00:00 Speaker A

Well, stocks fell this week as investors assess President Trump’s latest tariff threats. But according to StockTwits, retail investors are buying the dip. For more, let’s welcome in now Tom Bruni, StockTwits editor in chief and VP of Community. Tom, it is always great to see you on set.

00:15 Tom Bruni

Thanks for having me, Josh.

00:17 Speaker A

So let’s maybe recap some recent news, also look ahead. We had that, we had this surprise downgrade by Moody’s. On StockTwits, how did people respond to that? I’m sure were they, were they selling, Tom? Were they buying the dip? What was their response?

00:31 Tom Bruni

In general, people are still in that buy the dip mentality. So we saw that throughout the sell off in April. Since the lows, we see people going back to those key themes, you know. Despite what’s happening with the tariffs day to day, we still really haven’t seen the impact of those. They haven’t really been making their way through the company supply chains and all the actual earnings. And so all we have is speculation right now. And I think there’s this underlying tone that people feel like, you know, Trump and the administration are using the stock market, the bond market, markets in general, public perception as a scorecard. And so in many instances people are seeing tariffs as a short term thing as opposed to a longer term proposition.

01:27 Speaker A

So you see evidence, at least at StockTwits, okay, folks are still broadly constructive.

01:34 Tom Bruni

Yeah.

01:35 Speaker A

When they’re looking for opportunity, I’m curious where are they looking for it?

01:40 Tom Bruni

Yeah, so we did a poll about a week ago. We asked, you know, the S&P is up 20% of its lows. What are you doing at this point? Are you buying? Selling? Holding? 55% of people were buying, another 16, 20% were holding. So 75% of people are still looking for opportunities and I think it comes back to the technicals, right? You know, we’ve seen constructive price action under the surface. You’re seeing rotation in some of these core themes. So we talk about nuclear that got some movement today on the back of yesterday’s executive order. We’re talking about quantum computing. We’re talking about other AI plays. So depending on the news of the week and the catalysts that are popping up, you’re seeing this rotation under the surface. And for quantum computing specifically, we asked the community what’s your top play? And I think it was 42% of people said that QBTS is their top pick and there was a Barron’s interview…

02:51 Speaker A

Why D-Wave? Why?

02:56 Tom Bruni

Yeah, there was a Barron’s interview where, where the CEO said they wanted to be the Nvidia of quantum computing so…

03:06 Speaker A

I saw that. Right. Right. It doesn’t, sure.

03:11 Tom Bruni

Exactly. So I think that along with, I think they’re a little further ahead, like fundamentally, than some of their competitors. And so the catalyst of those two plus the underlying momentum, technically helped it.

03:25 Speaker A

What about crypto, ‘cause I know you guys have been making moves there as a platform.

03:30 Tom Bruni

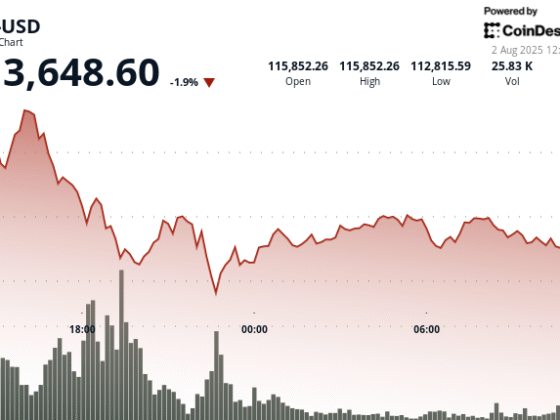

Yeah, crypto is a big focus for retail. And as StockTwits, we launched a huge initiative last week called CryptoTwits. So we’ve always been a platform for educating investors, providing an outlet for communities to come together and explore markets for kind of profit and joy. And so we’ve always had crypto on the platform but what we’ve rolled out is a unique, tailored experience with new tools, you know, 17,000 coins and tokens listed, new educators to follow. So it’s really an opportunity for traditional finance and crypto to come together on one platform. And as we’re seeing more and more traditional finance people start to adapt crypto into their portfolio, this seems like the perfect time for StockTwits to meet that demand.

04:25 Speaker A

So it’s about right now, it’s crypto, it’s AI, nuclear, quantum. Who is the StockTwits user right now, Tom? Who’s the? I mean is there an average demo? Are you seeing it evolving over time?

04:42 Tom Bruni

Yeah.

04:43 Speaker A

Yeah.

04:44 Tom Bruni

Yeah, so we definitely skew in the 25 to 40 range, educated, has money to invest. But we typically find that people are taking a core and explore type approach. We’ve talked about it in the past, you know, 75% of their assets maybe in the low, slow index funds. But then 25%, we’re seeing them swing for the fences looking for that alpha. And that’s why we see people gravitate toward these higher growth, higher potential, higher risk, higher reward areas like crypto, like AI, like nuclear. And so, yeah, we’re continuing to see appetite. Despite the day-to-day noise, crypto is the place to be. And of the survey that we recently put out, 55% of people on StockTwits think that Bitcoin could hit 150K in 2025. So still another 40% away but we shall see.

05:44 Speaker A

Line in the sand. God. Tom, thank you, sir. Always appreciate having you.

05:50 Tom Bruni

Thank you for having me.