Key takeaways:

-

Bitcoin breaks back above $112,000 on Friday as bulls clinch key support.

-

More crypto market volatility is expected after the release of the US jobs report later on Friday.

Bitcoin (BTC) touched $112,900 at the start of the European trading session on Friday as traders slowly flipped bullish on BTC price action ahead of US jobs data.

Shorts punished in $112,000 BTC price rebound

Bitcoin bulls were attempting to flip key resistance levels into support, data from Cointelegraph Markets Pro and TradingView showed.

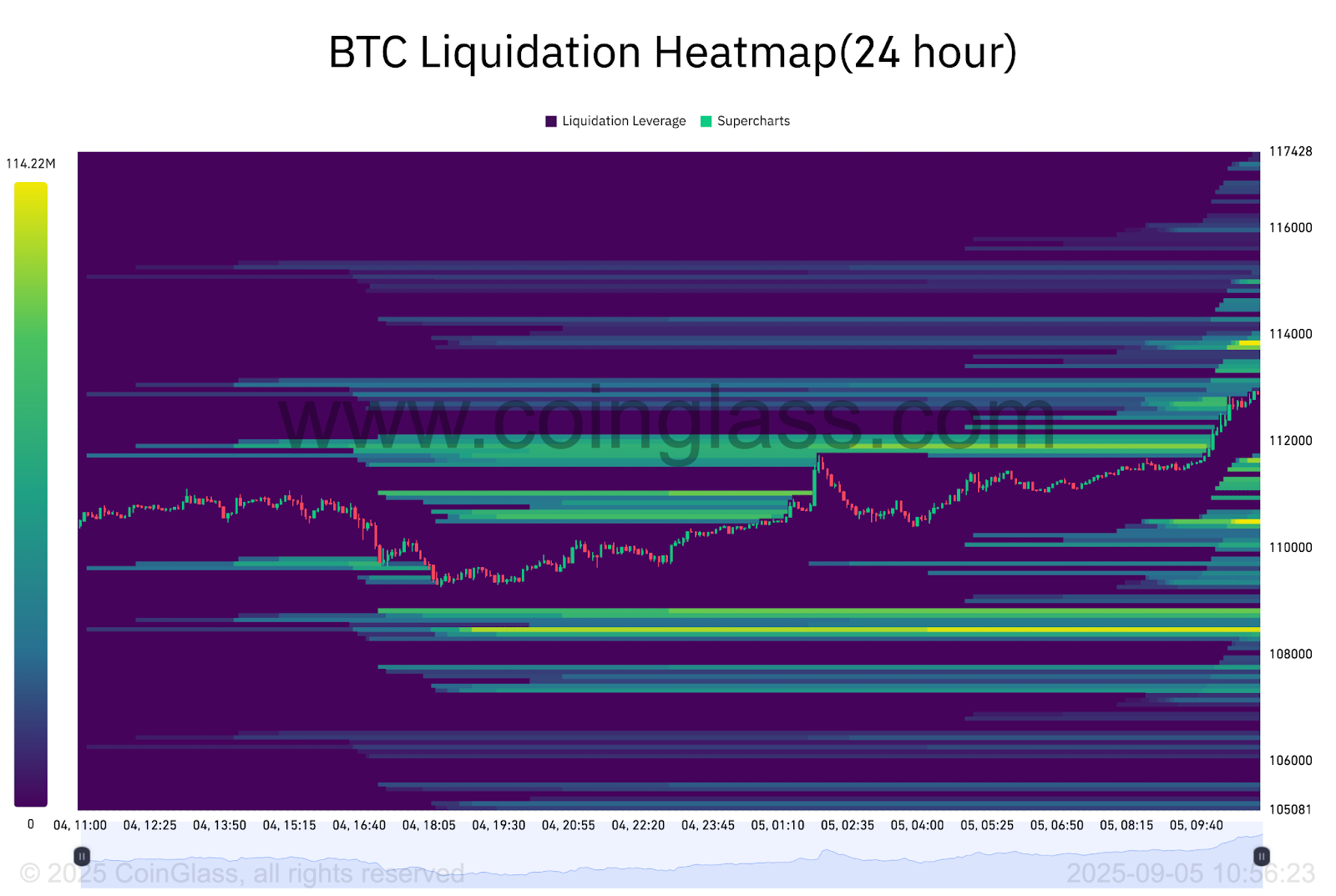

This included the $111,500-$113,000 zone, which formed the most significant clusters of ask liquidity on exchange order books.

Related: Bitcoin sets 2024-style bear trap ahead of ‘major short squeeze’: Trader

CoinGlass’ liquidity heatmap showed the price eating away some of that liquidity on the day, with the remainder extending to $115,000.

This price action by Bitcoin was accompanied by a $14.32 million liquidation of BTC short positions within an hour.

Bitcoin price “nicely bounced off decent bid depth (market demand) and $100M bought back,” analyst Skew commented on BTC’s performance on Friday, adding:

“In perps, we have clear rotation out of shorts and hedges going into a huge NFP day with the majority expecting further progress toward rate cuts.”

Skew added that the price must now show signs of “strength and demand” above key levels to confirm the breakout.

One of these levels is $112,000, which provides a good entry opportunity for long traders, according to MN Capital founder Michael van de Poppe.

If the BTC price breaks $112,000, it will be “another massive long opportunity,” he told his X followers on Friday, adding:

“Let’s break it upward.”

Fellow trader Rekt Capital flagged $113,000 as the level to reclaim to “fully confirm the breakout” and raise the chances of more sustained upside.

As Cointelegraph reported, buyers continued to accumulate and open new leveraged positions on Bitcoin’s recent dip below $110,000, but a break and a close above the $112,000 level remains key.

Traders shift focus to Friday’s US jobs data

With the US jobs report due for release Friday, capital markets commentator The Kobeissi Letter said that a “contracting labour market” could not be ruled out.

With the Federal Reserve under pressure to cut interest rates, a weaker-than-expected jobs report would signal a slowing labor market.

This could boost expectations for a 25-50 basis point rate cut, as the Fed prioritizes supporting employment amid cooling economic growth.

“The US now has more unemployed people than job openings,” the Kobeissi Letter said in a Friday post on X, adding:

“In 2 weeks, the Fed will cut rates and ‘blame’ it on a collapsing labor market.”

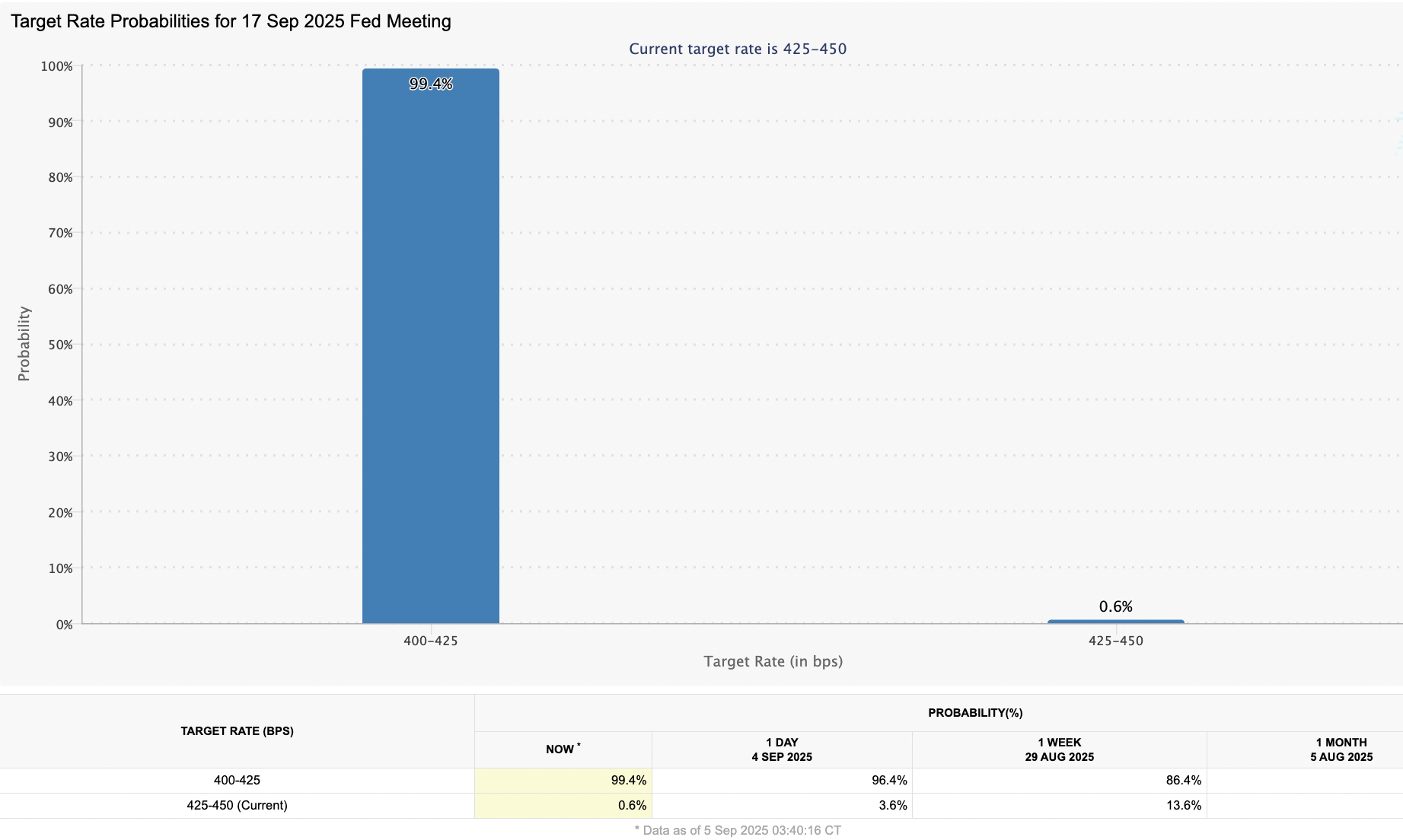

Market participants are now expecting a 99.4% probability that the Fed will lower the benchmark rate by 25 basis points in its September meeting, a move that many traders hope will spark a turnaround in BTC price, per the CME Group’s FedWatch tool.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.