Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The liquidity engine that has supported risk assets, including Bitcoin, since the beginning of 2025 is now shifting into reverse. According to macro analyst Tomas (@TomasOnMarkets), the six-month upswing in Federal Reserve liquidity has ended, and a potentially destabilizing wave of debt issuance by the US Treasury is about to begin. In a post published on X late Sunday, Tomas warned: “ Federal Reserve Liquidity set to fall… The Fed liquidity upswing that began on January 1 2025 is now over.”

Bitcoin Enters Danger Zone

The catalyst behind this reversal is the recent $5 trillion debt ceiling increase passed by Congress last week. That legislative decision gives the Treasury Department the green light to aggressively rebuild its cash balance at the Federal Reserve—known as the Treasury General Account (TGA)—which had been intentionally drained to inject liquidity into the system during the first half of the year.

“The US Government had previously been draining the Treasury General Account (liquidity injection). But a new debt ceiling agreement was reached last week ($5 trillion raise). This means the Government will start to flood the market with new debt to ‘refill’ the TGA (liquidity drain),” Tomas wrote. He emphasized that the refill target is currently set at $850 billion, up from recent levels around $350 billion, implying roughly $500 billion in liquidity will be removed from the system in the coming months.

Related Reading

The implications for Bitcoin are stark. Risk assets have historically benefited from rising dollar liquidity—particularly in the context of elevated ETF inflows, corporate adoption, and a weakening US dollar. But that backdrop is now shifting. As Tomas put it, “All else being equal, this TGA rebuild process should be bullish for the US dollar.” A strengthening dollar, when coupled with falling bank reserves, is generally a bearish environment for Bitcoin.

The pressure on liquidity won’t necessarily come all at once, but the mechanics are clear. Treasury will issue large volumes of new short-term debt—primarily T-bills—to finance the TGA refill. This issuance will compete with other dollar-denominated assets for funding, draining cash out of banks and money markets.

Tomas notes that this dynamic could be softened if money market funds rotate their cash out of the Fed’s Overnight Reverse Repo Facility, which still holds about $214 billion. “It’s possible that Treasury Secretary Scott Bessent could lower the target level, meaning less of a refill,” he adds. “I’d expect we may see a lot of T-bill issuance, which could tempt some of the remaining $214bn left in the Reverse Repo to leave the facility (liquidity injection) and lessen any negative impact of the TGA refill.”

Still, even with some reallocation from RRP, Tomas expects the overall effect to reduce reserve balances—bank reserves as a percentage of GDP are likely to fall below 10%, he estimates. While this is not as dire as the 7% level reached in 2019 (which triggered the repo crisis), it represents a sharp tightening compared to the first half of this year. “There could be some funding stress around the end of September (end-of-quarter),” Tomas cautioned.

Related Reading

Bitcoin’s performance has coincided with the exact window Tomas outlines as a liquidity upswing. As documented, Bitcoin’s price has closely tracked the direction of aggregate G5 central bank balance sheets and the level of US bank reserves. When those reserves shrink—especially in the face of stronger Treasury issuance and a rebounding dollar—Bitcoin has historically struggled to sustain upside momentum.

This concern is compounded by Tomas’s warning that speculative short positioning against the dollar has reached extremes. “Back in January, I was shouting about a fall in the dollar. Now everybody and their mothers are bearish on the dollar, and positioning is massively short across the board. It’s time for, at the very least, an upward correction/consolidation for the US dollar, in my opinion.”

Such a reversal in the dollar would mark a critical macro headwind for Bitcoin. The 90-day rolling correlation between Bitcoin and the US Dollar Index (DXY) remains firmly negative. In environments where the dollar strengthens—especially when driven by tightening liquidity—Bitcoin has rarely outperformed.

The next several weeks will be critical. If Treasury proceeds with aggressive issuance and market participants demand higher yields, liquidity could tighten faster than anticipated. While Tomas does leave open the possibility that Secretary Bessent may adjust the TGA target downward, the baseline scenario remains a $500 billion net liquidity drain—directly reversing the conditions that allowed Bitcoin to surge.

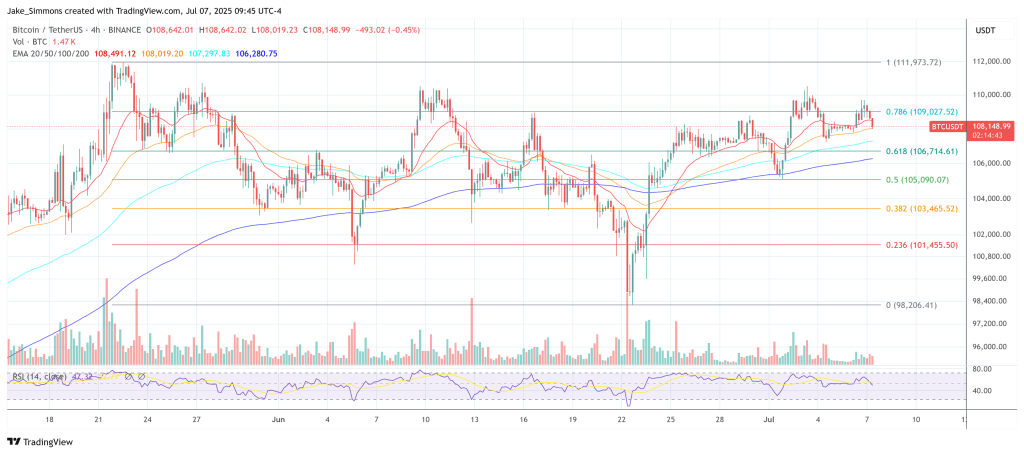

At press time, BTC traded at $108,148.

Featured image created with DALL.E, chart from TradingView.com