Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s near-term path, argues macro commentator Bruce Florian–founder of the Bitcoin Self-Custody Company Schwarzberg and a bestselling author–is being set far from crypto order books and deep inside the US money markets, where a once-enormous pool of excess cash has finally run dry. In a thread on X, Florian frames the Federal Reserve’s overnight reverse repo facility (RRP) as the “surplus pot” that quietly powered asset prices for two years—and now, with that pot empty, he believes markets are about to feel the unfiltered weight of tighter liquidity.

Why This Means Pain For Bitcoin

Florian starts by locating the inflection point: “The reverse repo facility (RRP) is at its lowest level in four years.” He then walks through the basic plumbing. During the pandemic response, “so much money was printed… there were fewer assets than excess cash,” so banks and money funds “parked [it] with the Fed in the RRP. Safe and earning interest.” As that pool drained, it didn’t disappear—it “was continuously pumped into the market over the last few years. Mainly into government bonds.” In his accounting, “around $2 trillion in excess liquidity from 2020/21 flowed into the market over the last 24 months,” keeping valuations buoyant despite higher policy rates and formal quantitative tightening.

Related Reading

The metaphor he uses is deliberate and evocative: “It’s like a tanker traveling at full speed. Even if you turn off the engine, it will continue to drift for many kilometers, solely due to the speed it has built up.” For Florian, that drift—the lagged effect of past liquidity—is ending. “Now the propulsion is gone. The surplus pot is empty, and the tanker comes to a standstill.”

He connects that mechanical turn to the looming supply calendar: “There are still trillions in government bonds that need to be purchased in the coming months and years.” With the RRP no longer acting as a buyer of first resort, “we will feel the full brunt of the reduced liquidity since 2022.”

The near-term cross-asset message is unambiguous. “This is bad for stocks, bonds, and Bitcoin in the short term,” he writes, adding that “stocks and Bitcoin can afford short respites… bonds cannot.” The constraint, in his view, is structural: “The US bond market is the most important market in the world.” If the RRP isn’t there to absorb cash and recycle it into Treasuries, “bond yields will continue to rise to attract investors.”

Related Reading

That dynamic, he warns, collides with political and macro limits: “interest rates are already far too high for the current administration.” His base case is that the central bank ultimately has to step in: “The Fed will likely intervene and rescue the bond market by providing new liquidity.” The path from here is “unclear… in the short term,” but the contours of the pressure are, in his telling, set by the plumbing.

Florian repeatedly stresses that any turbulence should not be misread as a Bitcoin-native failure. “The turmoil is once again coming from the fiat system, not from Bitcoin. Bitcoin merely reflects this development with its volatility.” That framing places Bitcoin downstream of dollar liquidity rather than in opposition to it.

The market, he cautions, will “do everything it can to drive you out of your position.” His counsel for positioning is psychological as much as financial: “If you know what you own, you can stay relaxed.” The long-term thesis remains intact in his mind—“Remember where Bitcoin is headed as an ideal store of value”—but navigating the next phase requires horizon discipline: “Because if you keep your eyes on the horizon, you won’t get seasick.”

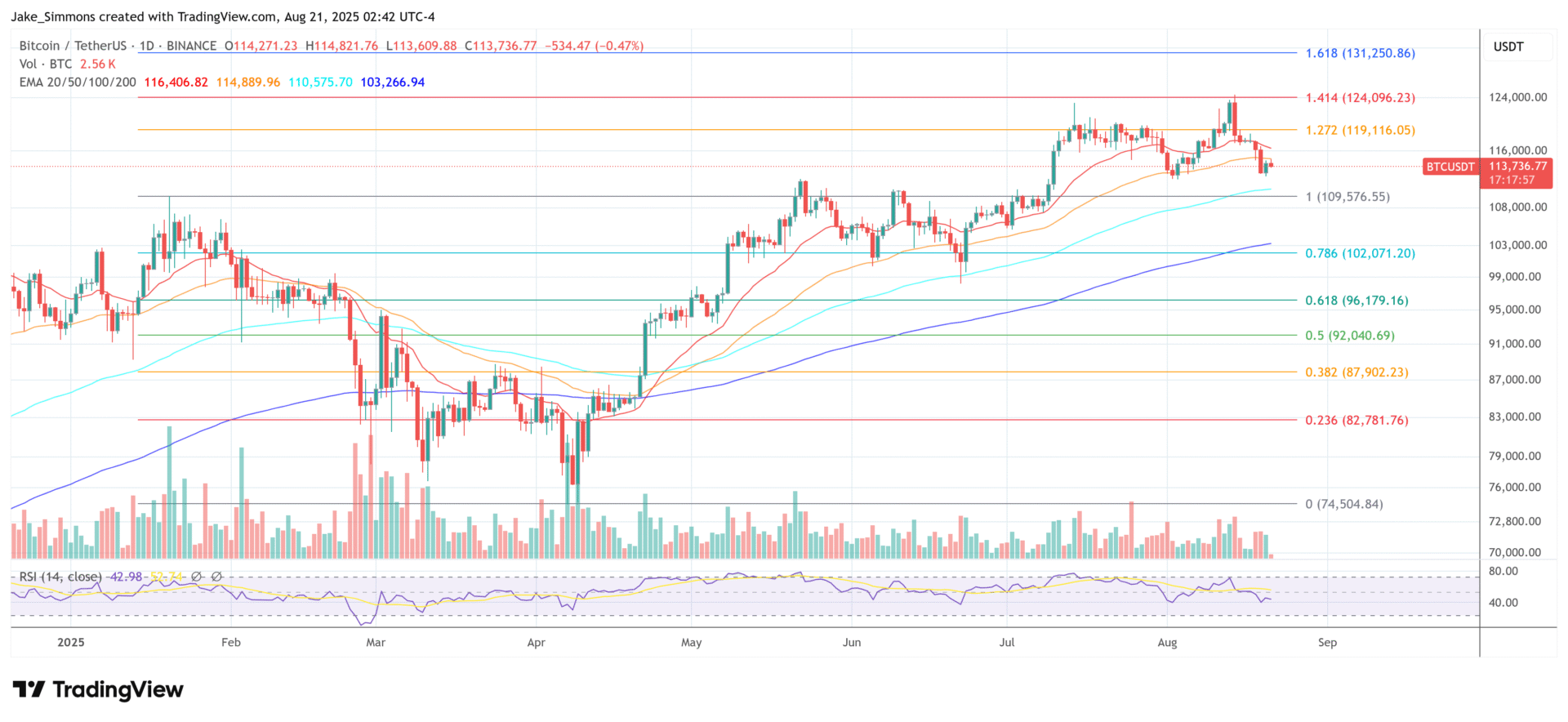

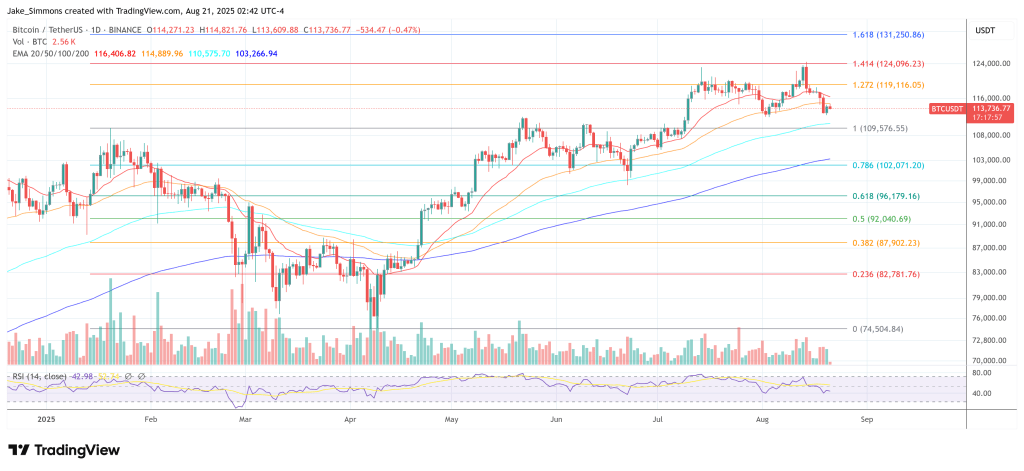

At press time, BTC traded at $113,736.

Featured image created with DALL.E, chart from TradingView.com