00:00 Speaker A

Let's get to the three things you need to know today.

00:02 Speaker A

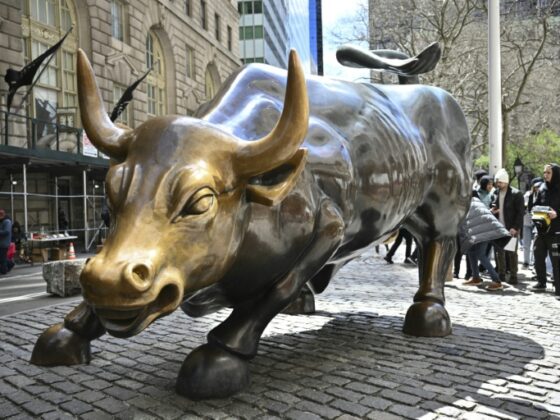

First up, US stock futures pulling back after a record run on Wall Street. All three major industries closing at new highs on Thursday and the Dow in particular closing above 46,000 for the first time.

00:15 Speaker A

Investors waiting for the latest look at the state of the American consumer when the University of Michigan Sentiment Index comes out later this morning. And all of this coming with just days to go before the Federal Reserve September meeting where the Central Bank is likely to cut interest rates by a quarter of a percent.

00:30 Speaker A

Plus, trade tensions rising between Mexico and China. Mexico is raising tariffs on Chinese-made vehicles to 50%. That's the maximum level, and China not taking it lightly, threatening Mexico to think twice.

00:41 Speaker A

While the US is not directly involved here, it still matters to the broader trade picture as the move by Mexico is seen as an effort to placate the White House.

00:49 Speaker A

Meanwhile, the US will urge its G7 allies to impose tariffs as high as 100% on China and India for their purchases of Russian oil. That's according to a Bloomberg report.

01:00 Speaker A

And Adobe, one of the top tickers of the day, the software company reporting earnings last night and giving strong guidance for both profit and revenue for the current quarter.

01:07 Speaker A

Adobe likely seeing a payoff from its investment in it into AI features. CEO Shantanu Narayen saying annual recurring revenue from AI influenced products topped $5 billion and the stock is higher ahead of the open.