Key points:

-

Bitcoin price weakness could end in a giant short liquidation event as bears get overly comfortable.

-

A new forecast suggests that market makers are deliberately preparing a giant bear trap.

-

BTC price action is already back at $113,000, liquidating blocks of shorts.

Bitcoin (BTC) is due for its “next major short squeeze” within weeks as market makers lay the ultimate bear trap.

A new forecast by popular trader Luca this week sees BTC price action repeating the late 2024 breakout.

Bitcoin market makers keeping bears “complacent”

Bitcoin exchange order books could hold the key to what will happen to BTC/USD in the coming weeks — and bulls will benefit.

Eyeing recent price performance, Luca suggests that the absence of fresh higher highs is, in fact, not a bearish signal.

“Look at how the price action has developed for $BTC over the last couple of weeks, since we topped out in mid-August. Not one single high got swept,” he wrote.

“I think the reason is that shorts are getting protected on the short-term.”

The theory explains that market makers keep the market artificially rangebound to convince short sellers that their bets will pay off.

“We've seen something similar before, back in 2024, all throughout that MASSIVE consolidation phase when the highs never got tapped until we actually had the breakout in November,” the post continues, referring to last year’s seven months of sideways price action.

The longer such a scenario goes on, the more “complacent” bears become — setting up ideal conditions for a short squeeze liquidation event. Luca concluded:

“I believe this is what will lead to the next major short-squeeze in the coming weeks and even though it may seem counterintuitive, I think that shorts getting protected right now and the highs not getting swept is a very positive indication moving forward.”

BTC price breakout “fully confirmed”

As Cointelegraph reported, many market participants are convinced that new lower lows will come for Bitcoin next.

Related: BTC vs. ‘very bearish' gold breakout: 5 things to know in Bitcoin this week

$100,000 remains a popular downside target, with arguments focusing on phenomena such as bearish divergences on leading indicators.

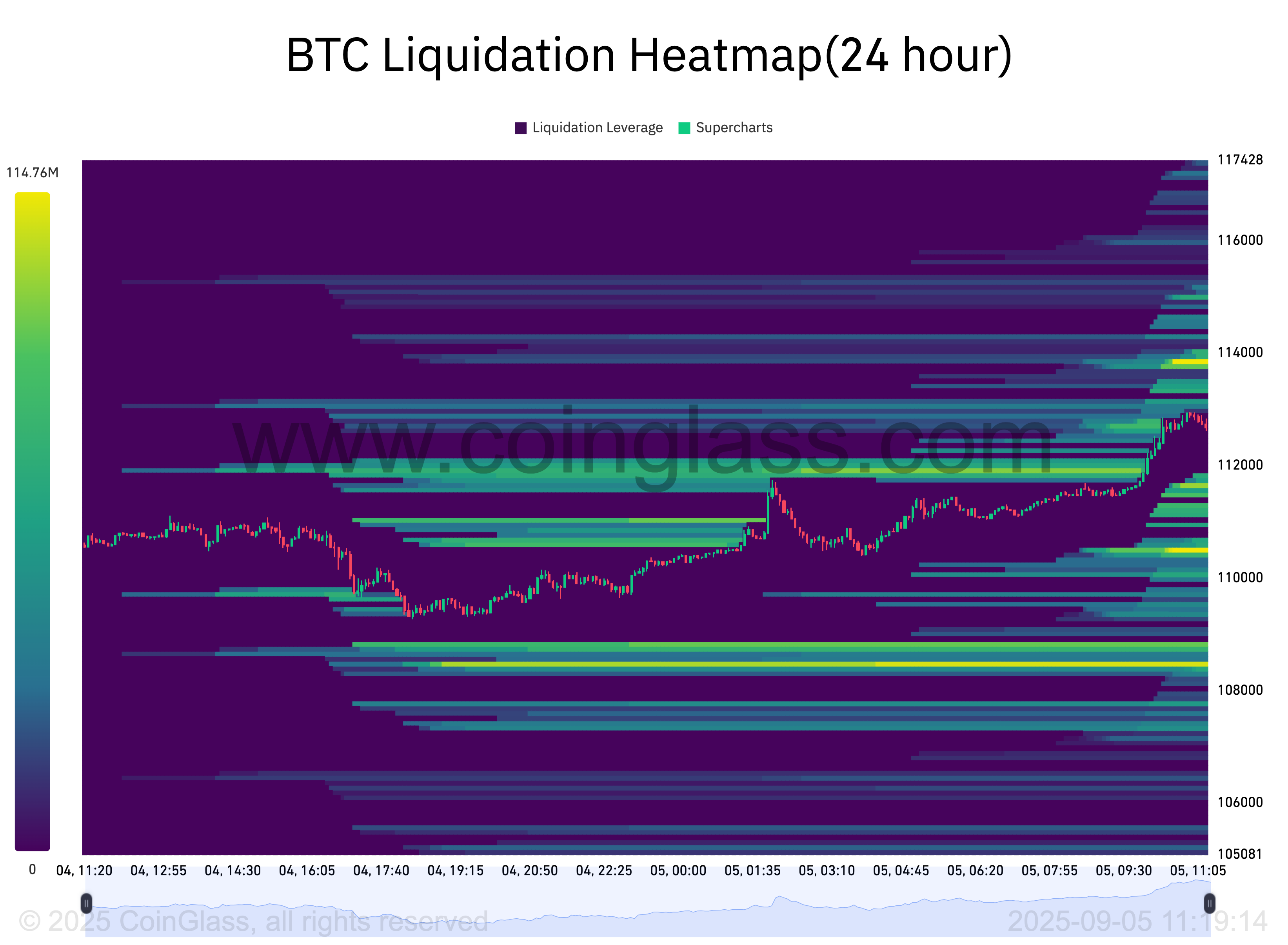

BTC/USD returned to $113,000 on Friday, with CoinGlass data showing around $100 million of crypto short liquidations in the past 24 hours.

This was enough for some to call the end of the correction from all-time highs, which began in mid-August.

“Bitcoin has technically fully confirmed its breakout,” popular trader and analyst Rekt Capital told X followers alongside a chart update.

“A Daily Close and/or retest of the ~$113k region (red) would ensure additional trend continuation to the upside.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.