Key points:

-

Bitcoin market momentum slows after its all-time highs, but investors are not wasting time adjusting to rangebound conditions.

-

Profitability has “cooled,” says Glassnode, but fresh gains are still possible.

-

Traders are eyeing a liquidity build-up at $115,000 for a BTC price dip.

Bitcoin (BTC) is in a “healthy yet fragile balance” as BTC price consolidation causes a drop in profits.

In its latest “Market Pulse” released Monday, onchain analytics firm Glassnode warned that fresh gains may not come soon.

Bitcoin toys with lengthier consolidation

Bitcoin is taking a reasonable pause after its surge to new all-time highs, but market shifts mean that another lengthy consolidation phase may result.

Glassnode reveals various signs that investors are now readjusting to range-bound BTC price behavior.

“Profitability metrics have started to cool. The percentage of supply in profit and unrealized profit both declined slightly but remain in euphoric territory,” it wrote.

“The Realized Profit to Loss Ratio also pulled back, suggesting that while most investors remain in profit, some are starting to de-risk in light of recent gains.”

Realized profit-to-loss ratio measures coins moving in profit and loss compared to their last transaction. Glassnode calls the metric’s drop from 3.9 to 2.6 “notable.”

“This reading hovers just above the high band of 2.7, indicating that realized profits still outweigh losses, though momentum has cooled,” it explained.

“The shift points to a market recalibrating after the recent ATH, with investors adopting a more measured stance amid reduced bullish intensity.”

That reduction does not mean that bears are starting to gain the upper hand, however. Rather than terminating its march higher at $123,000, BTC/USD appears to be coiling, cementing new support.

The current consolidation may nonetheless copy previous cooling-off phases, turning from days to weeks or longer, Glassnode hints.

“Overall, market conditions reflect a healthy yet fragile balance,” it concluded.

“Seller exhaustion appears likely and ready for another potential leg up, but if profitability continues to weaken, the market may transition into a broader consolidation phase as sentiment cools and positioning normalizes.”

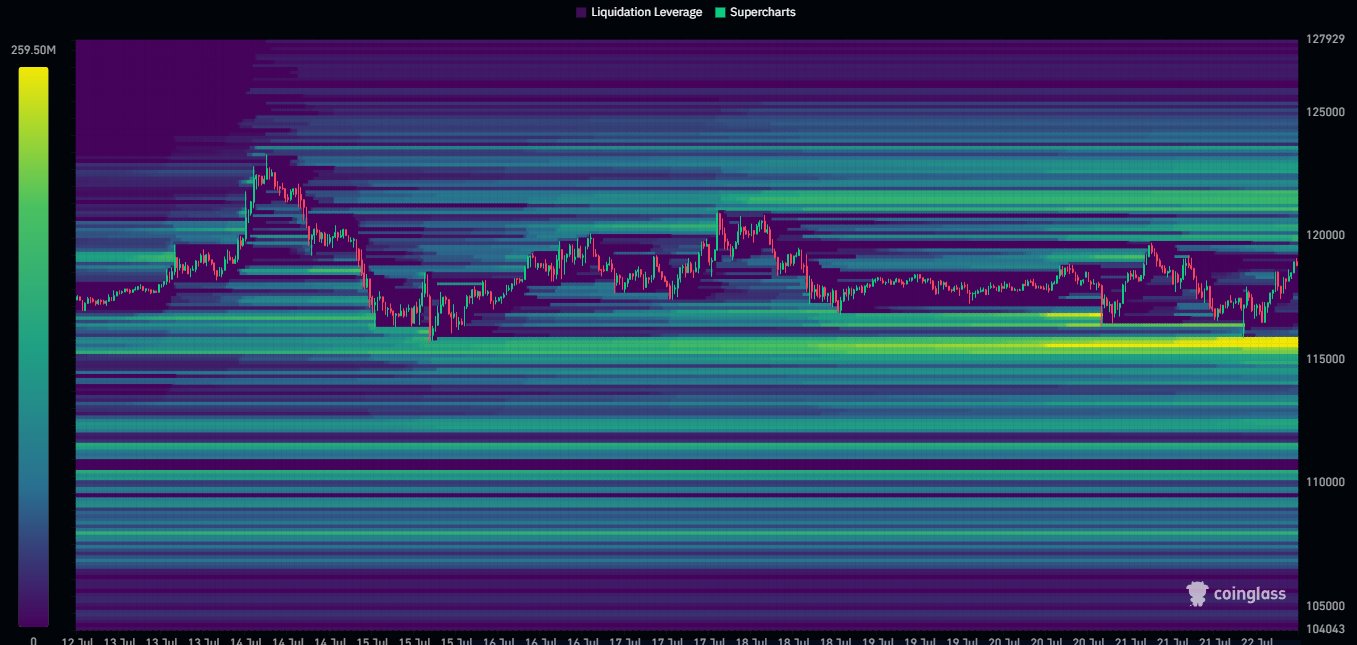

Liquidity points to $115,000 retest

Bitcoin traders are considering where new local lows may come as a result of the bull run breather.

Related: Bitcoin bull run ‘likely close to over' says trader as XRP flips McDonald's

Analyzing exchange order-book liquidity, market participants have highlighted $115,000 as an increasingly tempting price magnet.

“The longer price keeps hovering around this area, the more positions will be building up on both sides. Those positions will be fuel for wherever this moves next,” popular trader Daan Crypto Trades told X followers in a post on Tuesday.

“The main areas to watch in the short term are ~$115K-$120K. The biggest liquidity cluster currently sits below this local range at ~$115K.”

A separate post also gives weight to $118,000 as an important low-timeframe level thanks to trading volume.

As Cointelegraph reported, liquidity has played a key role in snap BTC price moves throughout Q2.

$BTC Pretty tight range considering this is trading near all time highs.

Keep an eye out for these local highs & lows for a potential liquidity sweep.

Most volume has been traded at this ~$118K area which is the mid range. You could watch that as a lower timeframe… pic.twitter.com/NvfUoHZ4dj

— Daan Crypto Trades (@DaanCrypto) July 22, 2025

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.