Bitcoin is trading above the $112,000 level, but its momentum is faltering as selling pressure intensifies. Analysts are divided on what comes next, with some calling for another correction and others suggesting that BTC may continue consolidating before any decisive move. The uncertainty highlights the fragile balance between bullish optimism and market caution.

Related Reading

Top analyst Darkfost shared insights that bring back a long-running debate: Does Bitcoin’s traditional cycle structure still hold? While opinions vary, one factor remains consistent across cycles—the influence of long-term holders. Dormant BTC, when moved, often unleashes powerful selling pressure, a dynamic still capable of shaking the market. This cycle has already confirmed that pattern.

As BTC climbed to its all-time high earlier this year, Coin Days Destroyed (CDD)—a key on-chain metric tracking the movement of older coins—spiked noticeably. Historically, such spikes have aligned with tops and significant corrections, showing that long-term holders continue to play a decisive role in shaping market direction.

Value Days Destroyed Signals Potential Relief For Bitcoin

According to Darkfost, the Value Days Destroyed (VDD) metric is offering crucial insights into Bitcoin’s current market structure. Much like Coin Days Destroyed (CDD), VDD tracks the movement of older coins, but it adds another layer by weighting this activity according to price. This adjustment introduces the concept of “value destruction,” giving more weight to long-term holders selling when BTC prices are higher, and less when they are lower. As a result, VDD provides a more nuanced picture of the influence older coins exert on the market.

Recently, VDD reached a level of 2.4, a threshold historically associated with significant selling pressure. In past cycles, spikes to this range have often marked moments when long-term holders locked in profits, contributing to local tops or sharp corrections. The latest spike aligned with Bitcoin’s push to its all-time high, reflecting the familiar pattern of dormant supply resurfacing at peak prices.

However, VDD has since been declining, now approaching levels similar to those seen during prior correction phases. This suggests that the intensity of selling from long-term holders is easing. If this trend continues, the market may find relief from one of its most persistent sources of supply pressure.

Ultimately, easing VDD levels could set the stage for renewed upward momentum, but the key factor will be demand. Without strong inflows and renewed conviction from buyers, the reduction in selling pressure alone may not be enough to spark a sustainable rally. Still, the moderation of long-term holder activity is a promising sign that Bitcoin could stabilize and prepare for another attempt higher in the coming weeks.

Related Reading

Price Action Details: Pushing Above $110K

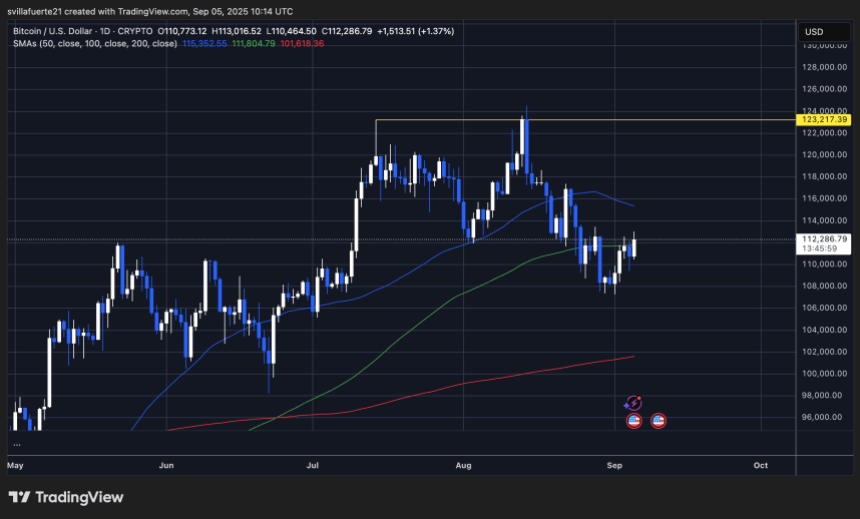

Bitcoin is currently trading at $112,286, showing a slight recovery after weeks of selling pressure that pulled the price down from its recent all-time high near $123,217. The chart reveals that BTC is still consolidating within a corrective structure, testing the mid-range between support and resistance levels.

The 50-day moving average (blue line) is trending above the current price, acting as near-term resistance around $115K, while the 100-day moving average (green line) sits close to current levels, providing a short-term pivot point. The 200-day moving average (red line) is much lower at $101K, serving as a deeper structural support if bearish pressure intensifies.

Related Reading

BTC is forming higher lows after its recent dip to the $110K area, signaling that buyers are cautiously stepping back in. However, momentum remains limited, and the chart shows the market has yet to reclaim any major resistance levels. A breakout above $115K would be needed to shift sentiment and open the way toward retesting the $120K–$123K zone.

Featured image from Dall-E, chart from TradingView