Key Points

- Popular AI tools consistently got the basics of Public Service Loan Forgiveness (PSLF) right, but faltered on more complex questions about repayment plans and forbearances.

- Google’s Gemini provided the most accurate and complete answers, while other systems, including ChatGPT, Grok, and Perplexity, gave incomplete or incorrect guidance.

- Borrowers should rely on official Department of Education resources or information from real human experts rather than AI for critical details about PSLF eligibility and rules.

Public Service Loan Forgiveness is one of the most sought-after federal student loan forgiveness programs, promising debt cancellation after 120 qualifying payments for borrowers who work in government or nonprofit jobs.

But this program has also been plagued by years of confusion, regulatory changes, and uneven implementation. The whiplash for some borrowers has been intense. With AI growing in popularity, some student loan borrowers are using it to get answers to technical questions.

But can AI actually be trusted to explain a program as complex as PSLF?

To find out, we posed a series of questions to four leading AI platforms (ChatGPT, Google Gemini, Grok, and Perplexity) ranging from the most basic definition of PSLF to more detailed scenarios. While all four tools correctly explained the basics, most stumbled when asked about nuanced issues such as whether the SAVE plan’s administrative forbearance counts toward forgiveness, whether the new Repayment Assistance Plan (RAP) qualifies, and whether a borrower’s loan must be serviced by MOHELA.

The results show that AI may be useful for simple answers but cannot yet replace official resources or expert guidance when it comes to navigating student loan forgiveness.

Would you like to save this?

What AI Tools Got Right About PSLF

Every system we tested correctly defined PSLF at a high level: a program that cancels the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time for an eligible employer. The tools explained that qualifying employers include government agencies and nonprofit organizations, and that repayment must be made under an income-driven plan or the 10-year standard plan.

For borrowers just learning about PSLF, these answers were generally accurate and helpful. The tools also highlighted the requirement that only Direct Loans qualify, and that FFEL or Perkins Loans don't qualify unless they are consolidated first.

This baseline accuracy is important, but it's also the simplest because it's defined clearly across multiple websites. For basic PSLF education, AI appears to be a reasonable starting point.

Where AI Went Off Track

The real test came with more complex questions.

On whether the SAVE forbearance counts toward PSLF, only Google Gemini offered a somewhat decent answer, but after multiple paragraphs that seem inappropriate for the question. The answer is simple: time in SAVE forbearance does not count, except potentially through the PSLF “buyback” process if the borrower qualifies.

ChatGPT, Grok, and Perplexity all gave inconsistent or incomplete responses, with some suggesting incorrectly that SAVE-related pauses might be credited like the COVID-era payment pause.

For example ChatGPT answered a clear “yes”: If your loan is placed into an administrative forbearance by the Department of Education (for example, during the pandemic payment pause, or due to servicing errors while rolling out the SAVE plan), those months can count toward PSLF. But this isn't correct.

When asked whether the new Repayment Assistance Plan created under the One Big Beautiful Bill Act (OBBBA) qualifies for PSLF, the answers diverged widely.

Gemini correctly identified RAP as a qualifying income-driven repayment plan beginning in 2026. ChatGPT also recognized RAP’s eligibility but hedged that the Department of Education had not finalized guidance (even though this is incorrect and it was written into the OBBBA that RAP qualifies).

Grok, however, incorrectly denied RAP’s existence as a repayment option, suggesting it must have been a typo.

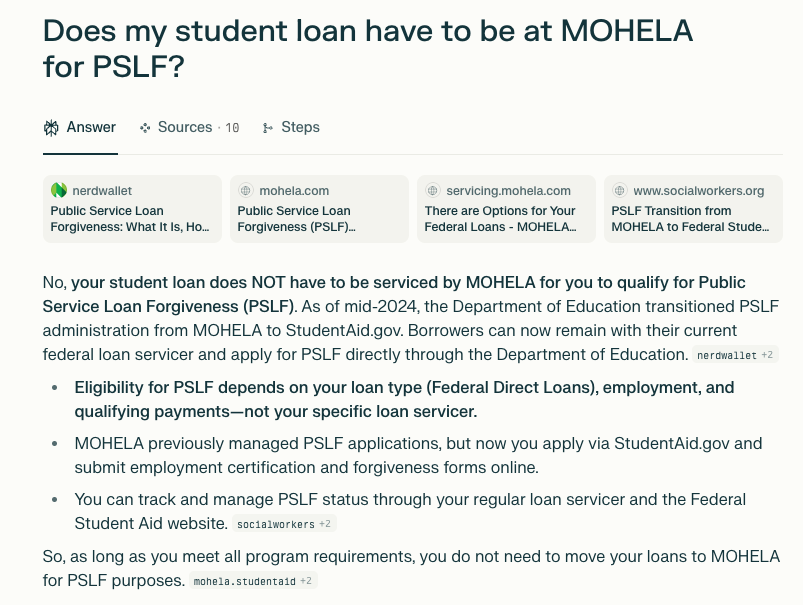

Even on the relatively straightforward question of whether loans must be serviced by MOHELA to count for PSLF, responses varied. Gemini and Perplexity correctly explained that servicing is now managed through StudentAid.gov and that loans can remain with any federal servicer.

ChatGPT suggested loans eventually move to MOHELA for tracking, reflecting outdated information. Grok gave a partial answer that was accurate in describing Direct Loan eligibility but incomplete in its explanation of MOHELA’s limited current role.

Why Accuracy Matters For Student Loan Borrowers

The gaps in AI responses highlight why borrowers should be cautious when using AI tools for financial decisions. Mistakenly believing that months in SAVE forbearance count toward forgiveness could delay cancellation by years. Misunderstanding whether RAP qualifies might lead borrowers to choose the wrong repayment plan. Confusion about servicer requirements could result in incorrect paperwork or confusion.

Because PSLF has historically been one of the most error-prone and complaint-heavy programs in federal student aid, accuracy is not optional. The Department of Education has repeatedly updated PSLF rules through waivers, account adjustments, and negotiated rulemaking. Each change has created new exceptions and caveats that AI systems often fail to capture fully.

Last year our study found that AI was incorrect in 43% of queries – and today's test around loan forgiveness is mirroring those results. If AI tools repeat those errors, the consequences for borrowers could be significant.

Safer (And Smarter) Alternatives For Borrowers

Borrowers seeking reliable information on student loan forgiveness should continue to rely on official resources or actual human experts:

- Studentaid.gov: The Department of Education’s website hosts the PSLF Help Tool, which verifies employer eligibility and tracks payment counts.

- Loan servicers: While imperfect, loan servicers remain the official point of contact for processing payments and forms. It's also important to note that loan servicers cannot give you information on future programs like RAP – they can only discuss current options that may work for you.

- Media organizations that specialize on education and personal finance: Highlighting our team, who has decades of experience discussing and covering student loans and personal finance and has testified before Congress, visited the White House, and continually reports on student loan and higher education policy.

- Certified professionals: For personalized advice, borrowers can consult financial planners or student loan lawyers that specialize in student loan debt.

@thecollegeinvestor Where can you find student loan information you can trust? Where are the accurate sources of information? Here’s a list of experts and creators we know and trust. @Jay | Student Loan & Debt Law @Student Loan Solutions @Student Loan Planner @Tara Talks Finance @Stanley Tate #greenscreen ♬ original sound – The College Investor

AI tools can provide a helpful overview, but borrowers should always cross-check information with official sources.

Bottom Line

AI is not ready to help you navigate Public Service Loan Forgiveness.

While the technology is improving, it still struggles with the nuance and exceptions that can make or break eligibility. For now, AI should be treated as a supplementary tool, not a primary source.

Borrowers who want to ensure they are on track for forgiveness should document their employment, submit PSLF forms regularly, and consult the Department of Education directly. AI may someday help simplify student loan programs, but today, it remains a work in progress.

Don't Miss These Other Stories:

Editor: Colin Graves

The post AI Still Falls Short On Student Loan Forgiveness appeared first on The College Investor.