@CointelegraphMT) July 11, 2025

Meanwhile, Cointelegraph reported that accumulator addresses, wallets that consistently acquire BTC without significant outflows, have ramped up significantly over the past month. CryptoQuant data shows these wallets now hold 250,000 BTC, the highest level of 2024. The 30-day demand has jumped 71%, up from 148,000 BTC in late June, reflecting renewed conviction among long-term buyers.

Related: Peter Schiff says sell Bitcoin for silver as BTC smashes new highs

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.