Key points:

-

Bitcoin’s speculative investor base now has an aggregate buy-in price of above $100,000.

-

Profit-taking ramps up as $3.5 billion is realized in just 24 hours.

-

The mystery owner of a 14-year-old BTC wallet sends 40,000 BTC to Galaxy Digital.

Bitcoin (BTC) speculators hit a new milestone as their aggregate buy-in price passed $100,000 for the first time.

The latest data from onchain analytics firm Glassnode confirmed that as of Tuesday, the cost basis of Bitcoin short-term holders (STHs) had reached six figures.

Bitcoin short-term holder cost basis now $100,000

Bitcoin’s more speculative investor cohorts are now on average six-figure buyers.

Breaking down the cost basis for various classes of BTC hodler, Glassnode confirmed that those entering the market within the last six months on aggregate paid over $100,000 per coin.

STH entities are typically thought to be more sensitive to low-timeframe BTC price action, feeling more pressure to sell based on sudden trends. Their cost basis, known as realized price, can form reliable support during Bitcoin bull markets.

The cost basis passing $100,000 reinforces that level’s significance should BTC/USD begin a deeper downturn.

Meanwhile, neither STHs nor their more entrenched counterparts, long-term holders (LTHs), have wasted time taking profits around all-time highs.

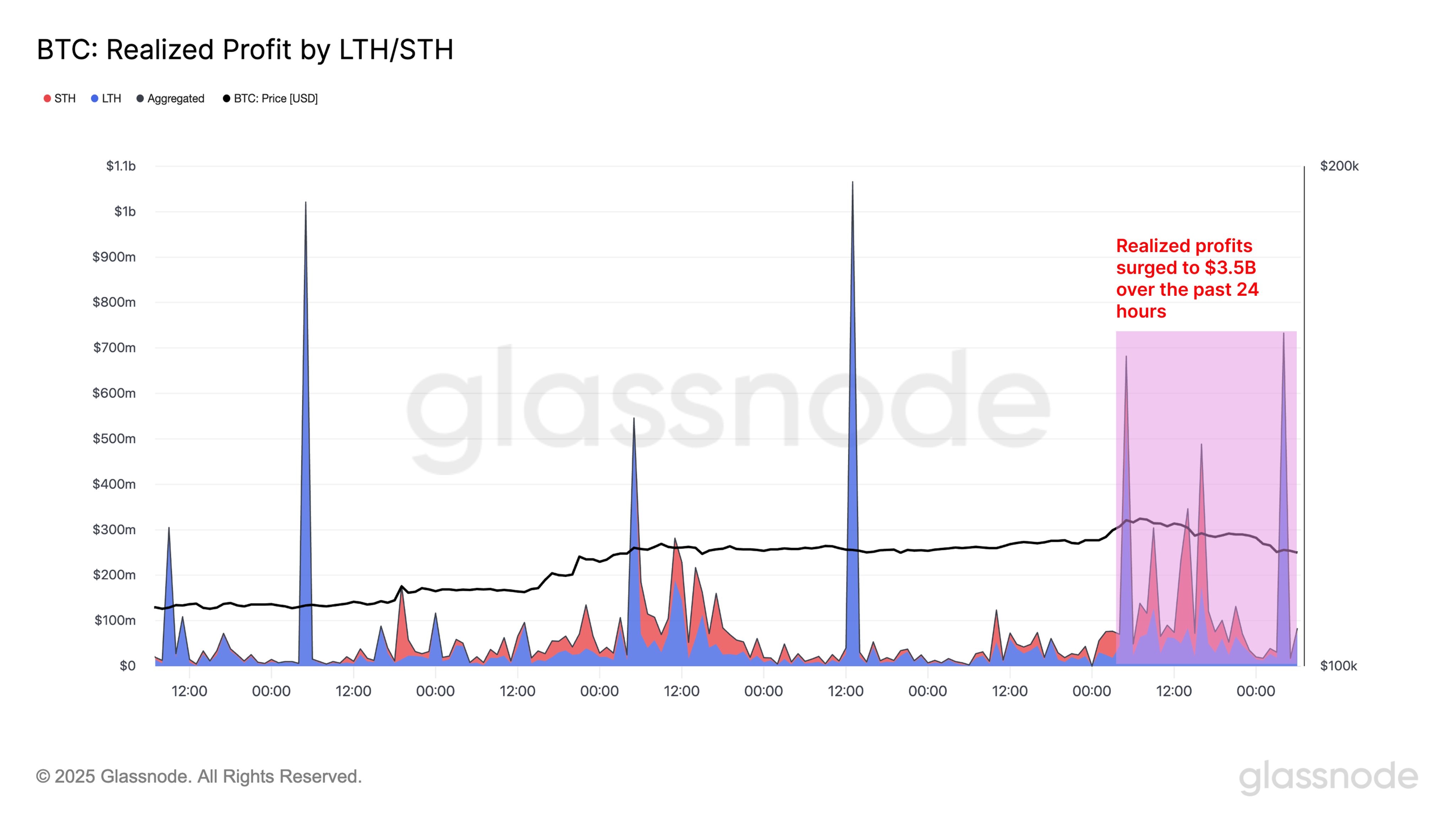

Glassnode confirmed that in the 24 hours to 4 am Eastern Time Tuesday, STH and LTH combined profit-taking was around $3.5 billion.

“One of the largest $BTC profit realization days this year – driven mostly by long-term holders,” it said on X.

BTC hodlers take profits off the table

Prior to the profit-taking event, Glassnode warned that the extent of recent gains may prove too tempting for hodlers, no matter how long their presence in the market.

Related: ‘Don’t get trapped!’ — Bitcoin price analysis sees dip with $118.8K in focus

“Capital rotation metrics point to a slight increase in short-term holder activity, yet the dominance of long-term holders remains intact, supporting market stability,” it reported in the latest edition of Market Pulse, its regular research series.

“Meanwhile, profit/loss indicators signal caution, with realized profit-taking rising and nearly 99% of the supply in profit, suggesting elevated euphoria and potential risk of corrections.”

As Cointelegraph reported, whales also took the opportunity to lock in gains this week.

They included the mystery owner of 80,000 BTC, which recently became active onchain for the first time in a decade; 40,000 BTC moved to a wallet at exchange Galaxy Digital on Tuesday, per data from Arkham.

UPDATE: The Bitcoin OG with 80,009 $BTC($9.46B) has transferred 40,009 $BTC($4.68B) to #GalaxyDigital.

And #GalaxyDigital has directly deposited 6,000 $BTC($706M) into #Binance and #Bybit.https://t.co/8Z4m7CAQ0i https://t.co/4fpZhBM5uY pic.twitter.com/gdl6f8wSZw

— Lookonchain (@lookonchain) July 15, 2025

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.