Bitcoin whales have reawakened after 14 years of patiently holding the world’s first and largest cryptocurrency, transferring billions of dollars in value.

A Bitcoin wallet “12tLs” transferred 10,000 Bitcoin (BTC) worth over $1 billion after 14 years of holding the assets on Thursday.

The mysterious whale initially received the 10,000 BTC on April 3, 2011, when Bitcoin traded for about $0.78 a coin, according to blockchain data shared by Lookonchain in a Friday X post.

Hours later, two other whale addresses — “bc1qm” and “1GcCK” — also woke up after 14 years, each transferring 10,000 BTC, BitInfoCharts data shows.

The whales held their BTC for 14 years for a more than 13 million percent increase, TradingView data shows.

Some cryptocurrency traders monitor whale transaction patterns as a gauge for institutional Bitcoin demand and short-term price action due to the potentially market-moving amount of capital transferred.

Related: Bitcoin treasury trend is new altseason for crypto speculators: Adam Back

The transfers follow a recent trend of long-term holders cashing in. About two weeks ago, another savvy investor realized a nearly $30 million profit after holding their Bitcoin stash since 2013 and realizing a 496-fold return on their $60,000 initial investment, Cointelegraph reported on June 23.

Related: Chainlink reveals compliance standard, targets $100T institutional crypto flows

Public companies continue Bitcoin accumulation, as BTC rides on S&P 500 all-time high

While some early investors are taking profits, others continue to accumulate Bitcoin.

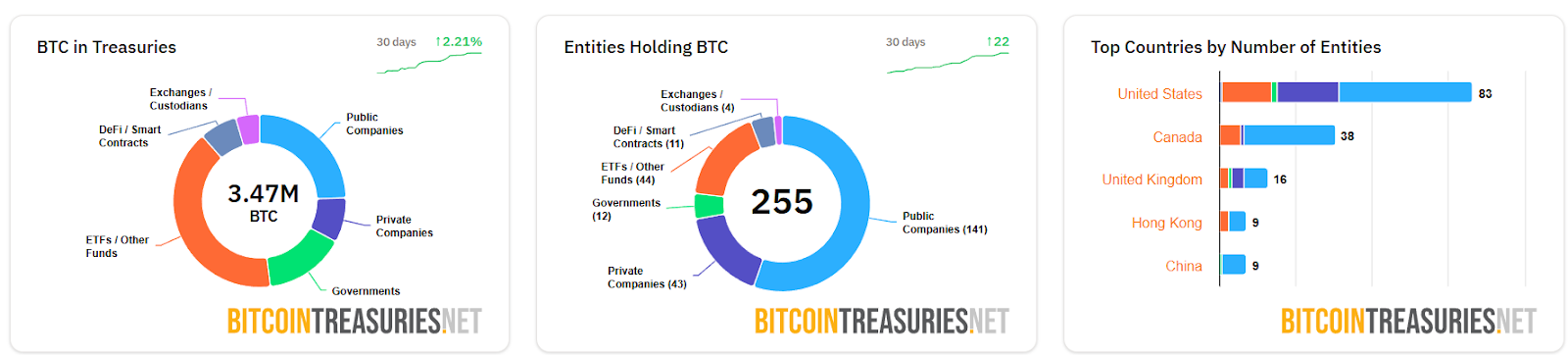

At least 255 companies are now holding a total of 3.47 million Bitcoin on their balance sheets — around 3.97% of the total supply — up from 124 just weeks ago, according to BitcoinTreasuries.NET.

Meanwhile, the S&P 500 and Nasdaq indexes rose to new all-time highs on Thursday, fueled by optimism after a better-than-expected US jobs report reinforced investor confidence in the US economy.

“Bitcoin is closely tracking equity performance and stands poised to follow equities to new highs,” Ruslan Lienkha, chief of markets at Cyprus-based crypto fintech firm YouHodler, told Cointelegraph, adding:

“A decisive push above its current consolidation range could see BTC retesting and surpassing its previous all-time high in the near term.”

Still, some analysts predict that Bitcoin’s price will remain capped below $112,000 in the absence of new buyers and the lack of retail interest, Cointelegraph reported on Thursday.

Magazine: History suggests Bitcoin taps $330K, crypto ETF odds hit 90%: Hodler’s Digest, June 15 – 21