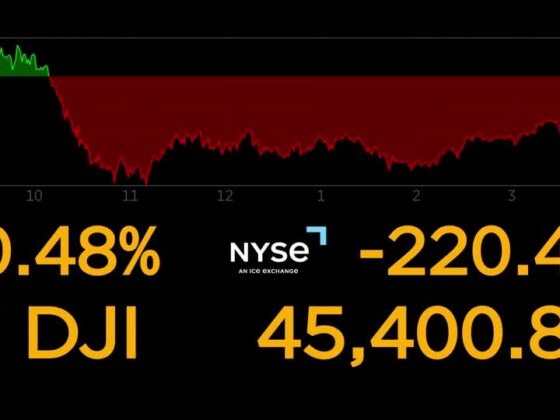

Shares of online legal service provider LegalZoom (NASDAQ:LZ) fell 4.1% in the afternoon session after the U.S. Labor Department's August jobs report came in much weaker than expected, sparking fears of an economic slowdown. U.S. employers added only 22,000 jobs last month, significantly missing the 75,000 that economists had forecast. The disappointing data led to a widespread sell-off on Wall Street, with major indices like the S&P 500 and Dow Jones Industrial Average trading lower. While a cooling labor market could prompt the Federal Reserve to cut interest rates, the scale of the miss has investors worried that the economy could be heading for a recession. This negative sentiment is weighing on the broader market, impacting individual stocks like LegalZoom.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy LegalZoom? Access our full analysis report here, it’s free.

LegalZoom’s shares are quite volatile and have had 15 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 3 days ago when the stock dropped 2.2% on the news that the major indices continued to retreat (Nasdaq -1.5%, S&P 500 -1.2%) amid profit-taking and renewed concerns about tariffs. The decline was not isolated to LegalZoom, as major indices including the S&P 500, Dow Jones Industrial Average, and the tech-heavy Nasdaq all tumbled. Reports indicate the market-wide slump was triggered by a court decision that ruled most of the Trump tariffs illegal.

Although the tariffs remain in place pending an appeal, the news has created a risk-off environment, causing a spike in bond yields and market volatility. The tech sector was particularly hard-hit by the negative sentiment, contributing to the downward pressure on many stocks.

LegalZoom is up 38% since the beginning of the year, and at $10.44 per share, it is trading close to its 52-week high of $11.18 from August 2025. Investors who bought $1,000 worth of LegalZoom’s shares at the IPO in June 2021 would now be looking at an investment worth $275.69.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.