The trading activity of Britain's premier value investor speaks volumes.

For more than a century, Wall Street has served as a bona fide wealth creator. Though other asset classes have helped investors grow their nominal wealth, nothing has been able to match the average annual return of stocks over extended periods.

However, this doesn't mean the broad-based S&P 500 (^GSPC 0.30%), ageless Dow Jones Industrial Average (^DJI -0.48%), or innovation-fueled Nasdaq Composite (^IXIC 0.03%) move from Point A to B in an orderly fashion. Stock market corrections, bear markets, and even crashes are normal, healthy, and inevitable aspects of the stock market cycle, and can be described as the price of admission to this time-tested wealth creator.

Berkshire Hathaway CEO Warren Buffett is arguably the most well-known proponent of buy-and-hold investing. The appropriately named “Oracle of Omaha” has frequently cautioned investors not to bet against America.

But even the world's savviest investors have their limits.

Image source: Getty Images.

Billionaire Terry Smith of Fundsmith, who's commonly referred to as “Britain's Warren Buffett,” has been sending a clear and unmistakable warning to Wall Street that investors would be smart not to ignore.

Britain's Warren Buffett has been a persistent net seller of stocks

The reason Smith, who's overseeing $23 billion in assets under management, is referred to as “Britain's Warren Buffett” is because he and Berkshire's billionaire boss share similar investment ideals. They're both long-term investors at heart, with a deeply rooted desire to buy stakes in high-quality/undervalued businesses.

Though Buffett and Smith are smart cookies who recognize the nonlinearity of stock market cycles (i.e., that stocks rise over long periods), their line-in-the-sand approaches when it comes to value investing mean their short-term actions don't always align with their long-term resolve.

Thanks to required quarterly Form 13F filings with the Securities and Exchange Commission, investors have the ability to track the buying and selling activity of Wall Street's smartest money managers — and Terry Smith is near the top of the list.

Fundsmith's 13Fs have sent an unmistakable warning to investors over the last year. Although seven new stocks have been introduced and five existing holdings added to, Fundsmith's billionaire boss reduced his position in 23 existing holdings and jettisoned eight others from July 1, 2024, through June 30, 2025.

This selling activity has been especially pronounced in Fundsmith's two largest holdings, Meta Platforms and Microsoft, which have been reduced by 27% and 31%, respectively, over the trailing year (ended June 30).

This selling activity sends a clear message: value is difficult to come by amid a historically pricey stock market.

This is the third priciest stock market spanning 150 years

Truth be told, “value” is in the eye of the beholder. A stock that you feel is expensive might be viewed as a bargain by another investor. This lack of a one-size-fits-all blueprint when it comes to spotting value is what makes Wall Street so unpredictable.

However, history paints a different picture that leaves virtually no margin for error.

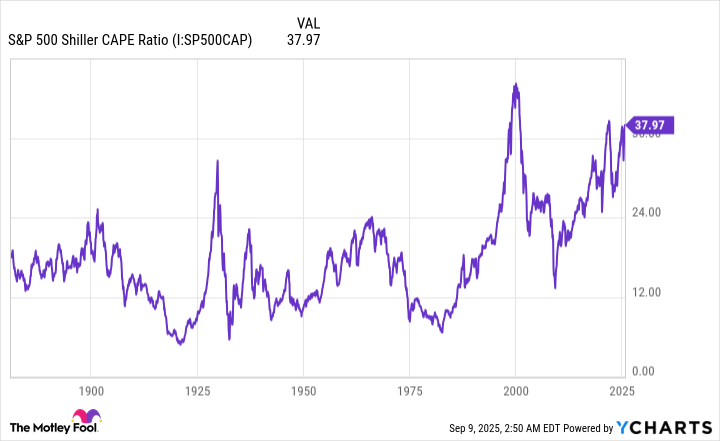

S&P 500 Shiller CAPE Ratio data by YCharts. CAPE Ratio = cyclically adjusted price-to-earnings Ratio.

The valuation measure that's raising eyebrows and making history is the S&P 500's Shiller price-to-earnings (P/E) Ratio, which is also commonly referred to as the cyclically adjusted P/E Ratio, or CAPE Ratio. It's a valuation tool based on average inflation-adjusted earnings over the previous 10 years, which means short-term shock events won't skew its reading.

When back-tested to January 1871, the Shiller P/E has averaged a multiple of 17.28. As of the closing bell on Sept. 8, the S&P 500's Shiller P/E multiple had topped 39, which marks its third-priciest reading during a continuous bull market in 154 years.

The worry is that history shows premium valuations aren't sustainable over extended periods. Since 1871, the Shiller P/E has surpassed a multiple of 30 and held this level for at least two months on six occasions, including the present. Following the five prior occurrences, the S&P 500, Dow Jones Industrial Average, and/or Nasdaq Composite lost at least 20% of their value, if not considerably more.

Billionaire Terry Smith is likely also aware of the historical context of next-big-thing innovations pushing the broader market into a bubble. Though artificial intelligence (AI) is the hottest thing since sliced bread, and AI stocks like Meta and Microsoft have played a big role in lifting the tide for Wall Street's major stock indexes, every game-changing technological innovation for three decades has endured an eventual bubble-bursting event.

While the Shiller P/E Ratio isn't a timing tool and can't concretely guarantee what's to come, historical precedent — and Terry Smith's trading activity — make clear that significant eventual downside is expected for stocks.

Image source: Getty Images.

There's another side to this story

Although history doesn't mince words of what's to be expected, this only tells part of the story.

Despite Britain's Warren Buffett being a net-seller of equities over the last year, he's continued to hold onto Fundsmith's core positions. The reason? The aforementioned nonlinearity of stock market cycles.

On one hand, stock market corrections are an inevitability of investing on Wall Street. But the pendulum swings disproportionately toward periods of growth, and billionaire money managers like Terry Smith know it.

In June 2023, the researchers at Bespoke Investment Group published a data set on X (formerly Twitter) that calculated the calendar-day length of every S&P 500 bull and bear market dating back to the start of the Great Depression in September 1929. Bespoke showed that the average S&P 500 bear market endured only 286 calendar days, or roughly 9.5 months.

In comparison, the typical S&P 500 bull market stuck around for 1,011 calendar days, or approximately 3.5 times longer than the average downturn over a nearly 94-year stretch. Statistically, it makes sense to wager on Wall Street's most influential businesses to increase in value over time, which is precisely what Terry Smith has been doing since Fundsmith's founding in 2010.

While Terry Smith's warning to Wall Street over the short run is undeniable, the stock market's foundation, and its ability to deliver superior long-term returns when compared to other asset classes, remains rock solid.