00:09 Josh

The mix ahead of the closing bell, and now all eyes are looking at the Fed as it prepares for its two-day FOMC meeting on Tuesday. Joining us now for more, we got senior markets reporter Inez Ferre with the Yahoo Finance playbook. Inez.

00:25 Inez Ferre

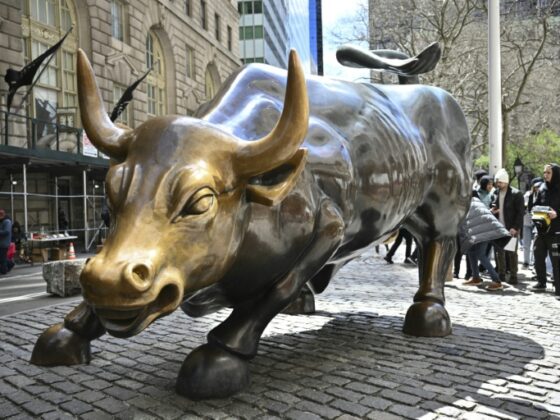

Hey, Josh. And strategists are expecting a 25 basis point cut next week. Not so much a 50 basis point cut, and that is because of the inflation print that we got this week, uh with strategists noting that you still had some areas of inflation that remain sticky, particularly the services sector. Also, the jobs data came in weak and that's why they are expecting that 25 basis point cut. You had a 911,000 fewer jobs in that one-year revision that came out that's ending in March. Also, jobless claims uh jumped up. Those weekly jobless claims jumping up by the most in since October 2021. And that's part of the reason really why the markets uh have been posting all-time highs according to these strategists because the Fed will be forced to cut rates next week, but not because we are seeing great, great progress on inflation, but more so because of the weaker labor market. Having said that, they're also saying you're not seeing the bottom coming out of the economy. You still have uh Wall Street that is relatively bullish when it comes to this uh bull run that we've had with stocks, particularly going into 2026. I mean, right now we are seeing the markets at all-time highs, depending on which Wall Street strategies you uh are paying attention to, you are seeing different price targets for the end of the year for the S&P 500. There you see some of them on your screen. But between rate cuts, and by the way, the market is anticipating about 65 or 75% probability that we will have three rate cuts this year. Between those rate cuts and the impact from the Trump tax incentives that were passed this year, uh that should extend the bull run into 2026.

02:00 Josh

Thank you, Nez. Appreciate it.