The valuations of these stocks make them very appealing.

Technology stocks are ruling Wall Street these days. While the Dow Jones Industrial Average shows an 11% gain in 2025, and the S&P 500 is slightly better at 16%, major tech funds are doing much better, with gains around 25% (at the time of this writing).

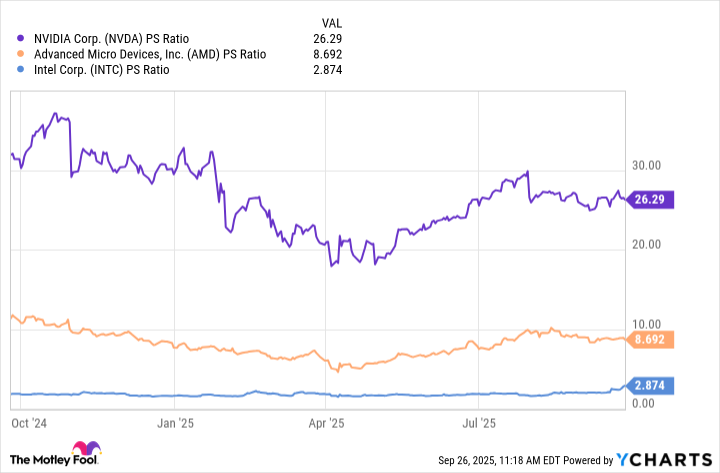

The takeaway? If you're going to beat the market this year, you need to be looking at tech stocks. But there are pockets of investors who are spooked by the crazy valuations that some tech stocks have — many of these companies are priced based on what investors believe their growth will be two or three years down the road. And they are reluctant to buy stocks with a sky-high price-to-sales (P/S) ratio.

However, there are many tech stocks that are much more affordable compared to their peers. And that's where you can find some cheap tech stocks to buy if you want to get in on the technology bandwagon.

Image source: Getty Images.

1. Intel

Intel (INTC -2.74%) has been a beleaguered tech stock for a while, but there are a few tailwinds right now that look like they might help the chipmaker turn things around.

Intel is the market leader in the data center central processing unit (CPU) space and recently secured a deal with the U.S. government to take a 9.9% stake. The deal, which is designed to encourage the development of high-end semiconductors in the U.S., gave Intel stock a boost when it was announced in August.

The company followed that up with a $2 billion investment from Japan's SoftBank, and then this month announced a $5 billion investment by Nvidia as part of a collaboration that will have the companies work together on data center and PC products.

Now Intel looks like a completely different company than it did at the beginning of the year. Intel stock is up 75% so far this year, but Intel still can be had for a low P/S ratio of 2.8 — much lower than you would get from either Nvidia or Advanced Micro Devices.

NVDA PS Ratio data by YCharts

2. Salesforce (CRM)

Salesforce (CRM -3.35%) operates a customer relation management platform and cloud-based software that allows companies to operate their sales, customer service, and marketing.

The company touts its artificial intelligence (AI)-powered Salesforce Customer 360 platform as a place where users can get a complete view of its customer data, which allows them to manage relationships, gain insights, and improve productivity.

Salesforce's second-quarter revenue of $10.2 billion was up 10% from a year ago, and its data cloud and AI annual recurring revenue jumped 120% from last year to $1.2 billion. It raised its full-year revenue guidance to a range of $41.1 billion to $41.3 billion, which would be up nearly 9% from last year.

But there are concerns — the stock is down 25% this year because revenue growth slowed to the single digits. CEO Marc Benioff shook off the criticism in an interview with CNBC, saying that the company's results are “absolutely fantastic” and the company guidance is “appropriately conservative.”

This may be a name you can buy on the dip. Salesforce stock is also cheap right now, with its P/S ratio falling to under 6.

3. Amazon

Maybe you wouldn't think that one of the biggest companies in the world would also be cheap. But Amazon (AMZN -1.09%) is, compared to its peers. In fact, it's by far the cheapest member of the “Magnificent Seven” grouping of tech stocks that pretty much rules Wall Street (when measured by P/S ratio).

AMZN PS Ratio data by YCharts

Amazon's e-commerce engine brought in $136.7 billion in sales in the second quarter, but the real power in this company is its cloud computing division. Amazon Web Services is the biggest cloud provider in the world with a 30% market share. It earned $30.87 billion in revenue from AWS in the quarter and $10.16 billion in profits. That's more than $1 billion more in profits than the e-commerce side brought in.

While it's bringing in a lot of money, it's spending it even faster. Amazon says it plans to spend $100 billion this year on capital expenditures for artificial intelligence as it builds out and expands its data centers. The company is building more than 1,000 generative AI applications to support its shopping, coding, advertising, streaming video, and more.

The investments should pay handsomely for Amazon in the future, which makes this a very appealing cheap tech stock to buy.

The bottom line

If you're looking to beat the market today (and tomorrow), you don't have to buy the most expensive tech stocks. Intel, Salesforce, and Amazon give investors exposure to semiconductors, artificial intelligence, cloud computing, and enterprise software without paying a premium price.

Each faces its own challenge: Intel must execute its turnaround, Salesforce must improve its revenue growth, and Amazon must find ways to improve its retail margins. But they are compelling names for investors who are looking to buy tech stocks without outrageous valuations.

Patrick Sanders has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Intel, Meta Platforms, Microsoft, Nvidia, Salesforce, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.