Key takeaways:

-

Bitcoin marks its steepest pullback in a month, with the ghost month trend hinting at further downside to $105,000.

-

Onchain data shows a rise in US and Korean spot demand, pointing to a short-term recovery.

Bitcoin (BTC) saw a sharp correction on Thursday, slipping below $117,000 on Aug. 14, marking its steepest pullback in a month. The daily chart flashed a bearish engulfing pattern for the first time since July 15, raising concerns that seasonal weakness during Asia’s “ghost month” could extend the downturn.

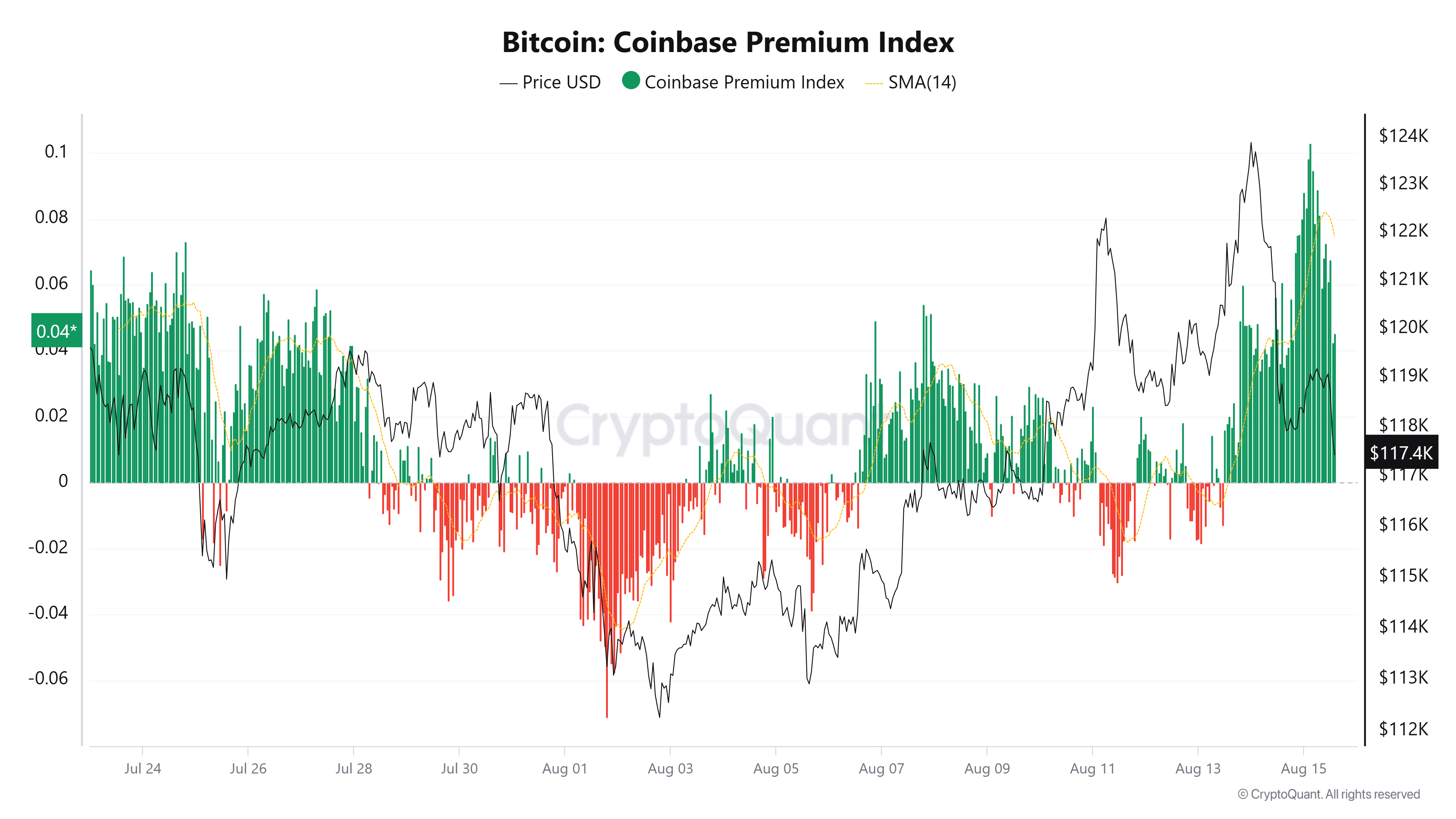

Despite the dip, onchain data point to resilient dip-buying activity. The Coinbase Premium Index climbed to a monthly high yesterday, signaling strong US spot demand. In Asia, the Kimchi Premium Index turned positive, indicating renewed Korean buying pressure.

Crypto trader Hansolar summed up the sentiment and said collective buy bids were spread across Coinbase, Bitfinex, and the South Korean market.

The bullish undertone is further supported by stablecoin flows. According to crypto analyst Maartunn, USDC inflows to exchanges surged to $3.88 billion since the price dip, suggesting traders are gearing up to deploy capital.

Data also indicates that capitulation signs were muted. Just 16,800 BTC were moved to exchanges at a loss by short-term holders (STHs), well below volumes seen in past sell-offs. For context, previously, when Bitcoin dipped more than 5%, over 48,000 BTC were sold at a loss by STHs.

📊MARKET UPDATE: #Bitcoin slipped 5% on Aug. 14, but capitulation signs were muted with just 16.8K $BTC moved to exchanges at a loss from Short-Term Holders, far less than in past drawdowns.

Blue arrow trend shows shrinking STH sell pressure. 👍 pic.twitter.com/sVUvRSVXj5

— Cointelegraph Markets & Research (@CointelegraphMT) August 15, 2025

Related: Analysts see Bitcoin buyer exhaustion as retail shifts to altcoins

Can ‘ghost month’ extend BTC’s correction period?

Anonymous analyst Exitpump notes that Bitcoin could find support between $116,000 and $117,000, where both spot and futures buying interest is showing up in the order books.

While this could lead to swift recovery, a recurring seasonal pattern tied to Asia’s “ghost month” has often coincided with sharp pullbacks.

This year’s ghost month runs from Aug. 23 to Sept. 21. In the Chinese lunar calendar, it marks the seventh month of the year, a period often associated with bad luck in Asian culture. While the phenomenon doesn’t directly impact markets, its psychological effect on traders can be significant, influencing risk appetite and profit-taking behavior.

Historically, Bitcoin has shown a tendency to sell off during ghost month. Since 2017, BTC’s average peak decline in this period has been roughly 21.7%, with notable drops such as -39.8% in 2017 and -23% in 2021.

With Bitcoin currently hovering near $117,320, a drawdown in line with the historical average could drag prices into the $105,000–$100,000 range before any meaningful rebound. This aligns with key technical support zones, where long-term buyers may look to step in.

While some years have ended ghost month with positive ROI, the recurring mid-period volatility means traders should remain cautious. Any deeper correction into late August could set the stage for a stronger recovery in Q4, after testing the resolve of short-term bulls.

Related: BlackRock Bitcoin, Ether ETFs buy $1B as BTC price mostly fills CME gap

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.