Energy bills are to fall by £129 from July, regulators have announced, easing pressure on British households after three consecutive increases.

Ofgem, the energy regulator, has set its price cap – the amount suppliers are allowed to charge their customers – at £1,720 per year, falling from its current cap of £1,849.

It follows three consecutive increases in bills that have heaped pressure on consumers and driven the rate of inflation up. Ofgem changes its price cap every three months.

Energy industry analysts at Cornwall Insight this week predicted that another “modest drop” would follow in October, with another to come in January.

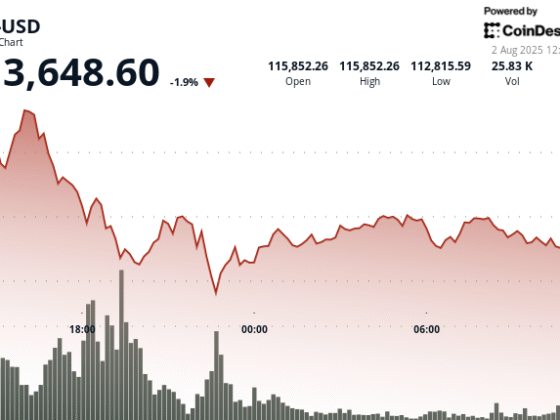

The fall in household’s bills comes after Donald Trump’s trade war hammered gas and oil prices as uncertainty over tariffs weighed on prices.

At the same time, Opec cartel members have been pushing through oil production increases, adding further downwards pressure.

Dr Craig Lowrey, of Cornwall Insight, said on Friday: “This fall in the energy price cap is undoubtedly welcome news for households, offering a degree of relief at a time when many are grappling with high living costs, and rising inflation.

“Lower prices in the warmer months are helpful, but the real benefit could come in October. With energy use typically rising as we head into winter, any drop in bills later in the year would be especially valuable for families trying to manage the high costs in the lead up to the Christmas period.”

However, he warned that the energy market “remains unpredictable”.

He said: “We know recent declines in wholesale prices have helped bring the cap down, but global events – from geopolitical negotiations to shifts in trade and weather – can quickly reverse that trend.

“Plus, even with the cap coming down, bills are still higher than what we used to consider ‘normal’, so support is still very much needed.”

It comes as worries are mounting over the amount of historical debt racked up by British households as prices soared in recent years. The total amount of debt and arrears owed to suppliers hit £3.8bn at the end of 2024.

Tim Jarvis, the director general of markets at Ofgem, said on Friday that the regulator was looking at ways it could address historical debts.

He told BBC Radio 4’s Today Programme: “We have to get on top of that number. It has been increasing significantly over the last year or two, as people have been struggling with their bills.

“And it’s a problem, not just for those people who are in debt… and the stress that it causes, but it’s something that we all pay for in our prices.”

Sharon Graham, the general secretary of Unite, said: “Ofgem has lowered its cap, but our bills are still sky high and nobody has any faith left in this regulator, which allows multinational companies to extract obscene profits from our energy system.