BitMine Immersion Technologies dipped nearly 27% despite a “chairman’s message” from FundStrat’s Tom Lee to bolster confidence in the Ethereum treasury company.

BitMine on Monday announced the new “The Chairman’s Message” monthly series, which is designed to give an insight into BitMine’s broader crypto plan.

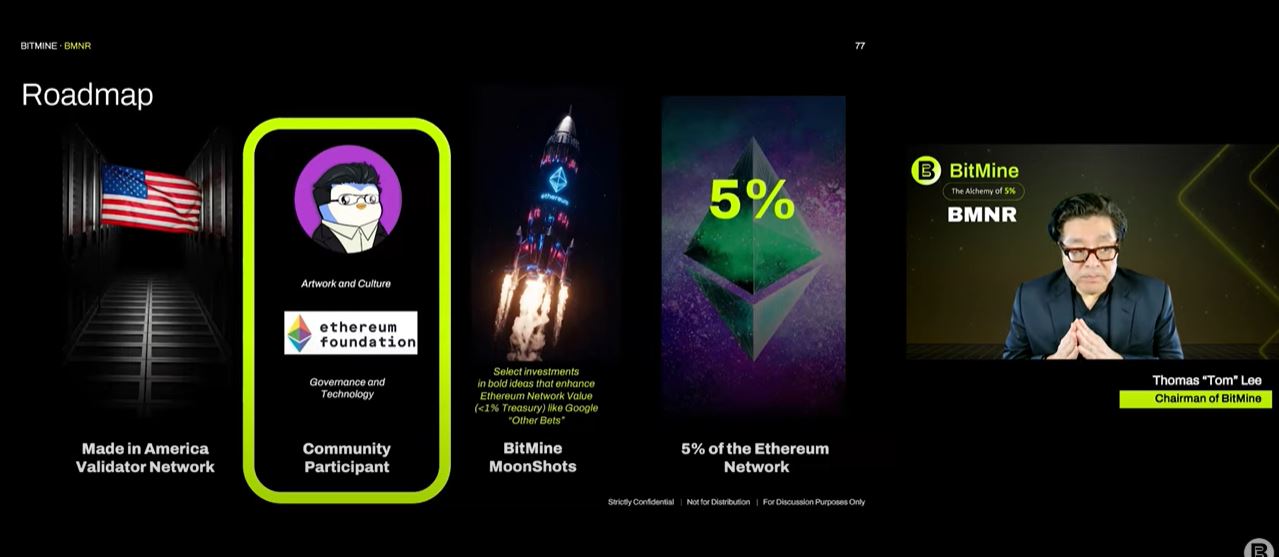

During the presentation, Lee talked about the firm’s long-term Ether plan, such as holding 5% of the supply, and projections of the token’s future valuation.

A slide shared by the firm on X also suggested the implied value of Ether (ETH) could be $60,000, citing unnamed research firms.

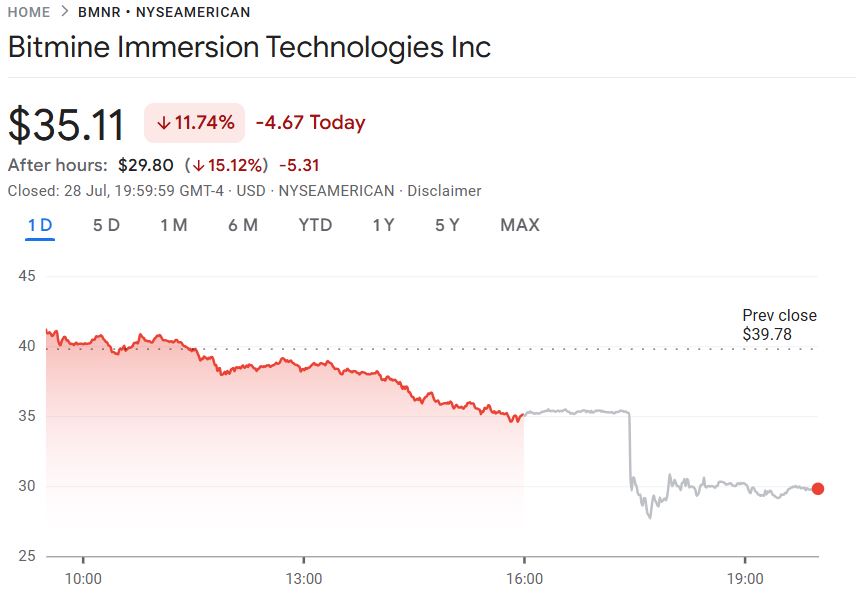

However, the messages failed to resonate with shareholders, with BitMine (BMNR) stocks dropping over 11% to trade at $35.11 over the trading day and then another 15% in after-hours trading.

It contrasts with its stock movement in the days after announcing its plans to buy Ether, when Bitmine stock skyrocketed more than 3,000% to a yearly high of $135 on July 3.

BitMine says it has 600,000 Ether

During the presentation, Lee confirmed BitMine holds 600,000 Ether worth over $2.2 billion.

He said long-term, BitMine wants to become a “made in America validator network,” with 100% of “operations geographically in the United States.”

Lee said the firm is working toward becoming a community participant in Ethereum to strengthen the ecosystem, and doubled down on the previously announced plans for BitMine to hold and stake 5% of the total Ether supply.

In June, Vincent Liu, the chief investment officer at Kronos Research, told Cointelegraph that treasury rollouts require “a well-planned strategy to protect capital and strengthen liquidity” because without “clear execution and long-term vision, it’s unlikely to deliver sustained value.”

Related: Crypto funds see $1.9B inflows as Ether leads weekly gains

Ether treasuries could help price boom

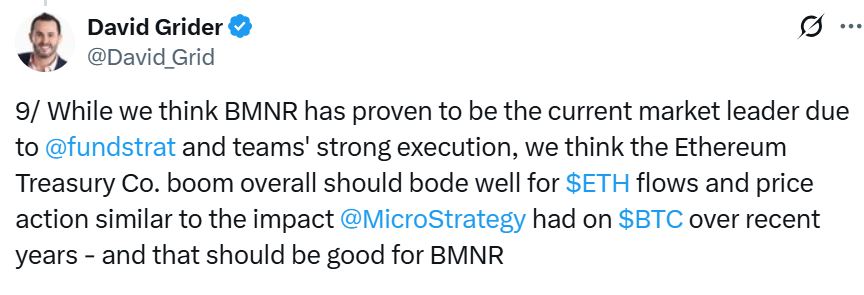

Meanwhile, David Grider, a partner at Venture capital firm Finality Capital, said in an X post on Monday that the Ether treasury company “boom should bode well for ETH flows and price action similar to the impact MicroStrategy had on Bitcoin,” which should be good for BitMine.

He also disclosed that Finality Capital has a position in BitMine.

Other notable corporate Ether buyers include SharpLink Gaming with 438,000 Ether, Bit Digital, which has more than 100,000 ETH, and Blockchain Technology Consensus Solutions, which increased its holdings to 29,122 ETH following a $62.4 million raise.

Ray Youssef, CEO of finance app NoOnes, previously told Cointelegraph that he thinks corporations view Ethereum as a critical infrastructure component fueling a surge in corporate treasuries’ uptake.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside story