Key points:

-

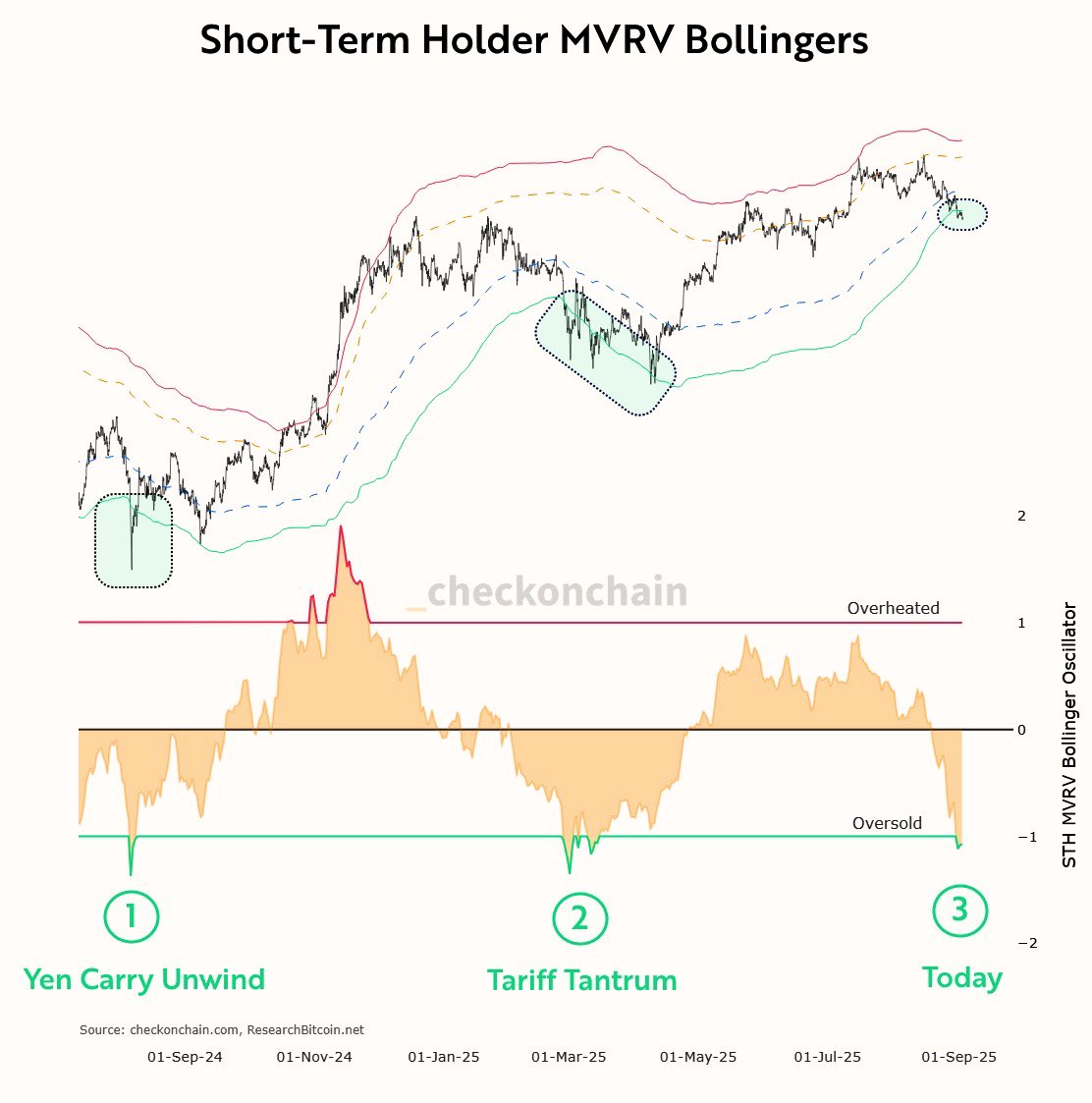

Bitcoin short-term holders are at the center of an “oversold” signal seen only twice in the past year.

-

Both occasions marked long-term BTC price bottoms within the current bull market.

-

Bitcoin RSI signals on low timeframes continue to hint at a bullish market reversal.

Bitcoin (BTC) has printed a new signal that has only appeared during local bull market bottoms.

New findings uploaded to X on Sept. 1 by Frank Fetter, a quant analyst at investment firm Vibes Capital Management, show a key hodler capitulation event.

Bitcoin bulls gain key “oversold” print

Bitcoin speculators have reached a key profit threshold as BTC/USD fell to its lowest levels since the start of July.

The aggregate cost basis or realized price of the short-term holder (STH) cohort — entities hodling for up to six months — now corresponds to the spot price.

That level tends to act as support during Bitcoin bull market corrections, but losing it conversely can lead to lengthy periods of BTC price weakness.

A leading indicator, Market Value to Realized Value (MVRV), measures the value of hodled coins to the price at which they last moved onchain.

At current prices, MVRV for the STH cohort is at breakeven. As Fetter noted, however, adding the Bollinger Bands volatility indicator to the mix delivers a key “oversold” signal.

“Officially got the Oversold print on the short-term holder MVRV Bollinger Bands,” he confirmed.

The bands, themselves a leading price indicator, offer standard deviation levels that allow observers to gauge how rare given levels are, in this case, STH-MVRV values.

Fetter said that downside deviation on STH-MVRV has only occurred twice in the past year.

In August 2024, when the Japanese yen carry trade unwound, STH-MVRV fell below the lower Bollinger Band standard deviation line. The same thing occurred in April this year, when US trade tariffs caused BTC/USD to drop below $75,000.

Bitcoin RSI bullish divergences are still in play

Bitcoin price action is teasing a rebound after “walking down” the bottom Bollinger Band through late August.

Related: BTC vs. ‘very bearish’ gold breakout: 5 things to know in Bitcoin this week

As Cointelegraph reported, signs that the latest correction may be coming to an end first appeared in low-timeframe relative strength index (RSI) readings.

Four-hour RSI began to print a bullish divergence with price over the weekend, a pattern that continues to play out, data from Cointelegraph Markets Pro and TradingView confirmed.

Still, on Monday, MVRV delivered a “death cross” on the daily chart, suggesting that downside pressure was not yet over.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.