BitMEX co-founder Arthur Hayes says Bitcoin holders need to be more patient and stop worrying about stocks and gold hitting record highs, because asking why Bitcoin isn’t higher misses the point.

“If you thought you were buying Bitcoin and the next day you were buying a Lamborghini, you’re probably getting liquidated because it is not the right way to think about things,” Hayes told Kyle Chasse in an interview published to YouTube on Friday.

“I’m sorry that you bought Bitcoin six months ago, but anyone who bought it two, three, five, or 10 years ago, they’re laughing,” Hayes said, echoing the frustrations of recent Bitcoin (BTC) buyers who are asking why Bitcoin’s price isn’t trading at $150,000 yet.

“People need to readjust their perspective on this,” he said. Curvo data shows that Bitcoin has seen an average annualized return of 82.4% over the past ten years.

Hayes shoots down idea that Bitcoin is lagging behind

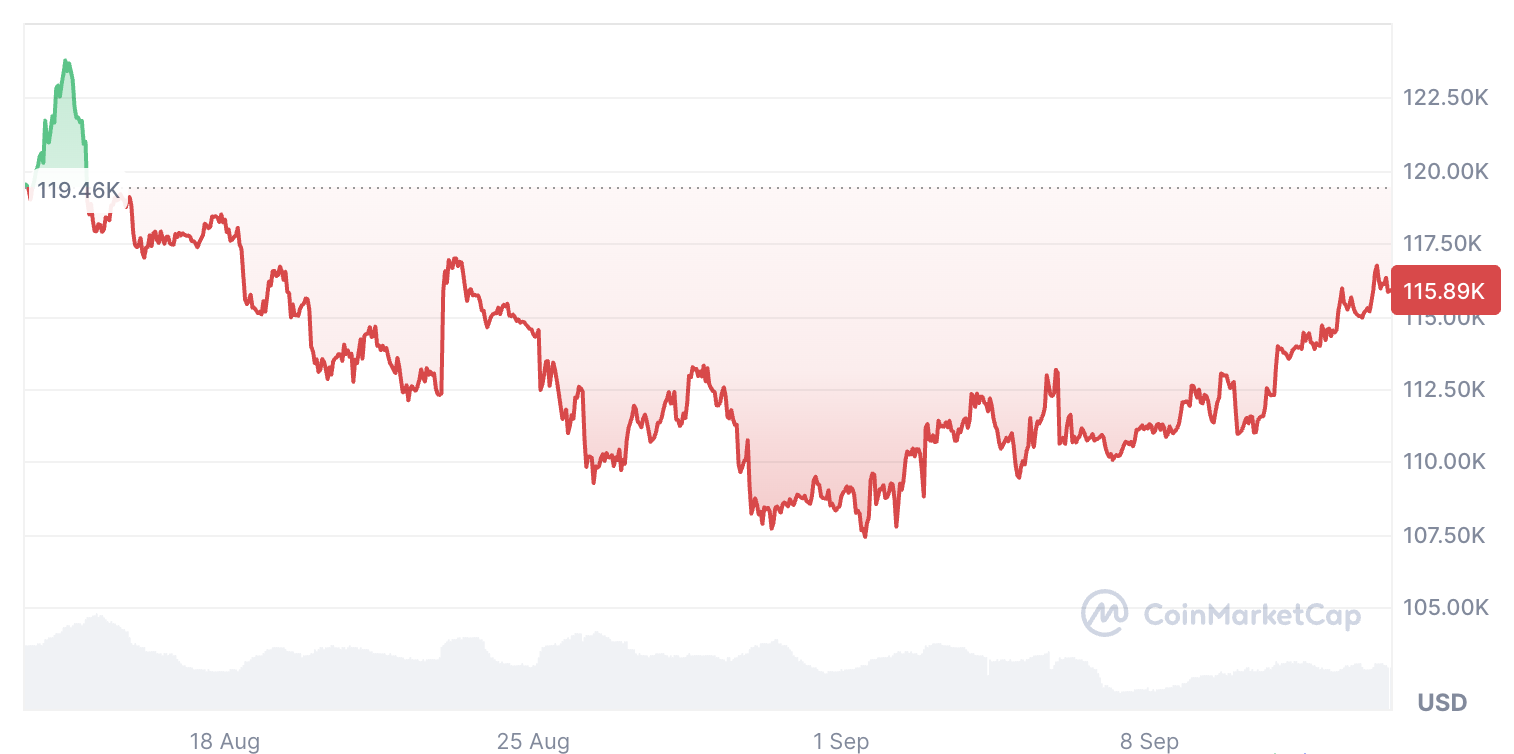

It comes as Bitcoin continues to trade below its all-time high of $124,100 reached on Aug. 14, currently sitting at $116,007 at the time of publication, according to CoinMarketCap.

Meanwhile, gold and the S&P 500 reached new all-time highs this week of $3,674 and $6,587, respectively.

Hayes dismissed the significance of these highs relative to Bitcoin and pushed back on a question from Chasse, about when Bitcoin and the broader crypto market might start attracting global M2 inflows, given that stocks and gold are hitting all-time highs.

“I think the premise of that question is flawed,” Hayes said. “Bitcoin is the best performing asset when you think about currency debasement ever,” Hayes said.

Bitcoin’s performance “is just so ridiculous,” Hayes says

Hayes said while the S&P 500 is “up in dollar terms,” it has still not recovered from 2008 when compared against the gold price. “Deflate the housing market by gold again and not anywhere close to where it was,” he added.

Related: Bitcoin reclaims $115K: Watch these BTC price levels next

“Big US tech is probably one of the only things that have done well deflated by gold,” he said.

“If you deflate things by Bitcoin, you can’t even see it on the chart; it is just so ridiculous about how well Bitcoin has performed,” he said.

In April 2025, Hayes projected that Bitcoin would reach $250,000 by the end of this year, and just a month later, in May, Unchained Market Research Director Joe Burnett made the same prediction.

Magazine: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Magazine

![Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.] Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.]](https://moneyvisa.com/wp-content/uploads/2025/07/Announcing-the-Trillion-Dollar-Security-Initiative-560x420.jpeg)