Key takeaways:

-

Bitcoin's new highs above $122,000 translate to 29% year-to-date gains, overtaking gold’s 27%.

-

BTC price uptrend remains resilient as an ascending parallel channel targets $125,000 next.

Bitcoin (BTC) has staged a “relentless rally” over the last five days, hitting an all-time high above $122,000 on Monday. Bitcoin is now up around 29% year-to-date, putting it slightly ahead of gold, which has gained around 27% in 2025.

Bitcoin and gold “are now the top-performing major assets so far in 2025,” chief market strategist at Creative Planning, Charlie Bilello, said in a post on X on Sunday, adding:

“We’ve never seen these two in the number one and number two spots for any calendar year.”

Gold (+28%) and Bitcoin (+26%) are now the top performing major assets so far in 2025. We’ve never seen these two in the #1/#2 spots for any calendar year. $GLD $BTC

Video: https://t.co/8pPyZehrH9 pic.twitter.com/XiQzuqf7q6

— Charlie Bilello (@charliebilello) July 13, 2025

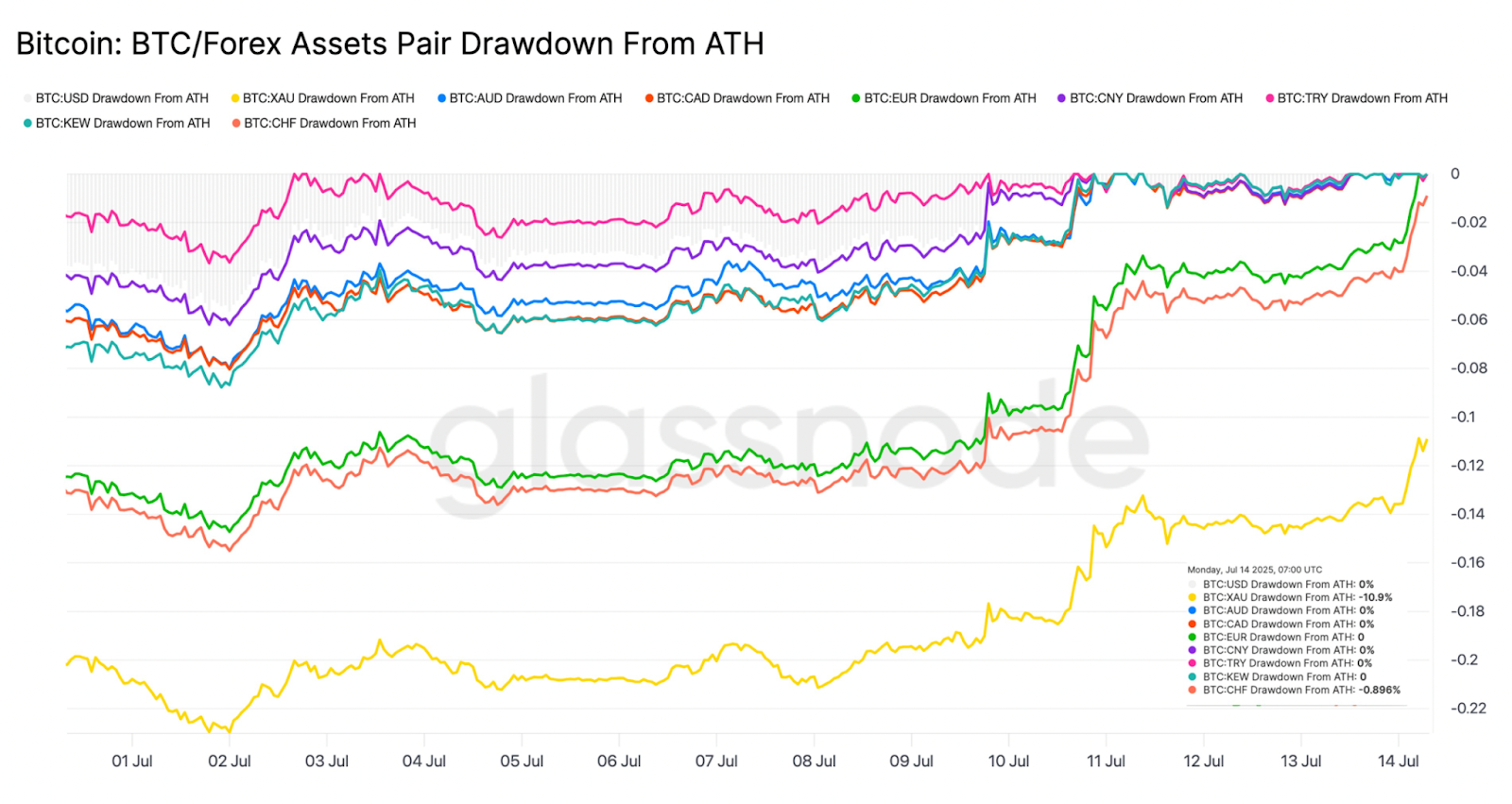

Bitcoin hits 23-week high against gold

BTC price against gold has hit a 23-week high last seen on Jan. 31, extending the monthly gains against its “analog” store-of-value rival.

Bitcoin price in gold rose to 36.54 ounces on Monday, up 25% since June 22, as geopolitical and economic uncertainties push unproductive assets higher.

Related: Strategy bags another $472M in BTC as Bitcoin jumps to new highs

Gold and Bitcoin are called “unproductive assets” because they do not generate income, dividends, or interest like stocks, bonds, or real estate, relying solely on price appreciation for returns.

The BTC/XAU ratio peaked at 41 in December 2025 and is currently about 12% below this level.

“Since Thursday, $BTC made a new ATH in USD terms each day,” said market intelligence firm Glassnode in a Monday post on X, highlighting the fresh all-time highs hit earlier in the day.

“BTC is still shy of ATH in CHF and gold terms,” the firm wrote, adding:

“But vs. gold, it’s now at the highest level since early Feb – after outperforming consistently since June 22.”

Bitcoin investor and research analyst Tuur Demeester told his followers to “expect fireworks” once BTC decisively breaks above the price of 1 kilogram of gold, which is around $108,000 at the time of writing.

Bitcoin near an all-time high in gold. Expect fireworks when we decisively break above 1 kg/BTC. pic.twitter.com/TzabYVU8FN

— Tuur Demeester (@TuurDemeester) July 14, 2025

“Bitcoin’s relentless rally shows no signs of fatigue, surging past $122K as momentum accelerates,” said crypto trading firm QCP Capital on BTC’s new all-time highs.

In a Monday Telegram note to investors, the firm added that BTC price outperformance stems from robust institutional appetite, evidenced by last week’s more than $2 billion in net inflows into spot Bitcoin ETFs, a clear signal of growing participation.

“The market appears to have underestimated the strength of this parabolic move, driven by a decisive technical breakout and a sharp pickup in institutional demand.”

Bitcoin’s ascending channel targets $125,000

Bitcoin price was trading at $121,600 on Monday, up 3% over the last 24 hours, per data from Cointelegraph Markets Pro and TradingView. BTC’s price action had led to the formation of an ascending parallel channel on the hourly chart.

“$BTC channelling nicely, respecting the median as resistance, and now pushing for the upper boundary of the ascending parallel channel,” popular Bitcoin analyst AlphaBTC said in his latest analysis on X.

The chart below shows that if BTC successfully overcomes the resistance from the middle boundary, the next logical move would be the upper boundary of the channel at $125,000.

The analyst added that the US CPI reading on Tuesday might propel BTC price toward this target.

“Bitcoin 125K next.”

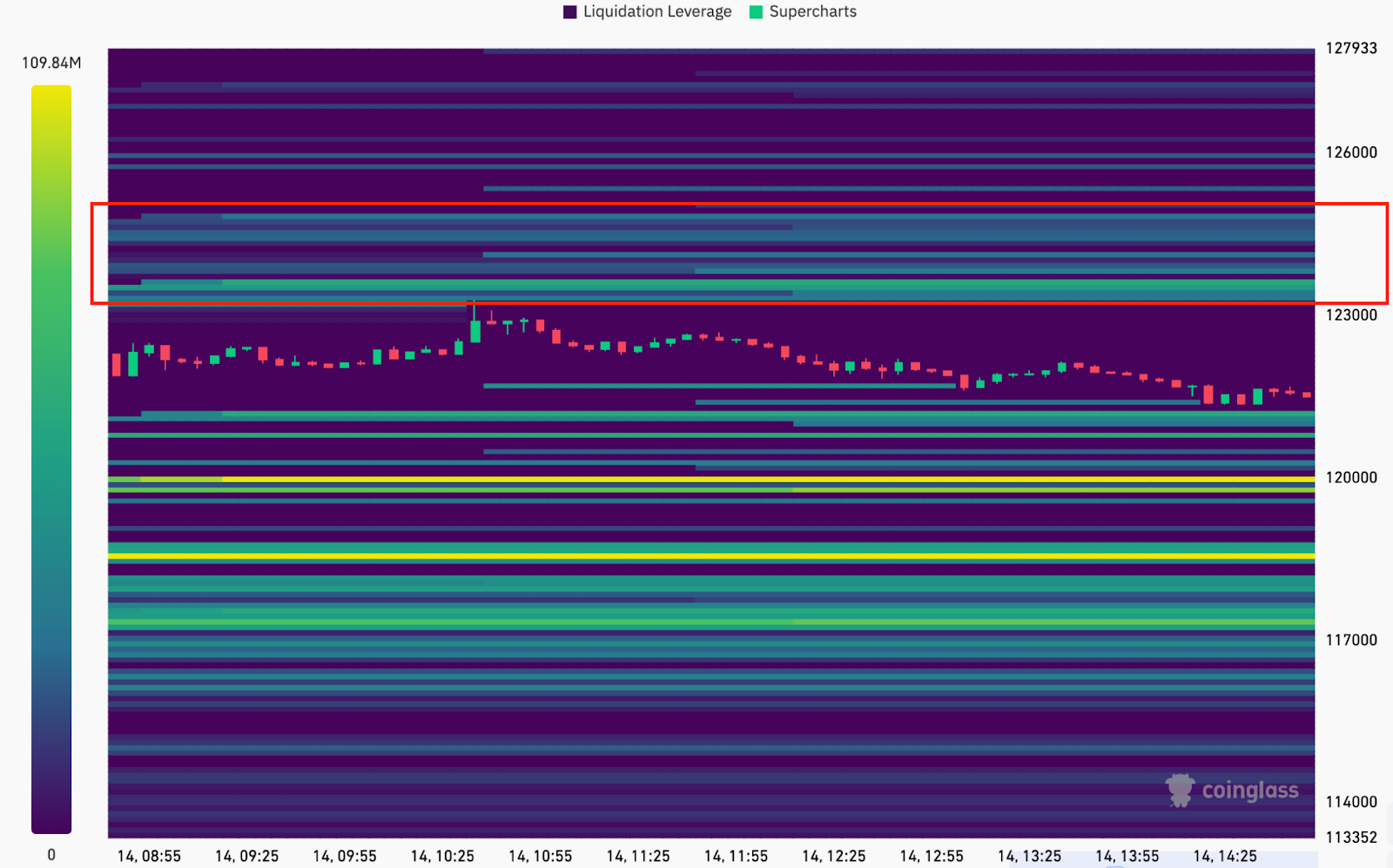

The BTC/USDT 24-hour liquidation heatmap shows the big liquidity clusters building just above $123,000 up to $125,000, per data from CoinGlass.

Heavy bid orders are also around $120,000, suggesting that the price could drop to collect this liquidity before resuming the uptrend.

As Cointelegraph reported, Bitcoin’s breakout on multiple time frames could unlock $130,000-$150,000 next.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.