Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

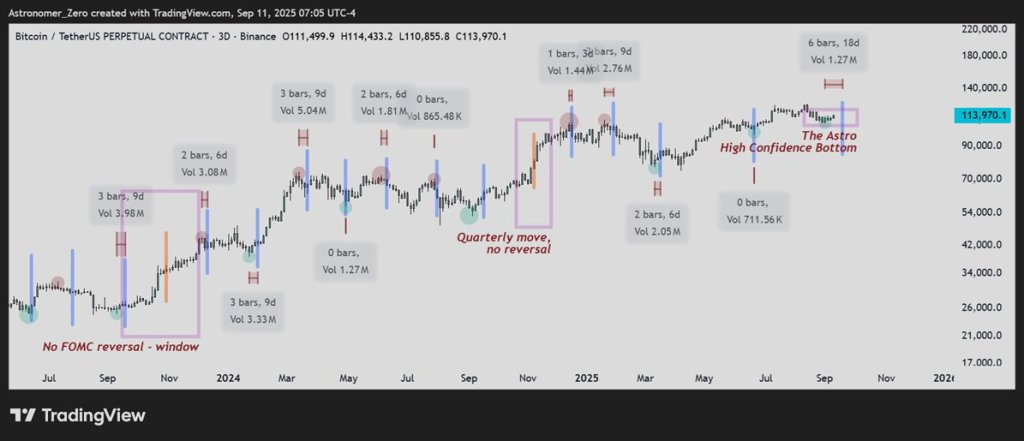

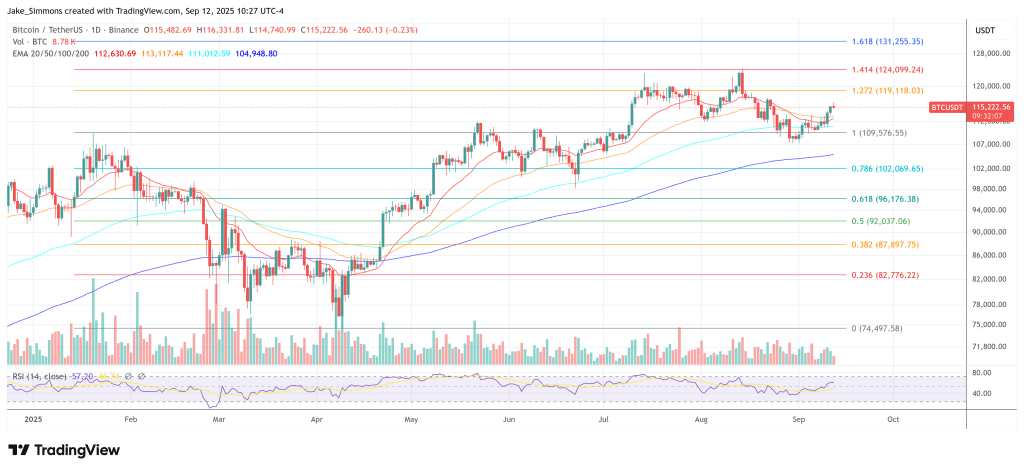

Bitcoin’s current rebound off the $107,200 low has sparked renewed debate over whether the market has already set its local bottom and is positioned to rally higher.. Independent analyst Astronomer (@astronomer_zero) argues that the probability is “90%+” that the low has been planted, citing both price structure and his recurring “FOMC reversal confluence” framework as confirmation.

Analyst Claims 90% Chance The Bitcoin Bottom Is In

Astronomer, who publicly documented his short-term bearish call from $123,000 down to the $110,000–$111,000 zone, revealed that he flipped long as the target was reached in late August. “Alright, as if the confluences of my confidence in the bottom being in the $110k area at the end of August weren’t strong enough … there now is another confluence lining up,” he wrote. According to him, the Federal Reserve’s policy meeting cycle has historically functioned as a turning point for Bitcoin trends.

Related Reading

He explained: “The FOMC meeting data reverses the ongoing trend at minimum 0 bars (on the date), or 6 bars at most before the date, and it has done that correctly 90%+ of the times. The few times it hasn’t, was because our quarterly long took over (which has more power).” In practice, Astronomer argues, markets front-run the event, as insiders and well-capitalized players set the post-FOMC direction before retail sentiment digests the outcome.

With the next FOMC scheduled for September 18, he contends the downtrend from $123,000 to $110,000 already exhausted itself ahead of schedule. “Now with FOMC coming up … the low is likely already planted, and the trend reversed to up again,” he said.

The analyst contrasted his methodology with the broader crypto commentary ecosystem, where many influencers continue to forecast further downside and a “red September.” He called such views “utter nonsense” rooted in surface-level seasonality. “Every time it does work, it plants its bottom before the actual meeting to front run the anticipation … insiders already have set the post FOMC price direction, regardless of the outcome,” he wrote, stressing that relying on generic “be careful” warnings ahead of central bank events misses the structural shift.

Related Reading

After his long entry at $110,000, Bitcoin has since climbed above $115,000, prompting Astronomer to declare September’s bearish thesis already invalid. “ September will close green. Yup, Septembears officially 6% in the wrong now. As September opened at 108,299, and price is now at 115,000. That puts September in the upper historical quartile of how green it is at the moment,” he noted.

He further pointed to the last two years as evidence that September’s reputation as a seasonally weak month for Bitcoin has lost statistical edge. “A certain month indeed doesn’t have to be green. ‘Seasonality’ is just a cookie cutter version of properly using cycles. Look at last two years, September has also been green and mean to the bears,” he wrote.

For Astronomer, the conclusion is clear: “When many confluences point in the same direction, it usually means you have solved the rubik’s cube correctly and so can confidently believe.” Still, he tempered the conviction with risk management discipline, stating: “Of course, I could always be wrong, although it has been a long time we lost a trade, never go all in. Take a decent size risk and sleep sound.”

With Bitcoin holding above $115,000 and the FOMC meeting days away, the market’s near-term verdict on whether a sustainable bottom has formed may arrive sooner rather than later.

Featured image created with DALL.E, chart from TradingView.com

![Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.] Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.]](https://moneyvisa.com/wp-content/uploads/2025/07/Announcing-the-Trillion-Dollar-Security-Initiative-560x420.jpeg)