Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In an interview with Dutch host Paul Buitink published on September 4, Henrik Zeberg, Head Economist at SwissBlock, set out a two-stage roadmap for Bitcoin and crypto: a final, powerful “melt-up” driven by liquidity and momentum, followed by a dot-com-style bust that he says will be catalyzed by a surging dollar and tightening financial conditions.

“We do have the largest bubble ever,” Zeberg said, arguing that equities, crypto and real estate will first climb further before the cycle turns. “The music is still playing and you can still get a drink at the bar,” he quipped, extending his Titanic metaphor to explain why he believes sentiment and macro signals have not yet turned decisively negative.

Bitcoin, Ethereum To Soar Before Dot-Com Style Crash

Zeberg locates the current moment late in the business cycle but not at the point of breakdown. He points to the absence—so far—of classic pre-recession triggers in yields, credit spreads and initial jobless claims. “A crash doesn’t come out of thin air,” he said. “We simply don’t see those signals just yet.” With global liquidity improving at the margin and the Federal Reserve already “pivoting” in tone, he expects a sharp upside phase reminiscent of Japan’s 1989 finale: a rising angle that steepens into a near-vertical blow-off. At the index level, he pegs the S&P 500’s terminal run at roughly 7,500 to 8,200 from around 6,400 today.

Related Reading

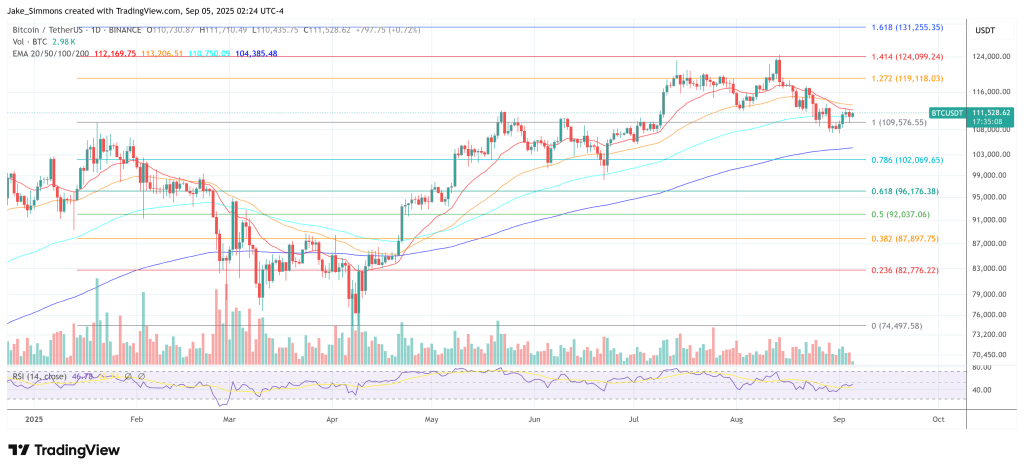

Crypto, in his view, will amplify the move. Zeberg expects Bitcoin to lurch first to “at least” $140,000, then top somewhere in the $165,000 to $175,000 range before the bust begins. He projects Ethereum near $17,000 on the assumption that the ETH/BTC ratio can stretch to about 0.12 in a late-cycle altcoin phase. He stressed the path would be abrupt rather than leisurely: “When things are moving in crypto and into the final phase of a bubble, it can be very, very fast.”

The fulcrum of his thesis is the US dollar. Zeberg is watching closely for a DXY bottom and then a surge to 117–120—“the wrecking ball” that, in his telling, would hammer risk assets as global dollar demand spikes. “If we’re going to see somewhat of a crisis, all this debt will need to be settled in dollars,” he said, calling the greenback “still the cleanest shirt,” even if it is “getting quite nasty.” In that scenario, liquidity preference overwhelms risk appetite, credit tightens and deleveraging begins—especially outside the US, where dollar liabilities collide with local-currency cash flows.

He argues that monetary easing cannot ultimately forestall a cyclical turn once the real economy rolls over. Rate cuts may initially goose markets—“You’re going to see it running up really fast”—but then “the more wise people in the market” will infer weakness rather than salvation. He thinks the Fed will start with 25 basis points this month, while leaving open the possibility of a larger shock move.

Either way, he sees a relatively short deflationary bust—“six to nine months” in one formulation—followed by policy panic and, on the other side, a stagflationary phase in which “the tools of the Fed will become impotent.” He was caustic about the profession’s inflation priors, skewering what he called the “hubris” of micromanaging CPI to exactly 2% and ridiculing the decision to award Ben Bernanke a Nobel Prize for what he described as “reinventing money printing,” calling it “the most stupidest thing I’ve ever seen.”

Zeberg’s commodity framework slots into that sequence. He expects gold to do its “finest duty” during a liquidity crunch—get sold to raise cash—before it reprises 2008’s pattern with a steep drawdown, then a powerful recovery. He cited the 2008 analog of a roughly 33–35% peak-to-trough decline in gold and as much as 60% in silver before the policy response set a new leg higher.

Related Reading

Secularly, however, he projects gold “into the 2030s” at as much as $35,000 per ounce as negative real rates, balance-sheet expansion and an eventual “monetary reset” reprice money. That reset, in his vision, would anchor a new settlement system on gold and ledger-based rails—“a digital element to it,” but “not Bitcoin.”

Strategy: The Largest Ponzi In The Market?

On single-name risk, Zeberg delivered one of the interview’s most incendiary lines about Strategy (formerly MicroStrategy), the largest corporate holder of Bitcoin. “I think we have the largest open Ponzi game when it comes to MicroStrategy,” he said. “Everybody needs to pile into the stock, then he can take on some more debt and he buys more Bitcoin.”

He tied the firm’s vulnerability to his macro template: if DXY heads to 120 and “the largest bubble in the world, the Nasdaq,” suffers an 85%-type drawdown, “Bitcoin is going to have a really, really bad period—and then that means MicroStrategy is going to have that.”

He called the structure “the largest house of cards we have seen in a long time” and warned that an unwind would be “really, really bad for people who think they can just hold on to it.” The characterization was his alone; he did not present evidence beyond his cyclical and balance-sheet logic, and his remarks were framed within his broader melt-up-then-bust scenario.

Beyond headline tokens, Zeberg argued that “99%” of crypto projects will ultimately fail, with only a handful emerging like the Amazons that survived the dot-com washout. He distinguished between speculative coins and blockchain projects that deliver real-world utility, while cautioning that “this rampant speculation” has been prolonged by an era of easy money.

As for timing catalysts, Zeberg downplayed the idea of a single trigger and instead described an environment that “becomes toxic” as high rates, falling real income and climbing delinquencies pressure banks and corporates. He is monitoring front-end yields—which he says have begun to “break some levels”—credit spreads, and the dollar’s turn.

He also noted that large-cap tech’s earnings concentration has “distorted” the market and that even quality small-cap tech is likely to be dragged lower in an indiscriminate unwind. The first stage, however, remains higher. “It’s a self-propelling cycle,” he said of the melt-up, powered by FOMO and the belief that “the Fed has got our back.”

At press time, BTC traded at $111,528.

Featured image created with DALL.E, chart from TradingView.com