Tokenized U.S. Treasuries on public blockchains hold $7.42 billion as of September 12, 2025, with large vehicles concentratedon Ethereum-linked issuance tracked by RWA.xyz.

Fidelity’s new OnChain share class adds another institutional line to that base. The Fidelity Treasury Digital Fund’s OnChain Class, recorded on Ethereum as the Fidelity Digital Interest Token, shows about $203.7 million outstanding to date, with Bank of New York Mellon as custodian and two on-chain holders.

The fund’s SEC materials describe an OnChain class where the transfer agent keeps the official share register in book-entry form, while ownership is also recorded on a public blockchain. Per RWA.xyz and fund filings, the portfolio invests at least 99.5% in cash and U.S. Treasuries under Rule 2a-7.

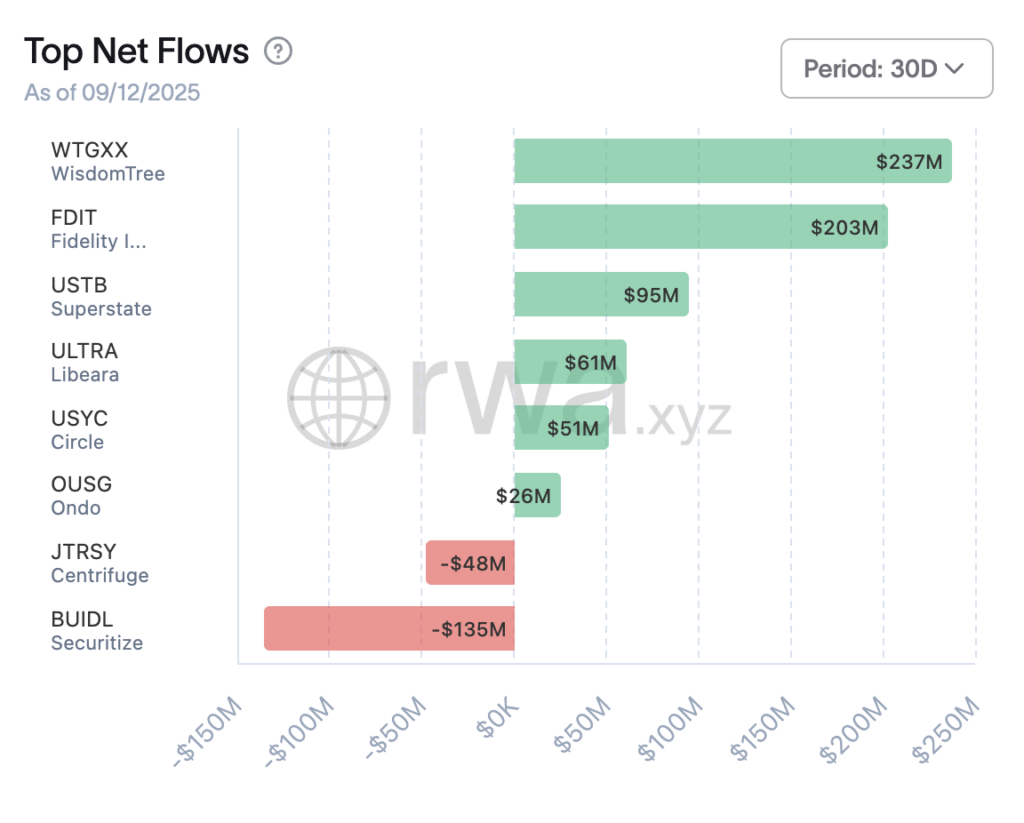

Cross-section data show where scale is accumulating and how quickly. BlackRock’s USD Institutional Digital Liquidity Fund stands near $2.20 billion. WisdomTree’s Government Money Market Digital Fund is approximately $832.3 million, up about 40% over 30 days on that tracker. Franklin Templeton’s on-chain U.S. government money fund is roughly $752.3 million.

Ondo’s short-term government bond fund is around $729.6 million, and its yield token USDY is about $690.4 million. Circle’s USYC is about $579.1 million. These products list Ethereum among their supported networks, alongside rollups such as Base, Optimism, Arbitrum, and in several cases, Solana, Avalanche, or Stellar.

To clear $10 billion by year-end, the market needs about $2.58 billion in net additions from today’s $7.42 billion base, or roughly $700 million monthly through December. The pool of traditional cash is large relative to that target.

Total U.S. money market fund assets stood at $7.26 trillion for the week ended Sept. 3, per the Investment Company Institute, so a one-basis-point reallocation into tokenized Treasury funds would equal about $726 million, and three basis points about $2.18 billion. Government funds remain the bulk of the category, framing an addressable investor base already holding the underlying instruments.

The yield backdrop and on-chain logistics set the run rate. Three-month Treasury bill rates were 3.94% as of Sept. 10, shaping income accrual across tokenized funds and influencing demand for “on-chain dollars with yield.”

On settlement cost, empirical work on Ethereum’s EIP-4844 shows lower data availability fees for rollups after the Dencun upgrade, which reduces frictions for minting, transferring and redeeming on L2 rails where many RWA tokens circulate, according to the Ethereum Foundation.

Distribution matters as much as technology. Circle’s USDC smart contract off-ramp for BUIDL enables near-instant redemptions into stablecoins around the clock.

USYC can now serve as yield-bearing off-exchange collateral for Binance’s institutional clients through bank triparty or Ceffu custody, expanding non-trading use cases that keep assets on chain during derivatives activity. These workflows reinforce the appeal of tokenized cash instruments as collateral and treasury assets, not just as passive holdings.

Enrollment Closing Soon…

Secure your spot in the 5-day Crypto Investor Blueprint before it disappears. Learn the strategies that separate winners from bagholders.

Brought to you by CryptoSlate

A base-case path to $10 billion by December

If the group around BUIDL, WTGXX, BENJI, OUSG, and USYC expands by a combined 8% to 10% over the next three and a half months, that alone adds roughly $600 million to $800 million.

Add a modest contribution from new or recently launched share classes such as Fidelity’s OnChain Class and potential follow-ons from other managers, and the monthly cadence meets the remaining gap. According to RWA.xyz 30-day changes, some products are already compounding at rates that, even if they slow, support this run-rate.

A higher-range scenario of $10.8 billion to $11.5 billion assumes two incremental brand entrants or large mandate allocations in Q4 total $1.0 billion to $1.5 billion, plus steady net mints in existing funds.

The money-market base shows that a two to three basis point flow from traditional products would more than cover that range, should qualified purchasers and professional investors seek on-chain settlement and 24/7 transferability, per the ICI weekly series.

A lower-range outcome near $9.1 billion to $9.6 billion would follow if front-end yields drift toward 3.5% and on-chain mint activity slows, or if tokenized fund buyers pause ahead of year-end.

Even in that case, the investor infrastructure continues to thicken, since share classes like Fidelity’s OnChain Class record ownership on chain while conforming to money market rules and custody norms, preserving the groundwork for future issuance.

The market is also consolidating on Ethereum from a network perspective. RWA.xyz’s product listings show the top vehicles available on Ethereum, with many also bridged to L2s. That positioning, combined with collateral integrations and stablecoin redemption rails, channels volume into Ethereum’s settlement layer even as more activity shifts to lower-cost rollups.

What to watch into December are three datapoints that will decide the finish line: on-chain holders and net mints on RWA.xyz’s tracker, fresh SEC filings for additional OnChain classes or series, and new collateral and custody arrangements that let institutions hold these tokens without sacrificing risk controls.

If net mints sustain a $600 million to $800 million monthly pace, the tracker will print $10 billion on Ethereum before year-end.