Nvidia is now the first company to surge past $4 trillion in market capitalization, rebounding from its DeepSeek-induced slump earlier this year. Other AI chipmakers, including AMD and China’s Huawei, are reporting strong financial results. Nearly every major chipmaker is now centering its strategy on AI.

But what if AI doesn’t work out?

This isn’t just a hypothetical question. Some signs suggest that AI growth is stalling, or at least slowing down. New models no longer show significant improvements from scaling up size or the amount of training data. Nobel laureate Demis Hassabis recently noted that “we are no longer getting the same progress” on AI development. Andreessen Horowitz, one of the most prominent investors in AI, similarly shared concerns that AI model capabilities appeared to be plateauing.

One reason for AI’s slowing performance might be that models have already consumed most available digital data, leaving little left over for further improvement. Developers are instead turning to synthetic data, but it might be less effective—and might even make models worse.

AI development is also enormously capital intensive. Training the most advanced models requires compute clusters costing billions of dollars. Even a single training run can cost tens of millions of dollars. Yet while development costs keep going up, monetary rewards are limited. Aside from AI coding assistants, there are few examples of AI generating returns that justify these immense capital investments.

Some companies are already scaling back their AI infrastructure investment due to cost. Microsoft, for example, is “slowing or pausing some early-stage projects” and has canceled equipment orders for several global data center projects. Meta, AWS and Google have all reportedly cut their GPU orders. Chip bottlenecks, power shortages, and public concerns are also barriers to mass AI adoption.

If the AI boom peters out, that’s bad news for the chip industry, which has used this new technology to avoid a serious slump.

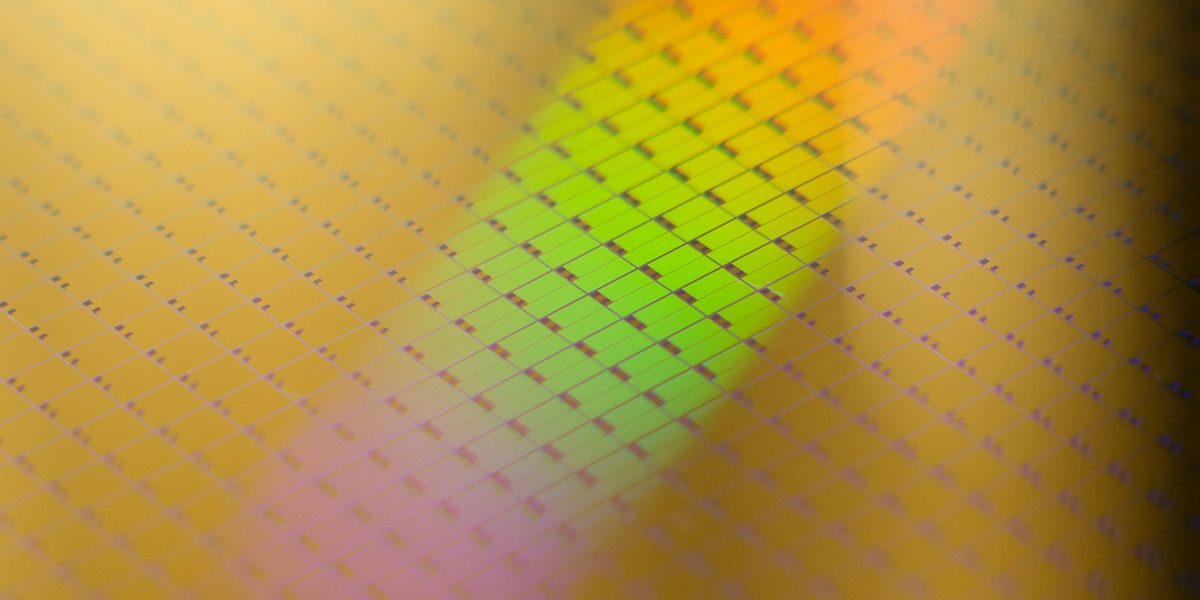

Chips are getting more expensive to make. Developing new manufacturing processes cost billions of dollars; building new plants can cost tens of billions of dollars. These costs are all passed onto consumers but, outside of AI, customers aren’t keen on buying more expensive chips. The fancy technologies in today’s AI processors aren’t that useful for other purposes.

AI delayed an industry reckoning: Manufacturing is getting more expensive, while performance gains are shrinking. The economic promise of AI justifies high chip prices, but if that goes away, the chip industry needs to find something else to persuade people to sustain investment in advanced chip manufacturing. Otherwise, advanced chipmaking will become unsustainable: New technologies will cost more and more, while delivering less and less.

A chip industry slump will upend several geopolitical and economic objectives. Governments have poured billions of dollars into building domestic chip industries. U.S. President Donald Trump routinely threatens to use tariffs to bring semiconductor manufacturing back home.

The U.S.’s supposed lead on chip development may prove to be a mirage, particularly as China dominates legacy chip production. And an AI reversal would shake up the world’s tech sector, forcing Big Tech to rethink its bets.

Given these stakes, policymakers need to encourage further innovation in AI by facilitating easier access to data, chips, power, and cooling. This includes pragmatic policies on copyright and data protection, a balanced approach to onshore and offshore chip manufacturing, and removing regulatory barriers to energy use and generation. Governments shouldn’t necessarily apply the precautionary principle to AI; the benefits are too great to handicap its development, at least at these early stages. Nor should large-scale AI applications, such as autonomous vehicles or home robotics, face unreasonably high requirements for implementation.

Investors should also explore alternate AI approaches that don’t require as much data and infrastructure, potentially unlocking new AI growth. The industry must also explore non-AI applications for chips, if only to manage their risk.

To ensure the chip industry can survive a slowdown, it must reduce the cost of advanced chipmaking. Companies should work together on research and development, as well as working with universities, to lower development costs. More investment is needed in chiplets, advanced packaging, and reconfigurable hardware. The industry must support interoperable standards, open-source tools, and agile hardware development. Shared, subsidized infrastructure for design and fabrication can help smaller companies finalize ideas before manufacturing. But, importantly, the drive to onshore manufacturing may be counterproductive: Doing so carelessly will significantly increase chip costs.

The future of chips and AI are now deeply intertwined. If chips are to thrive, AI must grow. If not, the entire chip sector may now be in jeopardy.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.