The Ownership Dividend: The Coming Paradigm Shift in the U.S. Stock Market. 2024. Daniel Peris. Routledge — Taylor & Francis Group.

Could the next opportunity in the stock market be with dividend stocks? According to Daniel Peris, the answer is “yes,” and after reading his insightful book, The Ownership Dividend: The Coming Paradigm Shift in the U.S. Stock Market, readers may find it hard to disagree with him. Peris is a senior portfolio manager at Federated Hermes, having joined the firm in 2002. His focus has been dividend-paying stocks, and he is considered one of the leading authorities on the subject. Previously, Peris authored several books on investing, including two about dividends: The Strategic Dividend Investor (McGraw Hill, 2011) and The Dividend Imperative (McGraw Hill, 2013). Both books remain valuable for any investment professional because they challenge one’s assumptions about how well companies use their cash.

In The Ownership Dividend, Peris writes that there is soon to be a realignment in the stock market that could create “profitable opportunities for those who are prepared.” The shift will be from investors preferring a price-based relationship with their investments over a cash-based one. After four decades of an “anything goes” environment, where investors were dependent on the ever-changing price of a stock, Peris believes the tide has begun to turn. Investors will demand that more companies share their profits via dividends. Predicting a realignment in the stock market is bold and could easily be dismissed; however, Peris makes a great case for why dividends should be given a lot more attention than they currently receive.

Peris carefully explains how the past four decades of declining interest rates have led investors to focus on the price growth of shares, rather than the income they provide. His argument is well crafted, and he challenges the generally accepted notion that large, successful companies do not need to share their earnings with shareholders by paying dividends. By recounting the role that dividends historically played in the stock market, Peris takes readers through an account of how dividends encouraged investment and how they have been diminished by the misapplication of the work of Franco Modigliani and Merton Miller, whose Dividend Irrelevance Theory has been misused as an argument for companies not to pay a dividend at all.

The Dividend Irrelevance Theory states that the dividend policy of a company has no effect on its stock price or capital structure. The value of a company is determined by its earnings and investment decisions, not the dividend it pays. Thus, investors are indifferent as to whether they receive a dividend or a capital gain. As Peris points out, however, this theory is often misunderstood. Created in 1961, the theory assumes that most companies would be free cash flow negative, because they operated in capital-intensive industries and would need external capital to fund their growth plans and to pay dividends. While that may have been the case in the 1960s, Peris estimates that this situation applies to only 10% of the stocks in today’s S&P 500 Index. The current S&P 500 is made up primarily of service companies that are free cash flow positive and have sufficient cash flow to fund their growth and also pay a dividend.

Peris provides countless reasons for the role that dividends play as an investment tool, but his review of stock buyback programs should be read by every investor. He is ahead of his time and unafraid to point out that perhaps the emperor has no clothes. While many on Wall Street applaud stock buyback programs as a tool to boost earnings per share, Peris exposes the reality that too often a significant portion of what is “bought back” is used for employee stock option plans. Investors would be well served to understand how stock buyback programs are often diluted by stock compensation plans. In fiscal year 2023, Microsoft repurchased $17.6 billion of its common stock and issued $9.6 billion in stock-based compensation. Microsoft is hardly an outlier; the past 40 years have seen dramatic growth not only in stock buyback programs but also in employee stock option plans.

Over the course of 10 chapters, Peris makes a compelling case for the importance of dividends. His book is written for practitioners, not academics, which makes the book approachable and absent of any pretense. While his target audience may not be professors, it would be a useful book for anyone teaching a course on investing, which should include the idea that on Wall Street, there is never just one way to value an investment. The fact that investing in dividend-paying stocks is out of fashion on Wall Street is well accepted; even Peris acknowledges that fact. But what if Wall Street is getting it wrong? What if Peris is right that dividends will soon become much more important?

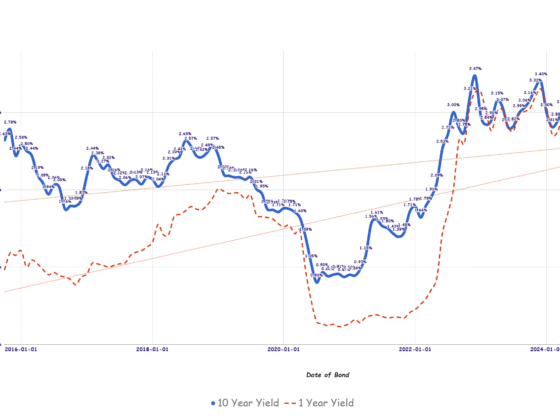

As Peris sees it, the fall in popularity of dividend investing can be attributed to three factors: the decline in interest rates over the past four decades, the change in the securities tax code in 1982 that enabled share buybacks, and the rise of Silicon Valley. These three factors caused the stock market to shift from a cash-based return system (where dividends mattered) to one that is driven by near-term price movements. However, these factors have potentially run their course. According to Peris, “The 40-year decline in interest rates has come to an end.” Over time, he maintains, the market will revert to where investors will expect a cash return on their investments.

Each factor is thoroughly explored by Peris, but his review of the relationship between interest rates and the cost of capital is especially timely. As interest rates fell from their highs in the early 1980s, companies had little difficulty raising capital. The recent rise in interest rates could make it more difficult. It was not long ago that investors were faced with money market funds and CDs having negative real rates of return, leaving them few options in which to invest for current income. Now that rates have risen, investors have more options and companies will no longer be able to borrow funds as cheaply as before, giving investors more leverage to demand that companies share their earnings via a dividend.

In each chapter, Peris provides ample evidence of the importance of dividends as an investment tool. His research into the topic is informative and valuable to anyone interested in the theory underlying dividends. However, he wrote this book for investors, and so after making his case for dividends, he also provides useful guidance on what sort of companies investors may want to consider to get ahead of the upcoming paradigm shift. While much of this information will be familiar to investment professionals, Peris’s fresh take on the subject is insightful.

The counterargument to Peris’s view is that Wall Street is expecting that the interest rate increases that were orchestrated by the Fed will soon be followed by a series of cuts, due to the Fed needing to address a slowing economy that might be in a recession. If interest rates were to decline to near pre-COVID-19 levels, it would be unlikely that the market would no longer favor price growth, as it has in the past.

Wall Street’s assumption that interest rates will soon fall, however, may be flawed. With low unemployment and strong housing and consumer spending, the Fed has no incentive to lower interest rates to stimulate the economy. In fact, higher rates give the Fed greater flexibility in the future to address unforeseen economic events. The reality is that Wall Street was expecting interest rates to be cut last year. That never occurred. Forecasts have now been adjusted to predict that the Fed will need to cut rates later this year.

All of this leads back to the point that Peris is making: Wall Street sometimes gets it wrong. The situation over the past 40 years was the result of specific factors that may have run their course. If that is the case, then the market should revert to investors favoring dividends over share growth alone. For those who are prepared, there will be opportunities. In The Ownership Dividend, Peris provides a roadmap of how to take advantage of the coming paradigm shift and, without question, the best argument for why dividends should be part of any investor’s strategy.

If you liked this post, don’t forget to subscribe to Enterprising Investor and the CFA Institute Research and Policy Center.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.