With equity markets hitting record highs and the Fed Model signaling historically low valuation spreads, investors face a perplexing landscape. This post explores the intricacies of the equity risk premium, scrutinizes traditional valuation models, and introduces an updated framework to guide strategic decision-making in today’s volatile environment.

US stocks hit new record highs following Donald Trump’s re-election to the White House. Market risk appetite remains high, but equity valuations also appear elevated. The Fed Model, which measures the spread between the S&P 500 Index forward earning yield and the US Treasury 10-year yield, is currently at -0.1%, a level not seen since 2002 (See Exhibit 1).

Does the negative Fed Model speak to the end of the equity risk premium? Should investors worry about current equity valuations? In this paper, we address these questions by evaluating the Fed Model through the lens of an intrinsic equity valuation model and disentangling the equity risk premium (ERP) from equity earnings yield.

The Fed Model

The FED model has become a very popular equity valuation indicator since Edward Yardeni introduced the model in 1998. The model, as defined in equation [1], compares the equity forward earnings yield with the risk-free 10-year Treasury nominal yield. A positive value indicates the stock market is under-valued, and vice versa. The valuation spread is seen as equivalent to the expected ERP.

Fed Model = Earning yield – US Treasury 10 year nominal yield [1]

The intuition is that stocks and bonds are competing assets; therefore, buying riskier stocks only makes sense when stocks can out-earn risk-free US treasuries. However, the Fed Model has continuously faced criticism from investors for lack of theoretical foundation.

Intrinsic Equity Valuation

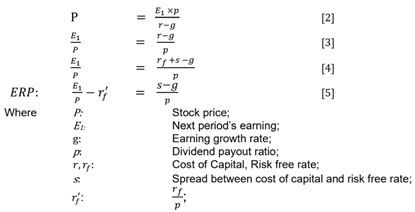

The Gordon Growth Model (GGM) provides an estimate on a stock’s intrinsic value based on the assumptions of a constant earnings growth rate, cost of capital and dividend payout ratio (See equation [2]). By following the steps described in equations 3 to 5, we can arrive at a modified version of the Fed Model depicted in Equation 5.

Compared to Yardeni’s model, the modified model no longer assumes the beta to the risk-free rate and the maturity of risk-free yields can vary. Meanwhile, the model indicates that the ERP is negatively correlated with earnings growth rates when fairly valued, i.e. higher earnings growth can lead to a narrower valuation spread. According to FactSet, S&P 500 companies are expected to see annual earnings growth of around 14% over the next two years, well above their historical growth trend.

An Empirical Framework

Many assumptions behind the GGM do not hold in the real world. For example, the growth rates vary over time; the yield curve is not flat; and so on. Without going through the extensive mathematical theory, we can adopt a generalized model as shown in equation 6 to describe the ERP as the forward equity earnings yield in excess of a linear exposure of the entire risk-free yield curve.

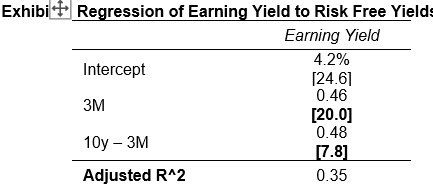

Long term beta exposures of the equity earnings yield to risk-free rate can be estimated by using linear regression techniques. In the spirit of model parsimony, I chose 3-month Treasury bill yield and yield slope (10 year minus 3 month) to approximate the entire yield curve. As shown in Exhibit 2, the beta coefficients of equity earnings yields to Treasury yields are statistically significant with t-stat > 7.0.

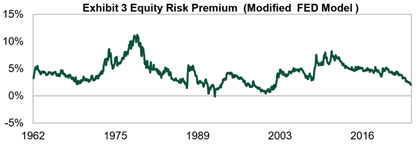

The historical ERP can then be estimated by using Equation 7 below. Exhibit 3 shows the time series of historical ERP. The current model estimate (as of November 30, 2024) is 2.0%, which indicates a narrow but still positive ERP.

Source: Bloomberg. Global Asset Allocation Quant Research. Data from 1/1962 to 11/2024. Historical trends are not predicative of future results.

Signaling Effect

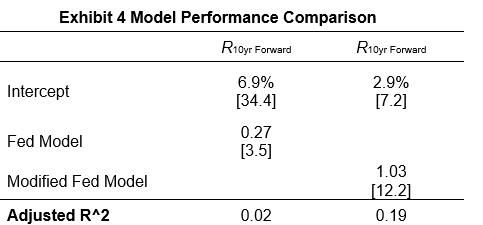

Is the Modified Fed Model a better valuation signal? To evaluate that, I built two linear models by using 10-year forward stock returns as independent variables and two equity risk premium time series as dependent variables, separately. Exhibit 4 below shows a summary of regression outputs. The modified model has a better fitness than the original model with a higher R2 and t-stat of Beta coefficients.

Valuation risk is running high thanks to a relentless market rally. The famous FED Model shows equity valuation has flipped into expensive territory. However, I believe higher-than-normal earnings growth is the main reason why the valuation spread has turned negative. Through a new valuation framework based on the intrinsic valuation model, I show that the current valuation level still provides room for positive stock returns in the near term at least.

References

Weigand, R. A., & Irons, R. (2008). Compression and expansion of the market P/E ratio: The Fed model explained. The Journal of Investing, 17(1), 55–64. https://doi.org/10.3905/joi.2008.701961

Yardeni, E., 1997. Fed’s stock market model finds overvaluation. Topical Study #38. US Equity Research, Deutsche Morgan Grenfell.

Yardeni, E., 1999. New, improved stock valuation model. Topical Study #44. US Equity Research, Deutsche Morgan Grenfell.