Back in lesson one, we looked at the main reason why we invest our money – which is to retain its spending power.

By keeping our money in a cash savings account and retaining the interest it generates over time, we can hope to at least keep up with inflation.

Hurrah! We’re not getting any poorer.

But we’re also not getting richer:

- We’re only keeping track with inflation…

- …and to do so, we can’t spend much – if any – of the interest earned.

Super-investors like Warren Buffett didn’t become multi-billionaires by saving into cash accounts.

In fact, it’s very hard to even retire comfortably if all we do is match inflation with our savings.

Please sir, can I have some more?

You need a savings pot of roughly £500,000 to generate an income of around £20,000 a year.

Let’s imagine you’re 40. You want to retire at 65, and you already have £100,000.

You can quickly calculate you might need to save at least £10,000 every year into your cash account to reach your £500,000 target in today’s money.

(Your pot by 65 in this example would be around £700,000. But remember: inflation will have eroded its spending power. So we’re assuming that £700,000 will only buy what £500,000 gets you today.)

Finding £10,000 a year in cash to save is very hard for most people. (It’s easier when using a pension, especially if your employer contributes.)

Ideally we want our money to work much harder to generate more of what we’ll need to enjoy a comfortable retirement.

Desperately seeking a better return than cash

The good news is there are plenty of other places we can put our money to work besides cash.

Examples: Corporate and government bonds, shares (equities), property, and gold.

The bad news is all of these options introduce new risks that we must take in order to have a shot at the potentially higher rewards they offer.

Cash is the only completely safe investment – and even it faces risks like bank crashes, or the risk that the interest we’re paid is inadequate to keep up with inflation.

Risk and return 101

Like a lot of investing, talk of risk and reward (i.e. the return you make on your money) can sound off-putting

But actually you’ll already understand the basics.

That’s because there are lots of different kinds of risk/return situations in everyday life:

- The lottery – astronomical one-off odds that you’ll win (/return) a lot of money.

- Learning to drive – the chance of an accident falls over time, but never to zero.

- Tossing a coin – 50/50 chance each time. Over many tosses it averages out.

- Russian roulette – ‘only’ a 1/6 chance of death at first. Rises to 6/6 eventually.

Investing risk similarly comes in different shapes and sizes.

Risk and return three ways

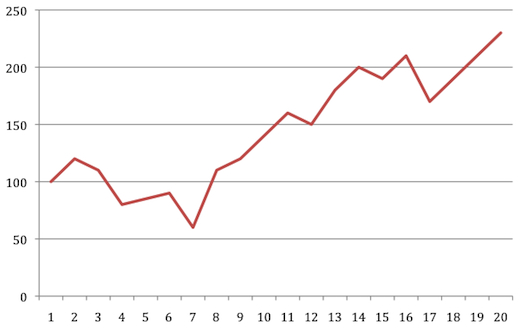

Remember the smooth graph of returns from cash we saw in lesson one?

Let’s call it Graph A:

Every year we have more money than before. That’s ideal, surely?

Well, compare it to the value of our investment over time in Graph B below – and pay attention to the ‘Y’-axis:

Graph B shows a much riskier investment. Risk here is synonymous with volatility – the value of this investment goes up (yay!) but also down (boo!)

You can see we even fell below our initial starting point for a while, before eventually coming good.

We endured this volatility for higher returns.

Things would have been very different if we’d cashed out early in year seven. We’d be down 40% on our starting capital.

That’s important: even when you invest for the long term, taking risks isn’t guaranteed to pay.

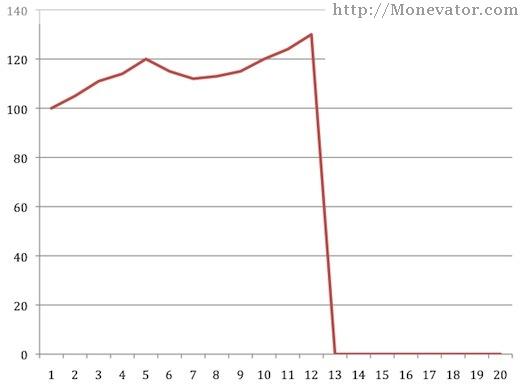

Introducing Graph C:

This time things started well, but in year 13 disaster struck. We lost the lot!

(How? Perhaps we invested in a failed company like WeWork or Northern Rock, or a buy-to-let apartment that burned down without insurance.)

Risk versus reward

These various graphs reveal two key risks when investing:

- Volatility – the risk of your investments going up and down in value.

- Capital loss – the risk of permanently losing some or all your investment.

Which of the following three investments do you prefer?

- Investment One goes up like Graph A for a final value of 150

- Investment Two goes up and down like Graph B for a final value of 150

- Investment Three bounces around even more than Graph B, before ending at 200

The sensible answer is to prefer Investment One to Investment Two. Why put up with sleepless nights from volatility for no extra reward in the end?

Investment Three might be worth it, provided you can take the volatility. But what if there’s a 10% chance of Graph C – a total wipeout?

And there’s the final snag. We don’t know what the graphs will look like in advance.

Hence we can never be sure how our returns will play out until the end.

Almost all investing decisions boil down to this interplay of risk and reward.

If something looks too good to be true, then you are probably not seeing all the risks.

Key takeaways

- The safest investment (or asset) is cash.

- There’s no point taking extra risk if you don’t expect a higher reward.

- Risk can mean volatility.

- But risk can also mean the chance of a permanent capital loss.

We’ll see as we go through this series that the best way to manage these risks is to diversify your money across different kinds of assets, to reflect your personal attitude towards risk and investment.

This is one of an occasional series on investing for beginners. Subscribe to get all our articles by email and you’ll never miss a lesson! Why not tell a friend?