Bitcoin has gained 7% since the start of September, showing renewed strength after weeks of uneven price action. Yet, the market is bracing for heightened volatility in the coming days as attention shifts to this Wednesday’s Federal Reserve meeting. Investors widely expect a rate cut, but the size of the move remains the key question shaping sentiment.

Related Reading

If the Fed opts for a 25 basis point cut, many analysts see it as a measured and healthy pivot that could support risk assets, including Bitcoin, without sparking fears of deeper economic weakness. Such a move would likely reinforce confidence in a controlled transition toward easier monetary policy.

On the other hand, a 50 basis point cut could send a very different signal. While it may initially provide liquidity relief, markets could interpret it as a sign of serious underlying fragility in the economy. That scenario risks triggering panic, especially if investors fear the Fed is reacting to problems worse than expected.

Bitcoin Holds Key Levels Ahead Of Fed’s Decision

According to top analyst Axel Adler, Bitcoin is showing signs of resilience as it trades at the upper boundary of its channel near $116,400, supported by a sustained bullish momentum score of 0.8. This score, which reflects the balance of market forces, suggests that despite recent volatility, Bitcoin’s structural strength remains intact.

Adler notes that the market is heavily driven by expectations of a rate cut, which has injected confidence into risk assets. The timing of this setup could not be more critical, with the Federal Reserve set to announce its interest rate decision on September 17, 2025, at 2:00 PM Eastern Time.

Interestingly, while Bitcoin has held its ground at key resistance levels, altcoins have started to show strength independently for the first time in months. This decoupling suggests that capital rotation is taking place, with investors diversifying beyond Bitcoin. As liquidity expands, this dynamic could mark the start of a new market phase, where both Bitcoin and altcoins drive momentum instead of BTC alone.

Related Reading

Testing Key Resistance Levels

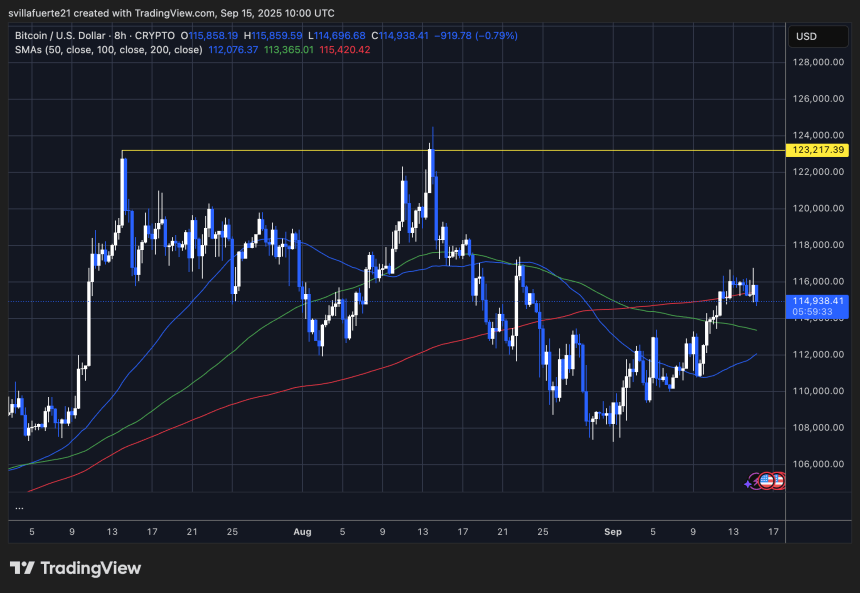

Bitcoin is currently trading around $114,938, showing consolidation just below the $116,000 resistance zone. The chart highlights a notable rebound from early September lows near $110,000, with BTC climbing steadily back into its mid-range. Price is now attempting to hold gains above the 50-day moving average (blue line) and is hovering around the 100-day (green line) and 200-day (red line) moving averages, which are converging and creating a dense resistance cluster.

This setup reflects a tense balance between bulls and bears. Bulls have managed to protect $110,000 and push BTC higher, signaling renewed strength. On the other hand, BTC has repeatedly failed to establish momentum above $116,000, a level that must be cleared decisively to target the major resistance near $123,217, marked on the chart as the next critical upside barrier.

Related Reading

The current sideways structure suggests a drift phase, with traders waiting for catalysts such as the upcoming Fed rate decision. A successful breakout above $116,000 could reignite momentum toward $120,000 and beyond. However, failure to hold above the 50-day SMA risks a retest of $112,000 or even $110,000 support. For now, Bitcoin remains range-bound, but pressure is building for a directional move.

Featured image from Dall-E, chart from TradingView