Ethereum is facing a pivotal test as the market struggles to hold momentum amid mounting selling pressure. After losing the $4,500 level, ETH has entered a tight consolidation range, with bulls now forced to defend current levels. Analysts warn that failure to reclaim $4,500 soon could open the door to a deeper correction, with downside targets near $3,900. This growing uncertainty weighs on sentiment, but institutions appear unfazed, continuing to accumulate ETH aggressively.

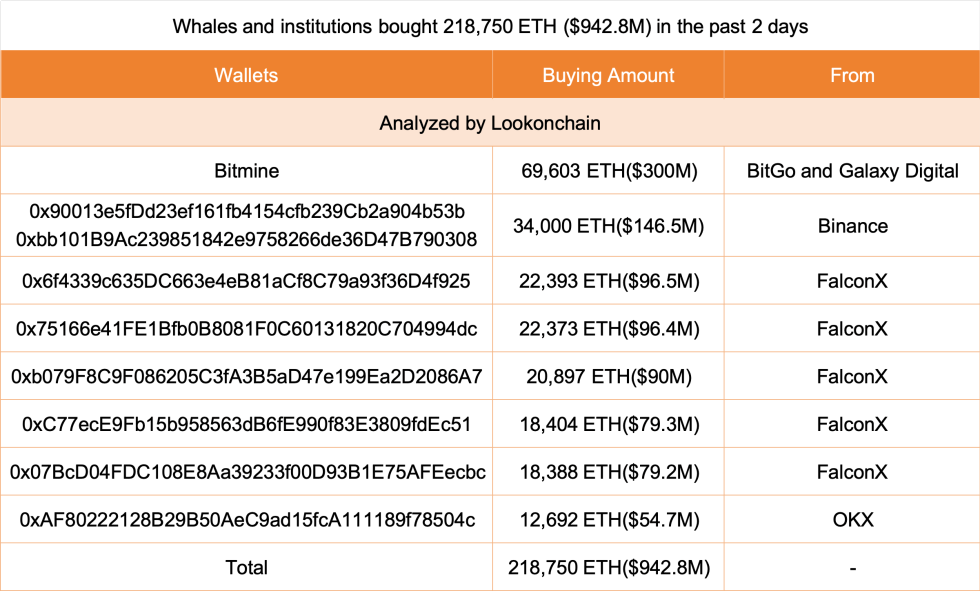

According to data from Lookonchain, whales and institutions purchased an impressive 218,750 ETH—worth approximately $942.8 million—in just the past two days. This surge in accumulation reflects a broader bet on Ethereum’s strength, not only as a leading smart contract platform but also as the centerpiece of an anticipated altcoin rally. With capital rotation away from Bitcoin becoming more evident, institutions appear to be positioning themselves early for Ethereum’s next potential leg higher.

Despite the pressure, Ethereum’s fundamentals remain robust, supported by increasing institutional flows, steady whale activity, and a growing DeFi ecosystem. The battle between bulls defending support and bears pushing for lower levels sets the stage for ETH’s trajectory in the next phase of this cycle.

Institutional Ethereum Accumulation Strengthens Bullish Outlook

Institutional flows into Ethereum remain strong despite the recent pullback. Lookonchain reports that Bitmine, one of the most active institutional players in the space, purchased 69,603 ETH—valued at around $300 million—from BitGo and Galaxy Digital.

Additionally, five newly created wallets collectively purchased 102,455 ETH, valued at approximately $441.6 million, from FalconX. These large-scale acquisitions highlight continued confidence in Ethereum’s long-term potential and reinforce the view that institutions are positioning themselves for future gains.

This wave of accumulation is significant for several reasons. First, it underscores Ethereum’s growing status as the centerpiece of institutional strategies, particularly in the context of capital rotation from Bitcoin into altcoins. Second, it demonstrates that even amid heightened volatility, demand for ETH remains resilient. These purchases, executed in size, suggest that institutional buyers are not only unfazed by short-term corrections but are actively using them as opportunities to scale exposure.

That said, risks remain in the near term. Technically, Ethereum must hold above $4,200 to avoid a sharper decline. Should this level fail, the next meaningful support lies near $3,900, a zone that could invite further selling pressure before buyers return. For now, institutional conviction provides a strong counterbalance to market uncertainty, signaling that Ethereum’s structural demand remains intact and may serve as the backbone of its next bullish phase.

ETH Consolidates Around Key Levels

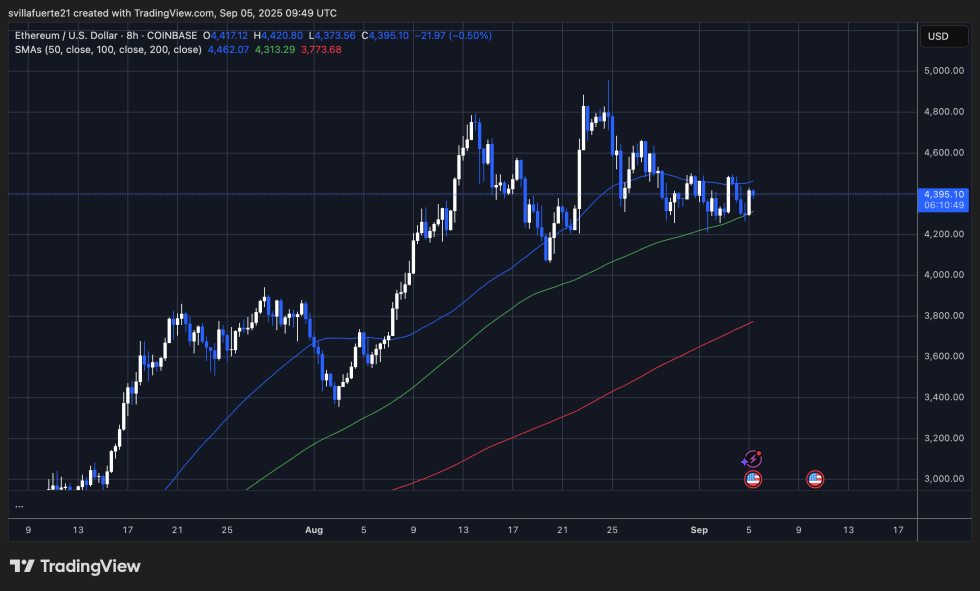

Ethereum (ETH) is consolidating just below the $4,500 level, currently trading near $4,395 after days of sideways movement. The chart shows ETH maintaining a tight range between $4,250 and $4,500, with repeated tests of both support and resistance levels. This pattern reflects growing market indecision, as buyers attempt to defend structural demand while sellers continue applying pressure.

The 50-day moving average (blue line) is slightly above current price levels, acting as dynamic resistance, while the 100-day moving average (green line) around $4,313 provides nearby support. A sustained close below $4,250 would open the door for a deeper correction toward $3,900, which is the next significant support zone. On the upside, ETH must break and hold above $4,500 to confirm bullish momentum and potentially retest highs near $4,800.

Despite the lack of direction in price action, the broader structure remains constructive, with ETH trading well above the 200-day moving average (red line), which is trending upward near $3,773. This suggests the long-term bullish trend is intact, but the immediate outlook hinges on whether bulls can defend the $4,200–$4,250 area. For now, ETH remains in consolidation, with breakout or breakdown signals yet to materialize.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.