Key takeaways:

-

Michael Saylor transformed MicroStrategy from a business intelligence firm into the world’s largest corporate Bitcoin holder.

-

Saylor’s conviction redefined corporate strategy, turning volatility into opportunity through long-term, dollar-cost averaging purchases.

-

His approach set the standard for institutional Bitcoin adoption despite concerns over dilution and debt.

-

Saylor’s playbook highlights research, perseverance, risk control and long-term thinking in Bitcoin investing.

Saylor’s Bitcoin awakening

In August 2020, Michael Saylor transformed from a technology executive into a symbol of corporate crypto adoption.

Saylor, long known as the co-founder and head of enterprise-software firm Strategy (previously MicroStrategy), made his first bold move into cryptocurrencies by allocating $250 million of the company’s cash to purchase Bitcoin (BTC).

He cited a weakening dollar and long-term inflation risks as the underlying reasons behind this strategic move. Incidentally, it marked the largest acquisition of Bitcoin by a publicly traded company at that time and set a new precedent.

Within months, Strategy expanded its holdings: $175 million more in September, $50 million in December and a $650-million convertible-note issuance, bringing Bitcoin holdings over $1 billion.

He recognized Bitcoin as “capital preservation,” comparing it to “Manhattan in cyberspace,” a scarce, indestructible asset.

The move drew both praise and criticism. Skeptics called it reckless, while supporters saw it as a bold innovation at a time when few dared to put Bitcoin on a company’s balance sheet. For Saylor, though, it wasn’t a gamble. It was a calculated hedge against monetary uncertainty and a signal that digital assets would reshape capital strategy.

Did you know? In 2013, Saylor tweeted that Bitcoin’s days were numbered, predicting it would “go the way of online gambling.” That post resurfaced in 2020, right as he pivoted Strategy into the biggest Bitcoin holder among public companies. He has since referred to it as the “most costly tweet in history.”

Saylor’s Bitcoin expansion

From that initial entry point, Saylor doubled and tripled down on his belief in Bitcoin. He applied structured finance tools to scale holdings and shape Strategy into a “Bitcoin treasury company.”

It all started during the July 2020 earnings calls when Saylor announced his plan to explore alternative assets, such as Bitcoin and gold, instead of holding cash. He put the plan into motion with quarterly Bitcoin buys that rapidly scaled holdings to tens of thousands of coins at a favorable cost basis.

By early 2021, Saylor had borrowed over $2 billion to expand his Bitcoin position, an aggressive posture powered by conviction, not speculation. He articulated a vision of long-term ownership by saying that Strategy will hold its Bitcoin investment for at least 100 years.

Despite Bitcoin’s extreme volatility, soaring to $64,000 from $11,000 in 2021 and then plunging to near $16,000 by the end of 2022, Saylor remained unwavering. In support of the claim that Bitcoin is the apex of monetary structure, his team used dollar-cost averaging to take advantage of price dips to increase holdings.

Saylor’s strategy worked: His company’s stock surged, often outperforming Bitcoin itself. By late 2024, Strategy’s stock had gained multiples of S&P 500 returns, and the business became viewed less as a software firm and more as a leveraged crypto proxy.

Saylor’s Bitcoin financing

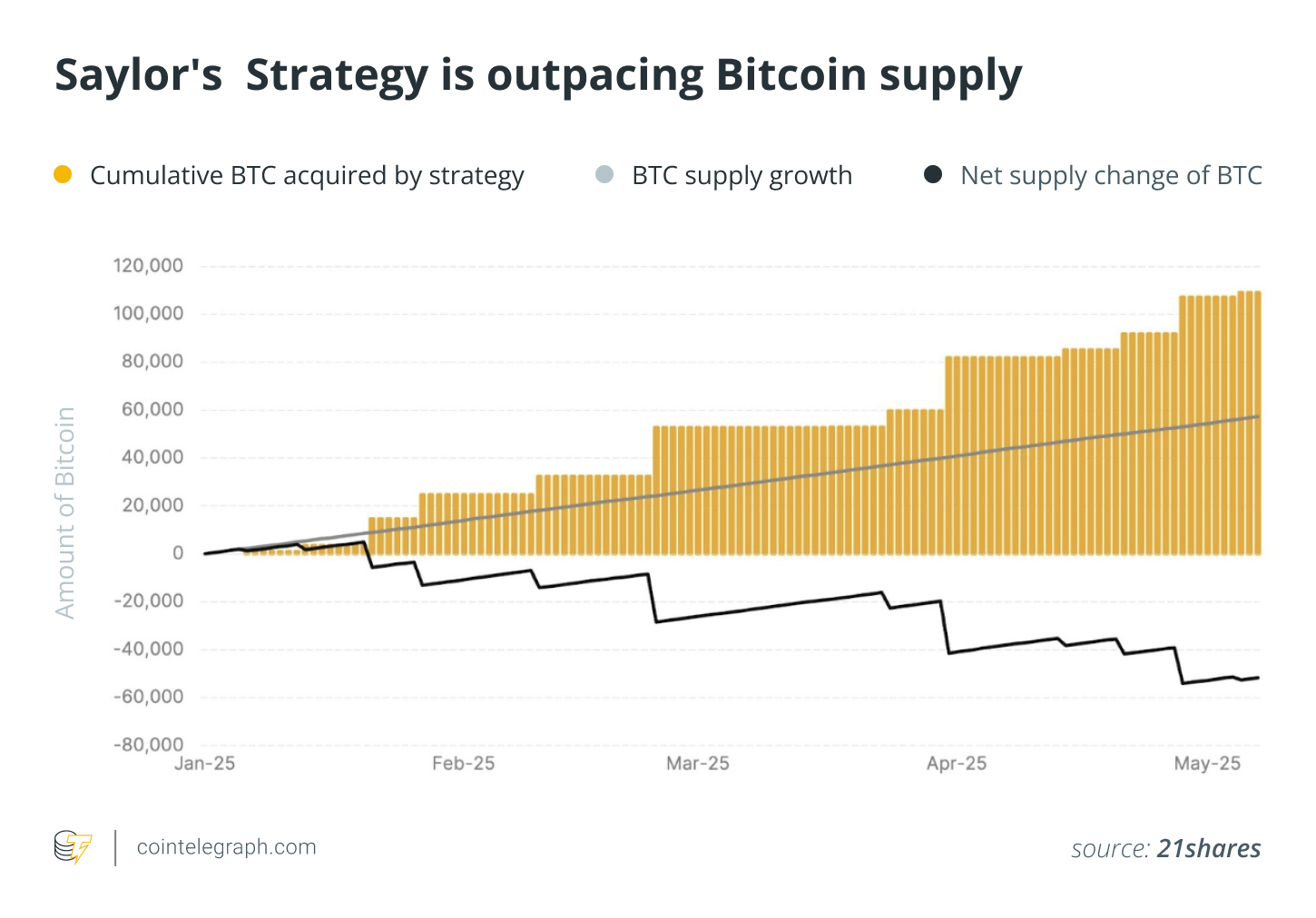

Saylor’s obsession evolved from a bold entry to dominating corporate demand for Bitcoin, shifting market dynamics through sheer scale. By early 2025, Strategy held over 2% of Bitcoin’s total fixed supply, roughly half a million BTC.

Year-to-date, Strategy acquired more than 150,000 BTC at average prices near $94,000, putting its holdings’ market value above $50 billion.

These massive allocations exert structural pressure on Bitcoin’s finite supply, and corporations now compete for scarce coins. Saylor set a benchmark that other firms began to follow. In the first five months of 2025 alone, institutional and corporate Bitcoin purchases surpassed $25 billion.

This scale shifted Strategy’s identity: Software revenue was dwarfed by Bitcoin’s impact on valuation. The equity-raising strategy, issuing stock and debt to fund purchases, was scrutinized as a recursion: If Bitcoin fell, debt could strain the company; if stock was diluted too much, investor confidence could wane.

In June 2025, Strategy added 10,100 BTC via a $1.05-billion purchase, having spent nearly $42 billion on Bitcoin overall. The company’s model was now replicable, but not without increasing systemic risk.

Saylor’s transformation from tech CEO to crypto-treasury architect made him a polarizing figure and inspired imitators. His aggressive playbook reframed not just Strategy’s valuation but the broader institutional adoption narrative.

Did you know? Saylor disclosed that prior to converting company assets into Bitcoin, he had used his own funds to buy 17,732 BTC, which at the time was valued at almost $175 million. This gave him enough conviction to push for Strategy’s corporate allocation.

What’s next for Saylor and Bitcoin?

Saylor has shown no signs of slowing down. Strategy continues to double down on Bitcoin, even financing new purchases through convertible debt and other creative instruments. With halving cycles tightening supply and institutional interest accelerating, Saylor positions Bitcoin not just as a store of value but as a corporate treasury standard.

Looking ahead, the main questions are whether more businesses will follow Strategy’s example, how corporate adoption will be influenced by regulatory frameworks and whether Bitcoin’s function will be limited to balance sheets or extend to other areas of the financial system. If Saylor’s theory is correct, he might not only be known as a bold CEO but also as one of the key players who revolutionized business financing in relation to Bitcoin.

What can you learn from Saylor’s Bitcoin obsession?

Saylor’s journey is unique, but there are practical lessons anyone exploring Bitcoin can take from his approach:

-

Do your research before committing: Before making an investment, Saylor studied the fundamentals of Bitcoin for months. For novices, this means avoiding hype and beginning with reputable sources, white papers and competent analysis.

-

Think long term: Saylor has no intention of making a quick profit. For individuals, this translates into only investing what you can hold through volatility rather than trying to time the market.

-

Risk management matters: Strategy took a hazardous but audacious step by borrowing money to purchase Bitcoin. Retail investors ought to exercise greater caution, refrain from taking on excessive debt and maintain cryptocurrency as a portion of a larger portfolio.

-

Have conviction, but stay flexible: Throughout the years, Saylor methodically planned his purchases, but he also doubled down on Bitcoin even during downturns. For beginners, dollar-cost averaging may become a useful strategy.

-

Separate personal belief from company strategy: Not everyone has a corporation to back Bitcoin bets. Saylor blended personal holdings and Strategy’s treasury. For individuals, it’s better to clearly separate personal savings from speculative investments.

Even if you don’t have Saylor’s fortune, you can still use some of his strategies to better navigate Bitcoin, such as doing your own research and being patient and disciplined.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.