Key points:

-

Bitcoin attempts to cement a rebound thanks to US jobs data showing labor market weakness.

-

BTC price action remains below $116,000, but order-book data has traders favoring a short squeeze.

-

Evidence of dip-buying emerges on major exchange Bitfinex.

Bitcoin (BTC) rejected from $116,000 at Friday’s Wall Street open as bulls sought a comeback from US trade-tariff lows.

Bitcoin bounces as US jobs miss boosts rate-cut odds

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD selling off at the start of the US trading session, retargeting local lows.

Nerves over a raft of new US trade tariffs had sent the pair as low as $114,116, and traders were split over what might happen next.

US jobs data helped boost the mood, however, July nonfarm payrolls came in at 73,000, well below the 100,000 estimate and indicative of the labor market starting to struggle.

This, in turn, boosted the odds of the Federal Reserve cutting interest rates sooner, just days after Fed Chair Jerome Powell adopted a hawkish tone on future policy.

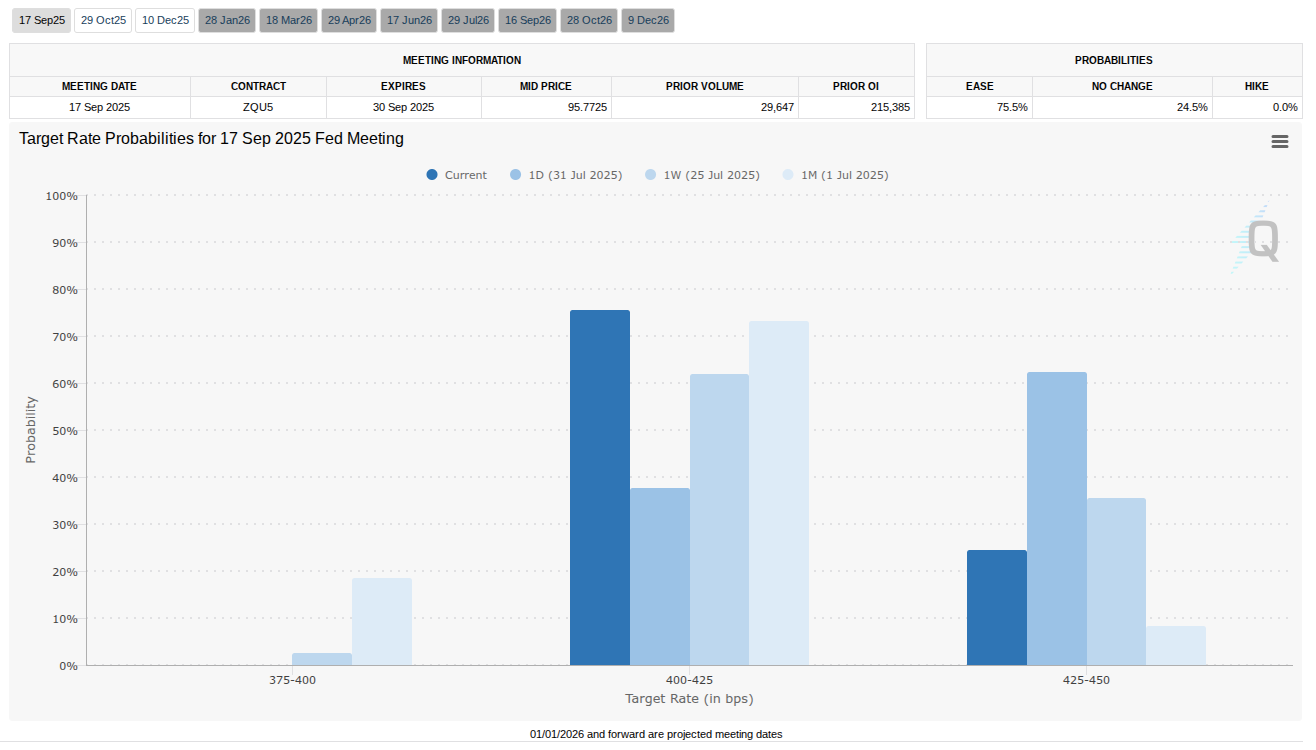

The latest data from CME Group’s FedWatch Tool showed market expectations rotating back to favoring a rate cut at the Fed’s September meeting.

Reacting, trading resource The Kobeissi Letter took issue with jobs revisions and the numbers contrasting with the Fed’s take on labor market strength.

“There are 2 scenarios after today's data: 1. The US labor market is entering a recession 2. Something is seriously wrong with the data,” it wrote in posts on X, calling downward revisions for May and June “massive.”

“The unemployment rate is rising and -258,000 jobs have seemingly disappeared from the data in 2 months.”

US President Donald Trump also responded, adding to existing pressure on Powell to cut rates.

BTC price analysis eyes liquidity squeeze

Turning to BTC price action, market participants once again eyed exchange order-book liquidity for hints as to the next move.

Related: Bitcoin ends record month at $115K with BTC price set for ‘vertical' August

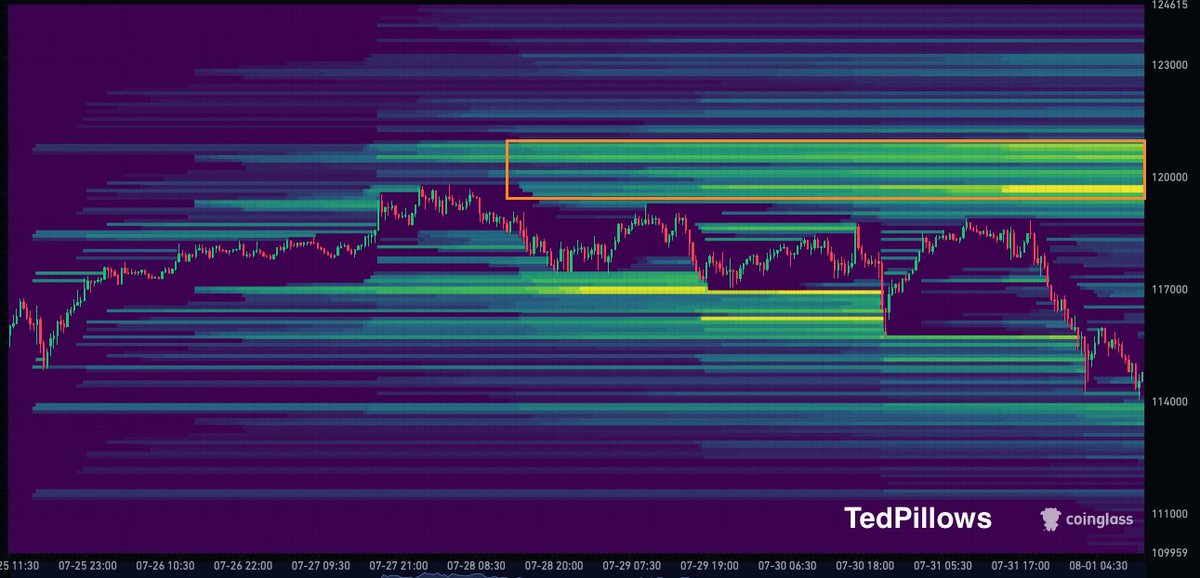

Large blocks of short liquidations lay in wait closer to $120,000 — a level long overdue for a revisit after successive “grabs” targeting longs.

“Just a matter of time before Bitcoin grabs it,” crypto investor and entrepreneur Ted Pillows argued alongside data from monitoring resource CoinGlass.

Additional exchange volume data uploaded to X by popular analytics account TheKingfisher showed Bitfinex traders buying below $115,000.

🚨That Bitfinex $BTC Perp CVD though 🚀

Bitmex and Bybit spot upWhat are you looking at anon? pic.twitter.com/o0aKzrrMNB

— TheKingfisher (@kingfisher_btc) August 1, 2025

Popular trader CrypNuevo meanwhile drew comparisons between current price action and that from the start of the year.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.