Updated on July 31st, 2025 by Bob Ciura

Income investors are always on the hunt for high-quality dividend stocks. There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

With this in mind, we created a downloadable list of over 130 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 69 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

While their length of dividend increases is the same, leading to some overlap, there are also some important differences between the Dividend Aristocrats and Dividend Champions.

As a result, the Dividend Champions list is much more expansive. There are many high-quality Dividend Champions that are not included on the Dividend Aristocrats list.

This article will discuss the Dividend Champions, and an analysis of our top 7 Dividend Champions now, ranked according to expected total returns in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Overview of Dividend Champions

The requirement to become a Dividend Champion is simple: 25+ years of consecutive annual dividend increases. The Dividend Aristocrats have the same requirement when it comes to number of years, but with a few additional requirements.

To be a Dividend Aristocrat, a company must also be included in the S&P 500 Index, must have a float-adjusted market cap of at least $3 billion, and must have an average daily value traded of at least $5 million.

These added requirements preclude many companies that possess a sufficient track record of annual dividend increases, but do not qualify based on market cap or liquidity reasons.

As a result, while there is some overlap between the Dividend Aristocrats and the Dividend Champions, there are also many Dividend Champions that are not Dividend Aristocrats.

Income investors might want to consider these stocks due to their impressive histories of annual dividend increases, so we have compiled them in the downloadable spreadsheet above.

In addition, we have ranked the top 7 Dividend Champions according to total expected annual returns over the next five years. Our top 7 Dividend Champions right now are ranked below.

The Top 7 Dividend Champions To Buy Right Now

The following 7 stocks represent Dividend Champions with at least 25 consecutive years of dividend increases, but they also have durable competitive advantages, long-term growth potential, and high expected total returns.

Stocks have been ranked by expected total annual return over the next five years, from lowest to highest.

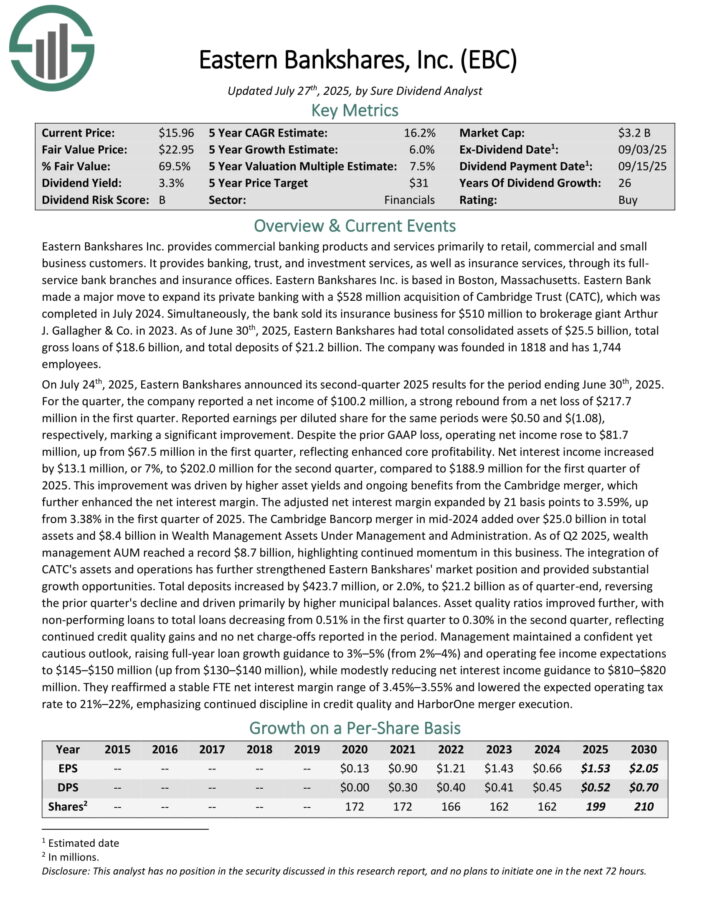

Top Dividend Champion #7: Eastern Bankshares (EBC)

- 5-year expected returns: 16.6%

Eastern Bankshares Inc. provides commercial banking products and services primarily to retail, commercial and small business customers. It provides banking, trust, and investment services, as well as insurance services, through its full service bank branches and insurance offices.

As of March 31, 2025, Eastern Bankshares had total consolidated assets of $25.0 billion, total gross loans of $18.2 billion, and total deposits of $20.8 billion. The company was founded in 1818 and has 1,744 employees.

On July 24th, 2025, Eastern Bankshares announced its second-quarter 2025 results for the period ending June 30th, 2025.

For the quarter, the company reported a net income of $100.2 million, a strong rebound from a net loss of $217.7 million in the first quarter. Reported earnings per diluted share for the same periods were $0.50 and $(1.08), respectively, marking a significant improvement.

Despite the prior GAAP loss, operating net income rose to $81.7 million, up from $67.5 million in the first quarter, reflecting enhanced core profitability.

Net interest income increased by $13.1 million, or 7%, to $202.0 million for the second quarter, compared to $188.9 million for the first quarter of 2025. This improvement was driven by higher asset yields and ongoing benefits from the Cambridge merger.

Click here to download our most recent Sure Analysis report on EBC (preview of page 1 of 3 shown below):

Top Dividend Champion #6: Andersons Inc. (ANDE)

- 5-year expected returns: 17.1%

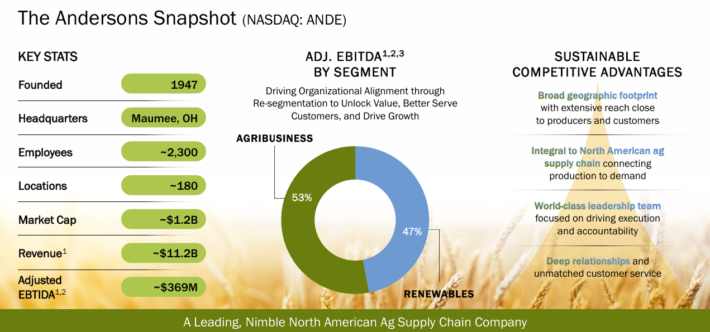

The Andersons is an agriculture company that conducts business in North America. It operates through the following segments: Trade, Renewables, and Nutrient & Industrial (formerly Plant Nutrient).

The Trade segment includes commodity merchandising and the operation of terminal grain elevator facilities. The Trade segment contributed over 68% of the company’s revenue in 2024.

The Renewables segment produces, purchases, and sells ethanol and co-products.

The Nutrient & Industrial segment manufactures, and distributes agricultural inputs, primary nutrients, and specialty fertilizers, to dealers and farmers, along with turf care and corncob-based products.

Source: Investor Presentation

On May 6th, 2025, the company reported its first quarter 2025 results for the period ending March 31st, 2025. Revenue was $2.66 billion, a decrease from $2.72 billion in Q1 2024, reflecting continued pressure in global grain markets and uncertain trade flows.

Net income attributable to The Andersons fell sharply to $0.3 million, or $0.01 per diluted share, compared to $5.6 million, or $0.16 per share in the prior year.

Adjusted net income was $4.1 million, or $0.12 per share, down from $5.6 million and $0.16, respectively.

Click here to download our most recent Sure Analysis report on ANDE (preview of page 1 of 3 shown below):

Top Dividend Champion #5: Sonoco Products (SON)

- 5-year expected returns: 18.0%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

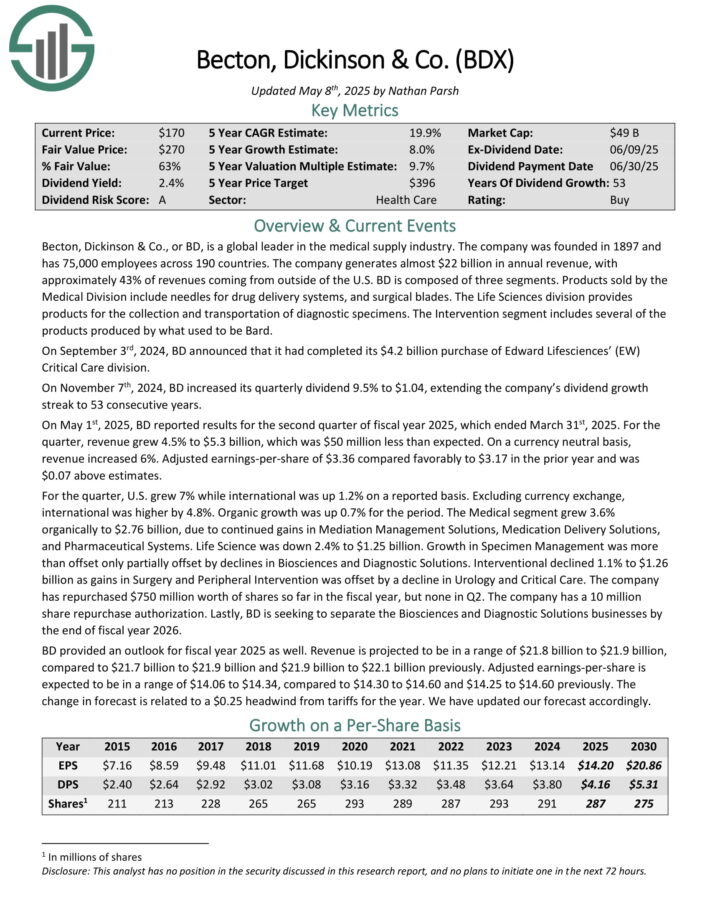

Top Dividend Champion #4: Becton Dickinson & Co. (BDX)

- 5-year expected returns: 18.4%

Becton, Dickinson & Co., or BD, is a global leader in the medical supply industry. The company generates almost $22 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S. BD is composed of three segments.

Products sold by the Medical Division include needles for drug delivery systems, and surgical blades. The Life Sciences division provides products for the collection and transportation of diagnostic specimens. The Intervention segment includes several of the products produced by what used to be Bard.

On May 1st, 2025, BD reported results for the second quarter of fiscal year 2025.

Source: Investor Presentation

For the quarter, revenue grew 4.5% to $5.3 billion, which was $50 million less than expected.

On a currency neutral basis, revenue increased 6%. Adjusted earnings-per-share of $3.36 compared favorably to $3.17 in the prior year and was $0.07 above estimates.

For the quarter, U.S. grew 7% while international was up 1.2% on a reported basis. Excluding currency exchange, international was higher by 4.8%. Organic growth was up 0.7% for the period.

Click here to download our most recent Sure Analysis report on BDX (preview of page 1 of 3 shown below):

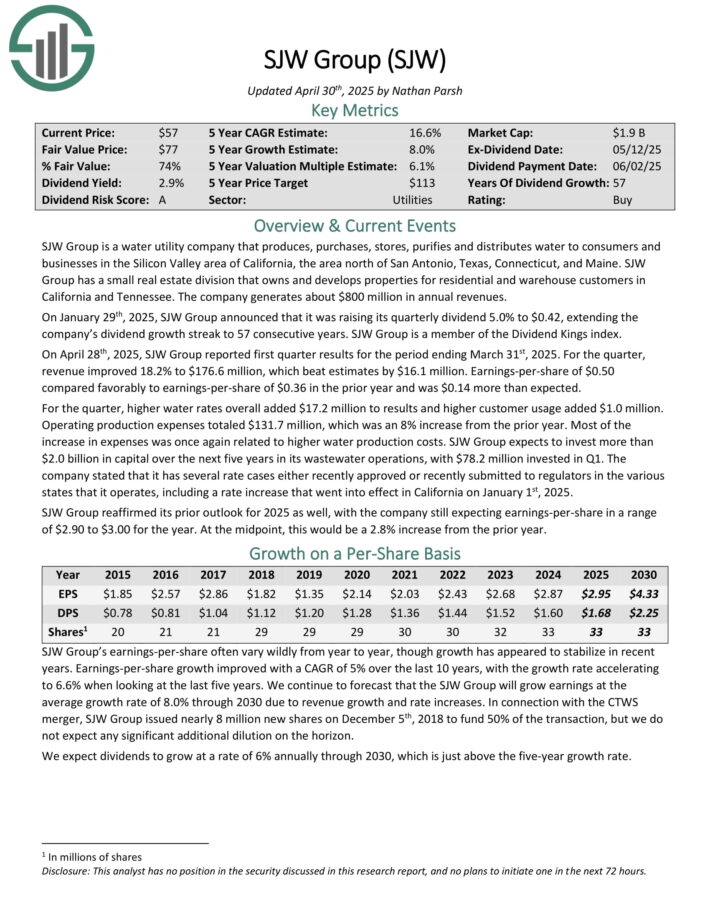

Top Dividend Champion #3: H2O America (HTO)

- 5-year expected returns: 19.9%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On April 28th, 2025, HTO reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue improved 18.2% to $176.6 million, which beat estimates by $16.1 million. Earnings-per-share of $0.50 compared favorably to earnings-per-share of $0.36 in the prior year and was $0.14 more than expected.

For the quarter, higher water rates overall added $17.2 million to results and higher customer usage added $1.0 million. Operating production expenses totaled $131.7 million, which was an 8% increase from the prior year. Most of the increase in expenses was once again related to higher water production costs.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

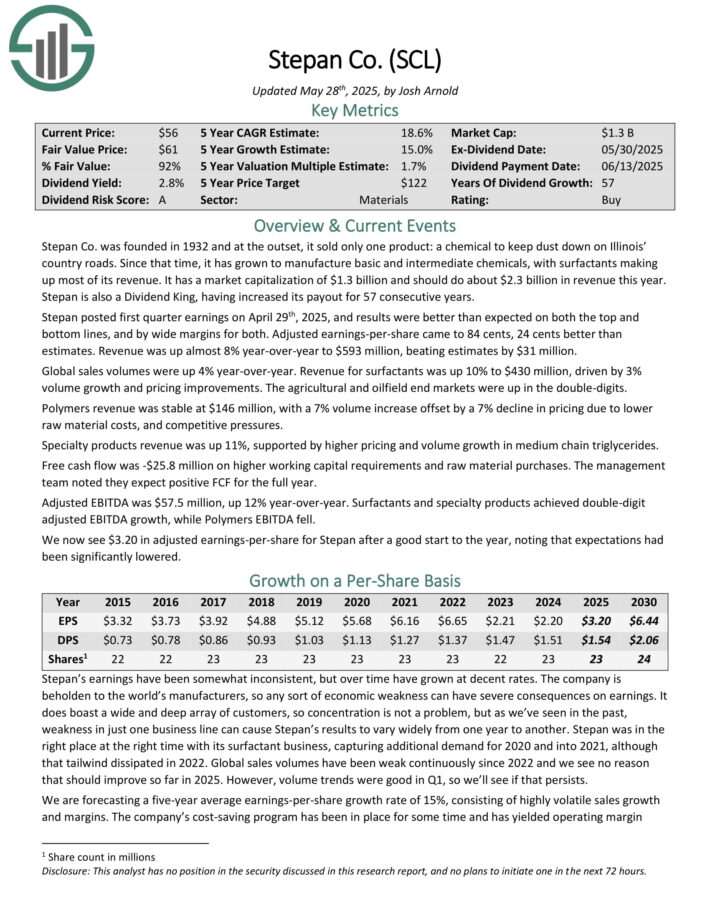

Top Dividend Champion #2: Stepan Co. (SCL)

- 5-year expected returns: 21.2%

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan is not beholden to just a handful of industries.

Source: Investor presentation

The surfactants business is Stepan’s largest by revenue, accounting for ~68% of total sales in the most recent quarter. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted first quarter earnings on April 29th, 2025, and results were better than expected on both the top and bottom lines, and by wide margins for both. Adjusted earnings-per-share came to 84 cents, 24 cents better than estimates. Revenue was up almost 8% year-over-year to $593 million, beating estimates by $31 million.

Global sales volumes were up 4% year-over-year. Revenue for surfactants was up 10% to $430 million, driven by 3% volume growth and pricing improvements. The agricultural and oilfield end markets were up in the double-digits.

Polymers revenue was stable at $146 million, with a 7% volume increase offset by a 7% decline in pricing due to lower raw material costs, and competitive pressures. Specialty products revenue was up 11%, supported by higher pricing and volume growth in medium chain triglycerides.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

Top Dividend Champion #1: Novo Nordisk (NVO)

- 5-year expected returns: 26.7%

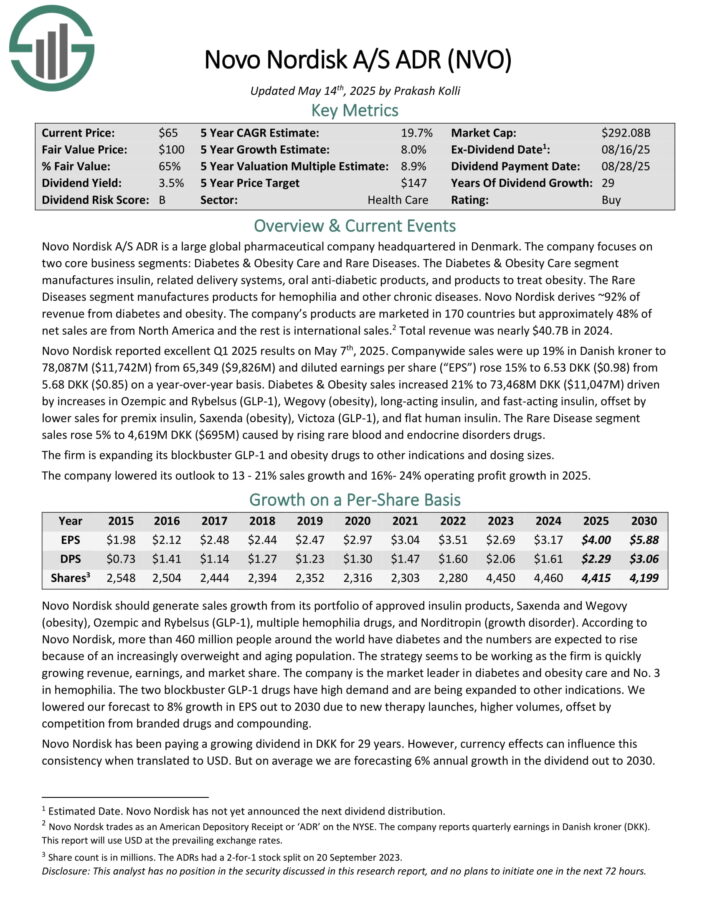

Novo Nordisk A/S ADR is a large global pharmaceutical company headquartered in Denmark. The company focuses on two core business segments: Diabetes & Obesity Care and Rare Diseases.

The Diabetes & Obesity Care segment manufactures insulin, related delivery systems, oral anti-diabetic products, and products to treat obesity. The Rare Diseases segment manufactures products for hemophilia and other chronic diseases. Novo Nordisk derives ~92% of revenue from diabetes and obesity.

Novo Nordisk reported excellent Q1 2025 results on May 7th, 2025. Company-wide sales were up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year basis.

Diabetes & Obesity sales increased 21% driven by increases in Ozempic and Rybelsus (GLP-1), Wegovy (obesity), long-acting insulin, and fast-acting insulin, offset by lower sales for premix insulin, Saxenda (obesity), Victoza (GLP-1), and flat human insulin.

The Rare Disease segment sales rose 5% caused by rising rare blood and endocrine disorders drugs. The firm is expanding its blockbuster GLP-1 and obesity drugs to other indications and dosing sizes.

The company lowered its outlook to 13 – 21% sales growth and 16%- 24% operating profit growth in 2025.

Click here to download our most recent Sure Analysis report on NVO (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks.

In order for a company to raise its dividend for at least 25 years, it must have durable competitive advantages, highly profitable businesses, and leadership positions in their respective industries.

They also have long-term growth potential and the ability to navigate recessions while continuing to raise their dividends.

The top 7 Dividend Champions presented in this article have long histories of dividend growth, and the combination of high dividend yields, low valuations, and future earnings growth potential make them attractive buys right now.

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 55 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.