Bitcoin price surged to $116,850 on Thursday, marking an over 2% increase, after reports emerged that President Donald Trump plans to sign an executive order allowing crypto and other alternative assets in 401(k) retirement accounts, potentially unlocking a massive new pool of institutional capital for Bitcoin.

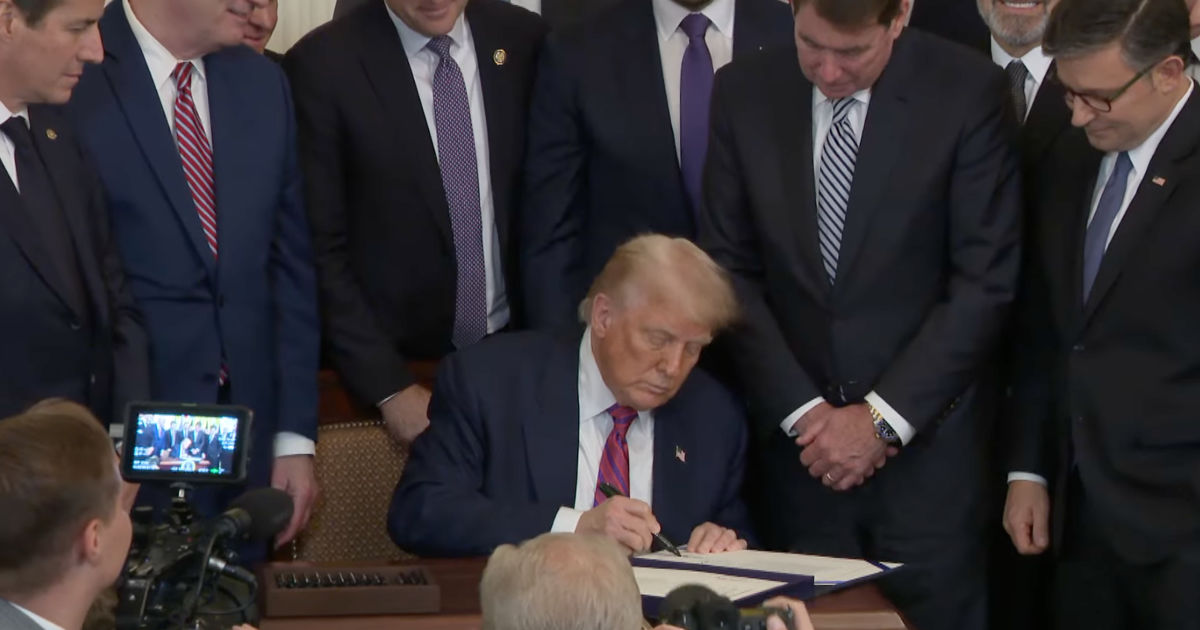

The executive order, expected to be signed on Thursday, will direct the Labor Department to reevaluate existing guidance around alternative investments in retirement plans governed by the Employee Retirement Income Security Act of 1974 (ERISA). The move could give Americans greater access to Bitcoin and crypto through their retirement savings accounts, which currently hold approximately $12.5 trillion in assets.

This executive order represents a watershed moment for Bitcoin adoption. Opening up 401(k)s to Bitcoin investments could fundamentally reshape the institutional landscape for Bitcoin and potentially drive significant new capital into the space.

The development comes as corporate Bitcoin adoption continues to accelerate, with recent weeks seeing notable moves from companies like Metaplanet, which purchased 463 BTC worth $53.7 million, and Smarter Web Company, which launched a $21 million Bitcoin-denominated convertible bond. The number of public companies holding Bitcoin has surged to over 200 in just the last few months, highlighting growing institutional confidence in the asset class.

The Labor Department will be tasked with clarifying fiduciary responsibilities for retirement plan providers offering funds that include alternative assets, potentially removing a key barrier that has historically limited Bitcoin and crypto exposure in retirement accounts. Industry experts suggest this could pave the way for more sophisticated Bitcoin investment products tailored to retirement savings.

The clarification of fiduciary duties could be a game-changer for retirement plan providers. It potentially removes one of the main regulatory uncertainties that has kept many institutional players on the sidelines.

Market observers note that the timing of the executive order coincides with growing institutional interest in Bitcoin as a treasury asset and investment vehicle. The recent launch of innovative financial products, such as Bitcoin-denominated bonds and specialized preferred shares, suggests the market is already evolving to accommodate increased institutional participation.

The executive order is expected to benefit not just Bitcoin and crypto but also other alternative assets, including private equity and real estate. However, Bitcoin’s position as the leading crypto has made it a primary focus for institutional investors looking to gain exposure to the crypto market.

Trading volumes across major cryptocurrency exchanges spiked following the news, with over $30 billion in Bitcoin changing hands in the past 24 hours. The market reaction suggests investors are pricing in the potential long-term impact of retirement account access to Bitcoin.