Key points:

-

Bitcoin market upheaval continues as Galaxy Digital moves thousands of BTC to exchanges.

-

RSI values collapse to rare lows before printing bullish divergences with price.

-

$117,000 emerges as an important BTC price upside target.

Bitcoin (BTC) is showing signs of recovery after “oversold” conditions hit rare lows Friday.

Bitcoin RSI rout underscores Galaxy Digital nerves

Data from Cointelegraph Markets Pro and TradingView showed bullish divergences creeping in on the relative strength index (RSI) for BTC/USD.

Bitcoin briefly dropped below $114,600 amid the ongoing distribution of thousands of BTC to exchanges by Galaxy Digital.

The event saw mass liquidations of over $500 million in 24 hours, and it formed the latest chapter in the story of roughly 80,000 BTC, which last moved onchain 14 years ago.

Bitcoin sell-off still underway!#GalaxyDigital deposited another 2,850 $BTC($330.44M) to exchanges 11 minutes ago.https://t.co/lD8tgkC4Pyhttps://t.co/T3wOpRSbnw pic.twitter.com/eJ4pEvDvOQ

— Lookonchain (@lookonchain) July 25, 2025

“The Bitcoin price has stalled ever since those coins started moving,” trader Daan Crypto Trades observed in an ongoing X commentary.

With the market still in flux, preliminary signals are emerging from chart data. RSI, which collapsed to just 6/100 on 15-minute timeframes during the first phase of the sell-off, is already printing higher lows while price makes lower lows.

“I have never seen $btc this oversold. Never. This is beyond oversold,” fellow trading account Crypto Analyst added on the data.

The hourly chart continues to hover around the 30/100 “oversold” barrier, tentatively offering higher lows.

”Time to watch” for BTC traders

Continuing, trader Skew had some potential good news for bulls. Mass capitulation, he noted, had not yet appeared, potentially aiding the rebound.

Related: Ether to show Bitcoin ‘leadership’ as BTC ETFs lose $285M: Research

“I see the current state of the market as cautionary more than panic,” he told X followers.

“Panic often has volume & considerable volatility which we dont have currently. Time to watch for sure though.”

$BTC

Furthermore this price decline has been led by market selling on spot exchangeshence why toxic flow is promoted in this environment

– the twap shorting into pricechange in this flow will come from two things

– absorption of market selling

– change from net short… https://t.co/BCKMYpTjrH pic.twitter.com/q1yuFAGvAc— Skew Δ (@52kskew) July 25, 2025

Skew suggested that market absorption of the spot supply is a key factor in halting the bleed, adding that $117,000 is now an important target.

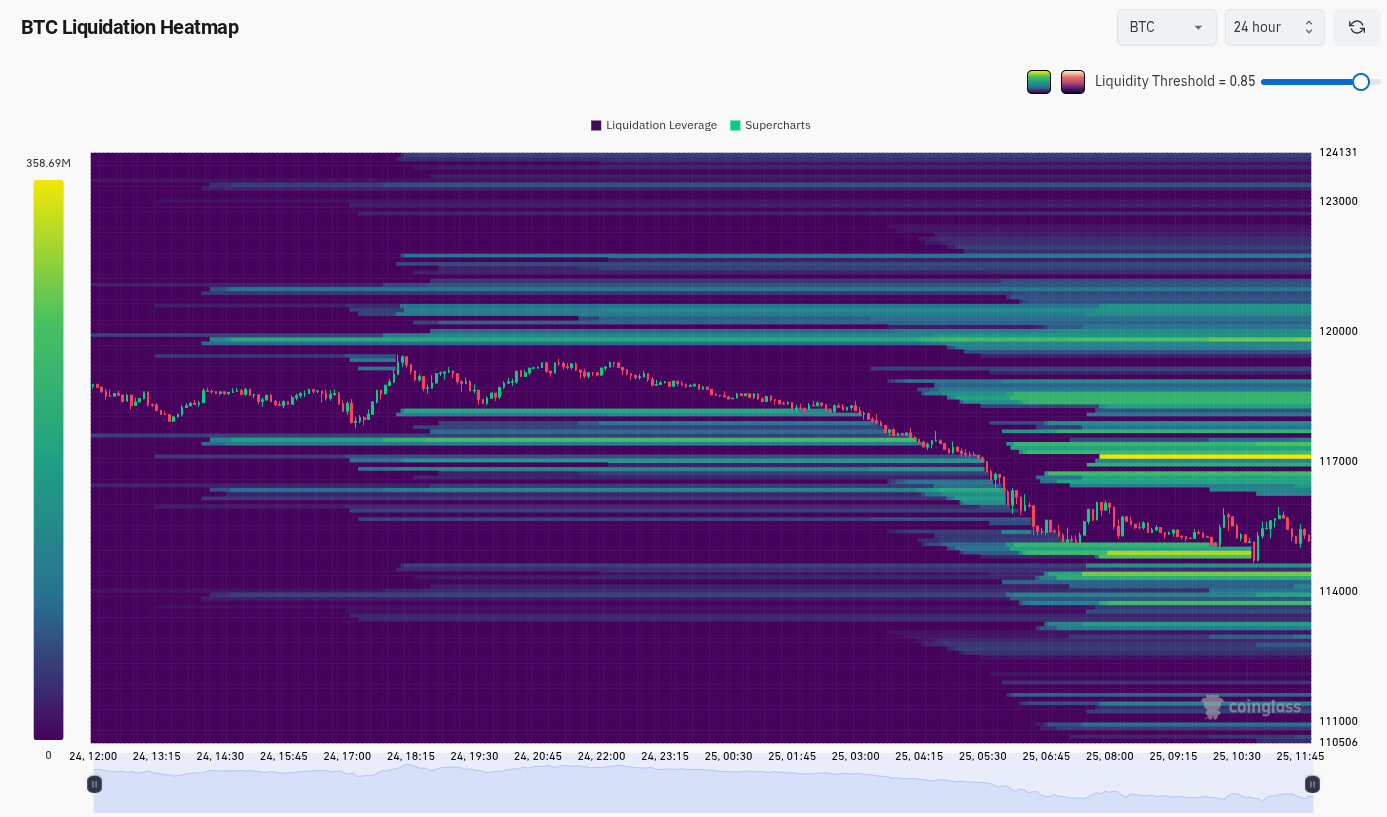

The latest data from monitoring resource CoinGlass showed bid support in place at $114,500, with a cloud of asks overhead extending up to $118,500.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.