Reminiscences of a Bond Operator: A Guide to Investing in Corporate Debt. 2024. Mark A. Rieder. Independently published.

New and seasoned corporate bond investors will be delighted to get acquainted with Mark Rieder’s conversational narrative and clear presentation of complex analytical ideas in Reminiscences of a Bond Operator. When asked about the top reference work in bond investing, I refer my colleagues and students to Frank J. Fabozzi’s The Handbook of Fixed Income Securities.[1] As comprehensive a magnum opus as Fabozzi’s book is, Rieder’s book, released in 2024, adds value as a highly technical guide enhanced by personal insight into analyzing corporate bonds and private credit, as well as structuring and managing a debt portfolio.

Rieder maintains that anyone can assemble a corporate bond portfolio, but only a skilled investor can consistently select the correct bonds to generate alpha without incurring significant losses. After reading this book and having 30 years of experience in analyzing individual corporate bonds and managing fixed-income portfolios, I can say that I learned fresh methods of analyzing individual issues and structuring total portfolios that will immediately influence my investing activities.

Mark Rieder is not a household name to analysts and portfolio managers the way Frank Fabozzi is. Still, his book deserves a place in the universe of corporate bond practical guides as issuers come and go and the world of credit changes, such as it did with the explosion in private credit after the 2008 Financial Crisis. He has a rich background in the analysis and management of fixed income, from his early days at Deloitte & Touche and Goldman Sachs to his tenure as Managing Director and Lead Corporate Bond Portfolio Manager at GIC, the sovereign wealth fund of the Government of Singapore. In 2023, he founded La Mar Assets, a global multi-strategy credit manager. Based on his long tenure through the Financial Crisis and beyond, he confidently speaks from a deep experience in the trenches of corporate credit.

Keep in mind that Reminiscences is not a primer in corporate fixed-income investing, yet it begins with an Overview of the Financial Markets (Part I). Subsequent parts of the book consist of The Research Process (Part II), Portfolio Management (Part III), Advanced Topics in Portfolio Management (Part IV), and lastly, Lessons Learned and Concluding Thoughts (Part V).

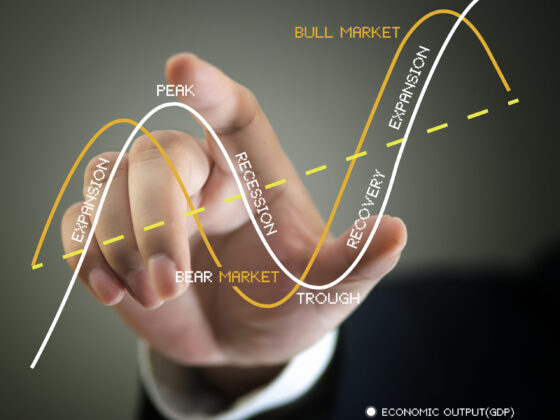

As rudimentary as the Overview may seem in its description, it provokes much useful thinking about the size and performance of the bond market, the largest issuer — the United States — and its growing financing needs, the demand for corporate debt in a zero-interest rate policy (ZIRP) environment, and the refinancing of such low-interest debt. The point of the book is summarized on page 40: “Savvy investors adjust their portfolios by increasing credit exposure when spread and yields are wider, then reduce exposure when spread and yields tighten.” If only bond investing were so simple. That is why the author provides in-depth exercises and case studies in the heart of the book.

Within The Research Process (Part II), I found that Chapter 9: Analyzing Company Cash Flows and Chapter 10: Rieder’s Matrix keeps analysis on track for one purpose: minimizing unknown information about the potential investment to make the best-informed decision at the time the trade is executed.

Within Portfolio Management (Part III), Chapter 13: The Difference Between Coupon, Yield, and Bond Returns provides sound insight into selecting issues based on moves in benchmark rates and credit spreads. It addresses hybrid securities at length, raising a topic that rarely enters discussions of fixed-income instruments. Rieder encourages investors to consider hybrids for higher yields, acknowledging all their risks compared to alternatives in the fixed-income market.

The following chapters (within Portfolio Management) are explicitly geared toward institutional investors: Chapter 17: The Rise of Credit Trading Widgets and Chapter 18: Private Credit Opportunities and Challenges. The latter explores an asset class that potentially creates situations with no limits on leverage. Rieder raises many important questions related to private credit’s surge over the past decade:

• Does private credit have a lower default profile than public debt?

• Will defaults increase as interest rates climb?

• Can companies that utilize private credit restructure ad infinitum?

• Could there be systemic risk stemming from the rush of life insurers into private credit?

• Are there any liquidity concerns?

The author suggests that the evolution of private credit markets will lead to a significant convergence between liquid and private credit. More than a decade of rapid growth in private credit issuance and investment could be explored in a future book on this issue.

Advanced Topics (Part IV) applies to investors and analysts in all asset classes. It addresses topics such as financial engineering, bankruptcy, reorganization, and, my favorite, credit portfolio risk management. It also deals with a subject many of us have experienced but rarely gets mentioned: inheriting a portfolio.

I do have one criticism of this comprehensive book. An index should have been included. Despite the author’s inclusion of extensive notes and my bookmarking of numerous pages, I frequently found myself searching for specific topics and individuals referenced.

To conclude, Reminiscences is an attractive guide to corporate bonds that is professionally focused but accessible to analysts and portfolio managers of all experience levels. It also serves as a launching point for deeper analysis of fixed-income topics that could be affected by increased market volatility.

1. Frank J. Fabozzi, et al., The Handbook of Fixed Income Securities, 9th ed, (McGraw Hill, 2021).