Listen and subscribe to Decoding Retirement on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

Retirement is no longer just about rocking chairs, gardening, grandchildren, or afternoons on the golf course.

Instead, it's evolving from what many consider a traditional retirement into something much more dynamic, said Andy Smith, executive director of financial planning at Edelman Financial Engines.

“I think it's important that people remember that there is no one-size-fits-all solution to retirement, to retirement planning,” Smith said in a recent episode of the Decoding Retirement podcast (see video above or listen below). “There's no one right way to retire.”

This embedded content is not available in your region.

Historically, many saw retirement as a time to focus on relaxation and family, he added. But that vision is changing.

“Nearly four in 10 Americans, about 39% of respondents, said that they want this adventurous retirement,” Smith said, citing the firm's Everyday Wealth in America report. “And 42% of respondents said that they wanted to stay active. There is this growing number who are thinking about or even envisioning this minimalist or even nomadic lifestyle.”

This shift requires both retirees and advisers to rethink how they plan for income and expenses. Instead of a linear, one-time retirement transition, planning needs to account for whether retirement unfolds all at once or in phases, Smith said.

Will there be part-time work, consulting, or income from travel or passion projects? How often will you travel, and during what part of the year? These questions impact not just your budget, but how and when you withdraw your money.

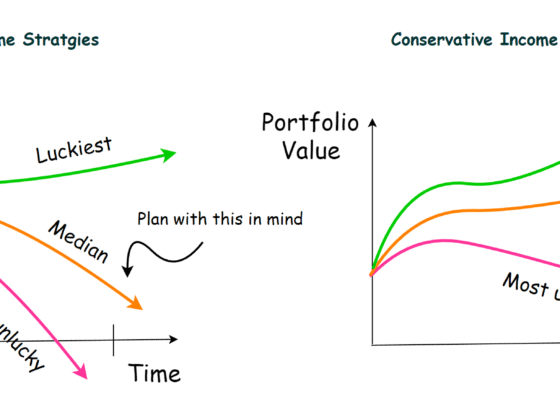

Previously, the conventional approach was to estimate a retirement nest egg, adjust for inflation and taxes, and draw down steadily. But that approach is giving way to a segmented plan, Smith said.

“What will the first three to five years look like? What about the next three to five?” he asked. “And if people can see how that manifests over time, then they can feel a lot more comfortable about spending different dollars in different ways.”

Smith noted that one challenge begins once you retire: deciding how to withdraw from a mix of accounts — Roth IRAs, traditional 401(k)s, HSAs, brokerage accounts, and Social Security — without triggering unnecessary taxes.

The key, Smith said, is having a comprehensive financial plan. “You have to figure out what you have and how much you have before you can ever build this sort of roadmap.”