Key points:

-

Bitcoin’s classic Mayer Multiple metric is far from overheated despite price being inches from all-time highs.

-

BTC price action could enjoy a “new upward impulse” as a result, says analysis from a popular CryptoQuant contributor.

-

October 2025 is gaining favor as the point of the next bull market top.

Bitcoin (BTC) is “undervalued” despite staying near all-time highs, according to new analysis of a classic BTC price metric.

In an X post on Tuesday, Axel Adler Jr., a contributor to onchain analytics platform CryptoQuant, revealed promising signals from Bitcoin’s Mayer Multiple.

Bitcoin Mayer Multiple “significantly below overbought thresholds”

Bitcoin may be circling $108,000 after 90% gains over the past year, but the Mayer Multiple is far from ready to call a BTC price top.

The Multiple compares BTC/USD to its 200-day simple moving average, and the resulting value can be used as a strength gauge when compared to similar periods in previous market cycles.

“Currently, the metric stands at 1.1х (price to 200-day moving average), which falls within the neutral zone (0.8–1.5х) and is significantly below overbought thresholds (1.5х),” Adler wrote.

“Today's Mayer Multiple indicates that Bitcoin is trading at a discount to its historical bull rallies and is rather undervalued than overvalued – a good fuel reserve for a new upward impulse.”

While the Multiple does not offer strict buy or sell signals, it forms one of a large number of onchain metrics which have yet to signal a bull market top.

As Cointelegraph reported, a giant list of 30 “bull market peak” indicators from monitoring resource CoinGlass remains 100% in “hold” territory.

BTC price top in October, analysts say

However, estimates of when the current uptrend may encounter its “blow-off top” vary.

Related: ‘False move’ to $105K? 5 things to know in Bitcoin this week

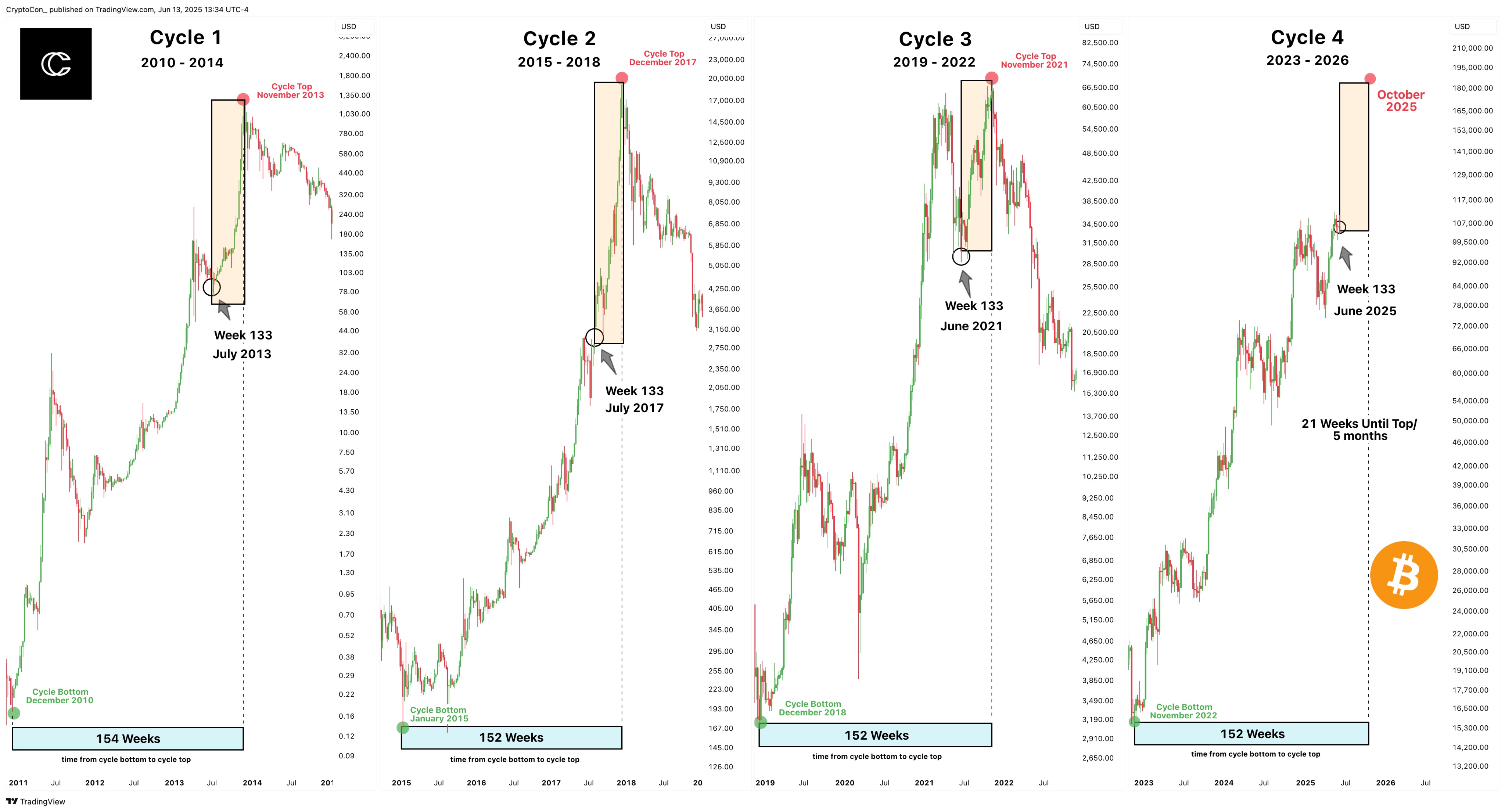

An increasingly popular target is October 2025, with that month flagged by trader and analyst Rekt Capital, also as a result of historical comparison.

“If Bitcoin is going to peak in its Bull Market in September/October 2025 as per historical Halving cycles… That’s only 2-3 months away,” he reiterated over the weekend.

This week, fellow trader Jelle agreed on the time frame for a cycle top, revealing that profit-taking had already begun.

Happy profit-taking day by the way – I just sold another 2% of the holdings. 💰

Still thinking we see a cycle top in October – and I'll be out right around that time.

Sticking to the plan, week in, week out.#Bitcoin pic.twitter.com/ohQ1PlkwcJ

— Jelle (@CryptoJelleNL) July 8, 2025

“Some people are under the impression that the cycle can extend into 2026 (year of the bear market) because of the slower price action,” analyst CryptoCon continued in his own X post on the topic.

“Most data seems to favor that the cycle will be complete by the end of this year. Let's see what October brings! More waiting inbound…”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.