The European Union will include cryptocurrency platforms in its latest financial sanctions against Russia, marking the first time digital asset services have been directly targeted.

The measures, part of the bloc’s 19th sanctions package, prohibit all cryptocurrency transactions for Russian residents and restrict dealings with foreign banks tied to Russia’s alternative payment systems, according to a statement by European Commission President Ursula von der Leyen published Friday.

The package also seeks to block transactions with entities operating in Russian special economic zones.

“As evasion tactics grow more sophisticated, our sanctions will adapt to stay ahead,” von der Leyen said. “Therefore, for the first time, our restrictive measures will hit crypto platforms. and prohibit transactions in cryptocurrencies.”

She added, “We are listing foreign banks connected to Russian alternative payment service systems. And we are restricting transactions with entities in special economic zones.”

The sanctions are not yet final and require approval from all 27 EU member states.

Related: Privacy is ‘constant battle’ between blockchain stakeholders and state

Von der Leyen said the measures respond to Russia’s “largest-scale drone and missile attacks against Ukraine,” which have also seen Shahed drones violate EU airspace in Poland and Romania.

Russian oil companies have reportedly used digital assets to circumvent sanctions, conducting tens of millions of dollars worth of monthly transactions using Bitcoin (BTC) and Tether’s USDt (USDT), Reuters reported in March, citing four sources with direct knowledge of the matter.

In July, the US Department of Justice charged Iurii Gugnin, also known as George Goognin and Iurii Mashukov, a Russian national residing in New York, with 22 criminal counts, including the laundering of over $540 million through his crypto companies, Evita Investments and Evita Pay, while facilitating transactions for sanctioned Russian entities.

Related: Swiss banks complete first blockchain-based legally binding payment

Ukraine seeks to empower financial resilience via Bitcoin reserve

On the other side of the conflict, Ukraine is looking to strengthen financial resilience with a proposed national Bitcoin reserve.

Ukrainian lawmakers have started working on a national Bitcoin reserve proposal, with a draft bill in its final stages, according to Yaroslav Zhelezniak, a member of parliament who confirmed the plan to local media outlet Incrypted in May.

The proposal was announced during the Crypto 2025 conference in Kyiv on Feb. 6. “We will soon submit a draft law from the industry allowing the creation of crypto reserves,” Zhelezniak said.

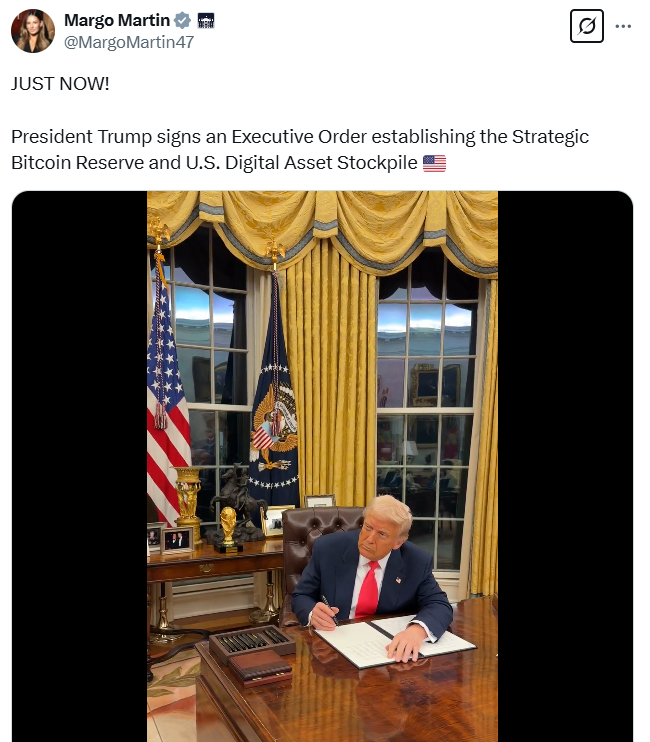

Bitcoin has been gaining recognition as a national reserve asset since March 7, when US President Donald Trump signed an executive order to establish a national Bitcoin reserve seeded with BTC confiscated from criminal cases.

A month later, Swedish MP Rickard Nordin issued an open letter urging Finance Minister Elisabeth Svantesson to consider adopting Bitcoin as a national reserve asset, citing its growing recognition as a “hedge against inflation,” Cointelegraph reported on April 11.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder