Ethereum is currently trading around critical price levels as the market shifts into a new phase. The momentum that propelled ETH higher earlier this year has started to fade, with the asset now entering a consolidation period. While some altcoins have managed to post modest gains and Bitcoin continues to trade sideways, Ethereum’s price action reflects a cooling trend as traders wait for clarity on the next decisive move.

Despite this pause in momentum, institutional demand for ETH remains strong. Fresh data reveals that large players continue to accumulate Ethereum, even amid volatility and broader market uncertainty. This persistent inflow of institutional capital highlights confidence in Ethereum’s long-term role as the leading smart contract platform, with its deep DeFi, NFT, and layer-2 ecosystems continuing to attract adoption.

Still, Ethereum’s short-term path is heavily influenced by macroeconomic forces. Weakening US labor data and uncertainty surrounding the Federal Reserve’s interest rate policy continue to shape risk sentiment across financial markets. While the Fed’s eventual pivot to rate cuts would support liquidity and risk assets, the timing remains unclear, keeping volatility elevated. For Ethereum, this mix of strong institutional demand and uncertain macro headwinds defines the tense equilibrium that currently grips the market.

Institutions Signal Confidence In Ethereum

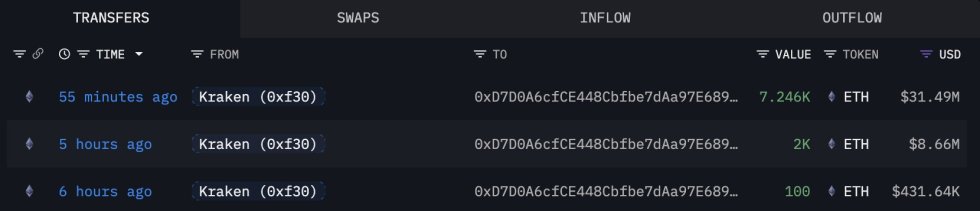

According to data from Lookonchain, four newly created wallets withdrew a combined 78,229 ETH—worth approximately $342 million—from Kraken in just the past 10 hours. Such large-scale withdrawals are typically interpreted as signs of long-term holding intentions, since institutions and whales often move funds off exchanges for custody or strategic allocation.

This activity marks a significant shift compared to the first half of the year, when Ethereum and the broader altcoin market were under heavy pressure. Back then, aggressive corrections swept through the sector, wiping out speculative gains and forcing many short-term participants out of their positions. Sentiment was dominated by caution, and ETH struggled to maintain momentum as liquidity drained from altcoins.

The landscape today looks very different. Ethereum has not only recovered from those drawdowns but has also surged to new all-time highs, reaffirming its dominance in the smart contract space. Altcoins, too, are benefiting from renewed confidence, with capital rotation supporting fresh rallies across the market.

Institutional flows like these highlight a deeper conviction that Ethereum remains a cornerstone of the crypto ecosystem. As ETH consolidates at higher levels, continued accumulation by large players suggests that the foundation for further upside remains strong, even amid lingering macro uncertainty.

ETH Holds Tight Range

Ethereum is currently trading at $4,436, showing signs of strength after consolidating in a tight range near $4,300 for several days. The 4-hour chart indicates ETH is attempting to push higher, testing overhead resistance levels as bulls try to regain momentum. The 50 SMA at $4,338 and the 100 SMA at $4,388 have acted as short-term support, with price now trading just above them—an encouraging sign for buyers.

The next key resistance is the 200 SMA at $4,416, which ETH is currently pressing against. A clear breakout and consolidation above this level could open the door for a retest of $4,600, with the potential to extend toward $4,800 if momentum builds.

On the downside, support remains well-defined. The $4,300 zone has held multiple times, and with the 50 and 100 SMAs aligned there, it provides a solid cushion for bulls. A breakdown below this area could invite renewed selling pressure, dragging ETH back toward $4,200 or even $4,100.

Ethereum appears to be in the early stages of a potential recovery. Holding above the $4,400 region and breaking past the 200 SMA would strengthen the bullish outlook, while failure here could mean more consolidation before any decisive move.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.