Key points:

-

Corporate Bitcoin treasuries such as Strategy’s are predicted to drain OTC desks and then exchanges.

-

The resulting supply imbalance will “uncork” BTC price action.

-

In the meantime, profit-taking is still a major priority for existing hodlers.

Bitcoin (BTC) demand from over-the-counter (OTC) desks and exchanges will “uncork” BTC price growth, a new forecast said.

In new X content Wednesday, swing trader Bedlam Capital Pres bet on a fresh Bitcoin supply shock.

OTC desk BTC balances point to price “uncork”

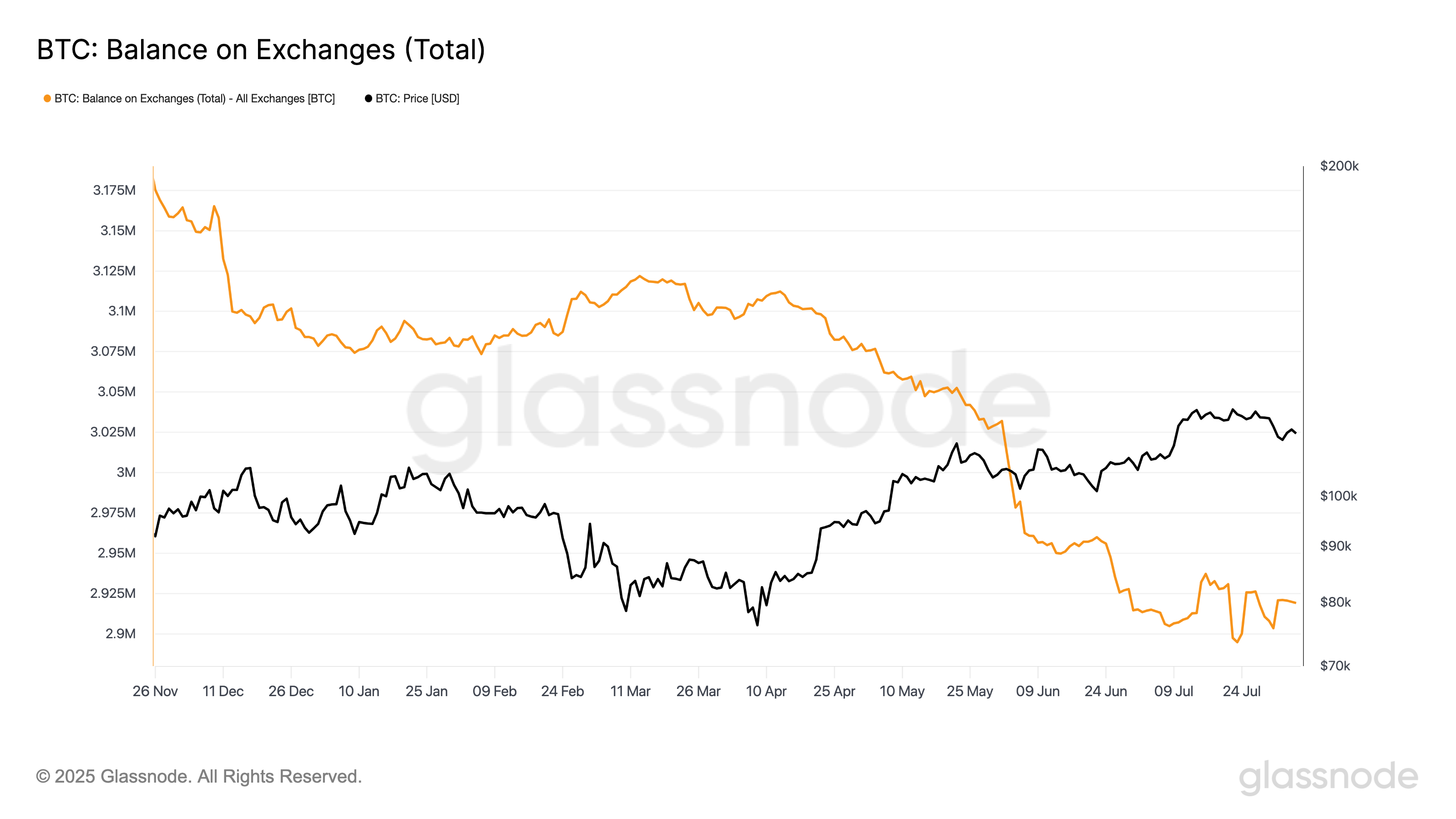

Bitcoin is set to be “uncorked” as declining reserves on exchanges and OTC desks produce a supply imbalance.

Bedlam Capital Pres, which champions Bitcoin treasury company Strategy (MSTR) as the “most asymmetric trade in the market,” sees demand only increasing from there.

“$MSTR buys most of its BTC from OTC trade desks. MSTR bought 182,391 BTC YTD,” it noted, citing a Cointelegraph report.

“OTC trade desks' collective balances are down to around 155,000 BTC. As the OTC desks run low, the demand on the public exchanges will increase, and that is what will uncork BTC's price.”

As Cointelegraph reported, corporate Bitcoin treasuries’ BTC exposure increased by 630 BTC on Monday alone, even as BTC price action wobbled around three-week lows.

Strategy, which has the biggest Bitcoin treasury of any public company, has purchased BTC almost every week in 2025, regardless of price.

Exchanges have seen their BTC reserves start to bottom out over the past month as longtime hodlers profit.

Onchain analytics firm Glassnode put combined exchange balances at 2.919 million BTC as of Tuesday.

“In sum, the market has shifted from euphoria to reassessment, with oversold conditions and seller exhaustion hinting at potential for a bounce,” onchain analytics firm Glassnode summarized in the latest edition of its regular newsletter, Market Pulse.

“However, fragility is growing, and the structure remains vulnerable to external negative catalysts or delayed demand revival.”

Spotlight on “notable” realized profits

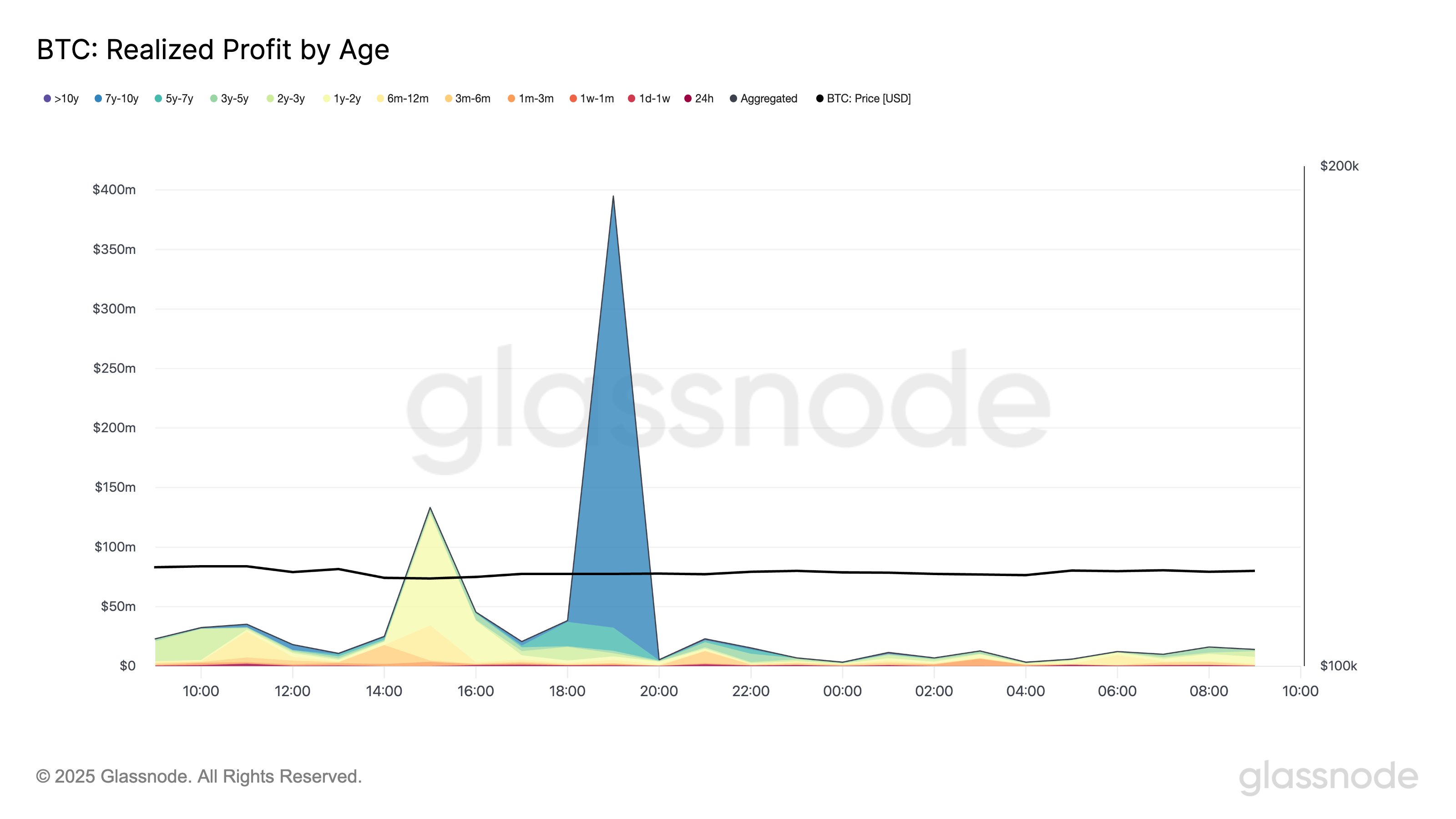

Profit-taking continues to feature high on the radar for market participants amid fears of a deeper BTC price correction.

Related: Bitcoin analysis warns BTC price ‘going lower’ first as $113K slips

Glassnode calculated 24-hour realized profits through Wednesday at over $1 billion.

“$362M (≈35.8%) came from ancient coins held for 7–10 years – a rare event that may reflect internal transfers or true exits,” it told X followers.

“Another $93M came from 1–2 year holders, also marking notable profit realization.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.