Whales, or big cryptocurrency investors, have lost millions of dollars by betting on the price appreciation of the Trump family-linked World Liberty Financial (WLFI) token.

Since its launch on Monday, the WLFI token’s price fell by over 40%, despite a large-scale token burn event that permanently reduced the token’s circulating supply, aiming to tighten supply and boost the value of the remaining tokens on the market.

Despite the over 40% decline, some of the pre-sale holders are still showing confidence in the presidentially endorsed token.

Out of more than 85,000 pre-sale participants, 60% were still holding the token, while only 29% had fully sold, wrote blockchain data platform Bubblemaps, in a Wednesday X post.

Whales lose millions on Trump-linked WLFI’s 40% dip, despite 47 million burn

Big crypto investors, or whales, were suffering millions in losses on the Trump family-linked World Liberty Financial (WLFI) token, which continued to decline despite a proposal to reduce the circulating supply.

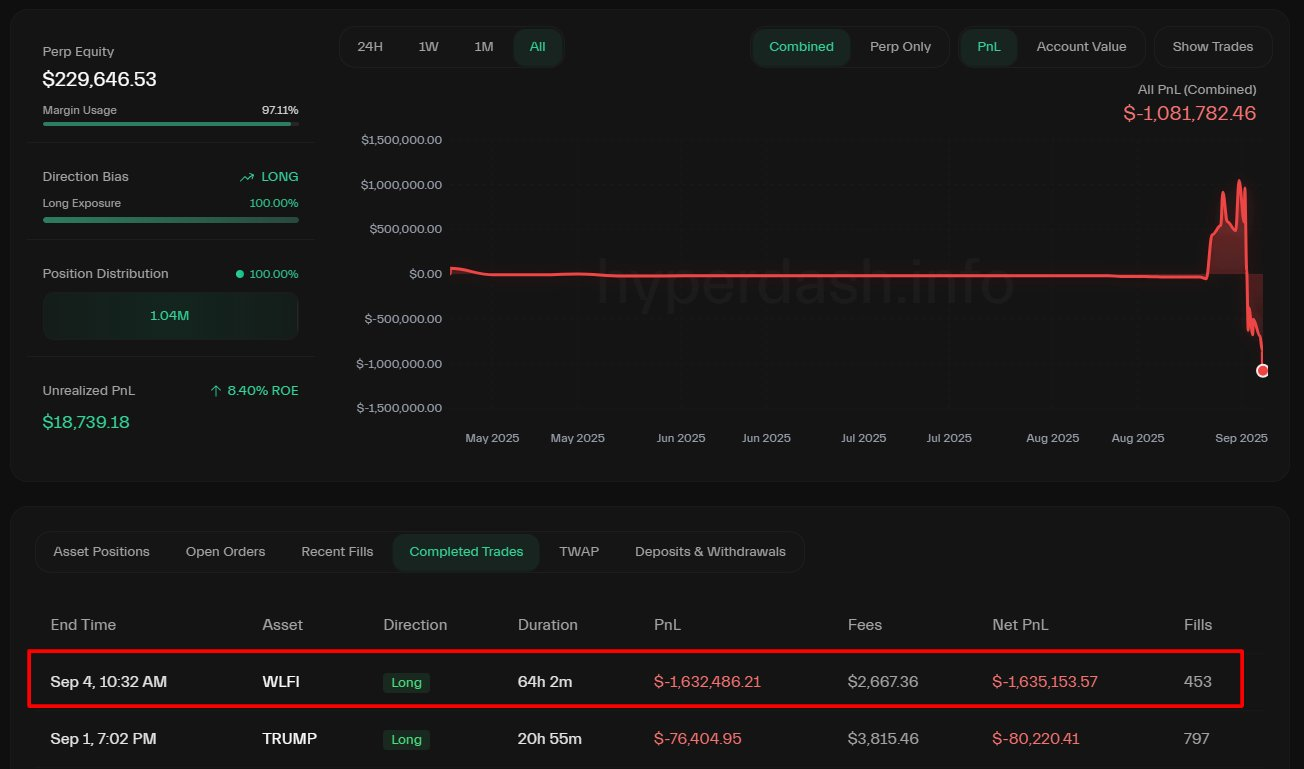

Whale wallet 0x432 lost more than $1.6 million after closing a 3x leveraged WLFI long position, according to Onchain Lens.

“The moral of the story: never be in FOMO,” short for fear of missing out, wrote the platform in a Thursday X post, referencing the whale’s hasty investment move.

The investor had opened a second long position on the WLFI token just 15 hours after closing a previous one with a $915,000 profit, only to lose the $1.6 million.

Confidence in Trump-linked token weakens

Other whales were also exiting WLFI positions at a loss, signaling waning confidence in the Trump-affiliated token’s price outlook.

The whale selling came a day after the WLFI platform burned 47 million tokens on Wednesday, permanently removing them in a bid to tighten supply and boost the value of the remaining tokens.

The token burn was not enough to stop its post-launch decline, as the WLFI price fell another 18% in the 24 hours leading up to 8:31 am UTC Thursday, marking a total decline of 41% since it was launched on Monday, according to CoinMarketCap data.

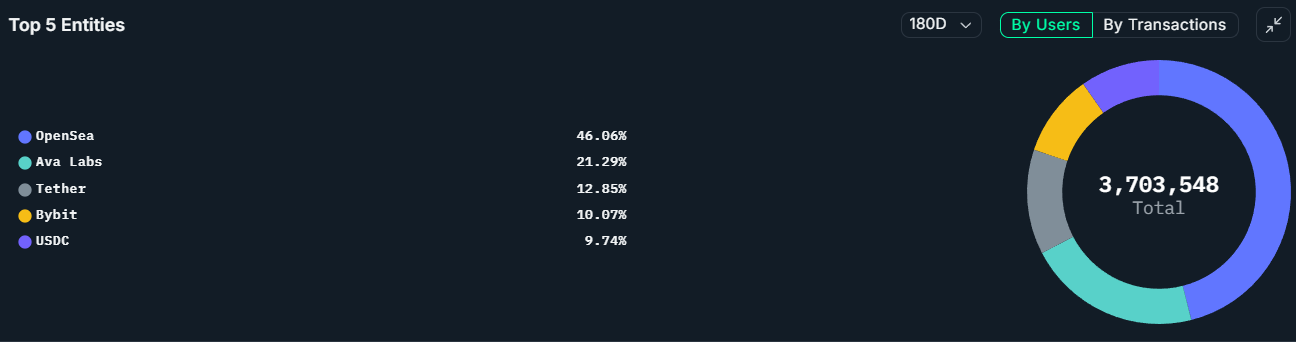

Avalanche activity driven by DEXs, trading bots, whale memecoin speculation

Smart contract blockchain Avalanche recorded a consistent surge in blockchain activity, as analysts pointed to growing decentralized trading activities and returning crypto whale speculation on the next emerging memecoin.

Avalanche’s transaction growth surpassed all other blockchains the past week, increasing 66% to 11.9 million transactions across more than 181,000 active addresses, signaling growing investor mindshare focusing on the blockchain.

The milestone occurred after a “landmark effort” by the US Department of Commerce, which adopted Avalanche, along with nine other public decentralized blockchains, to publish its real gross domestic product (GDP), Cointelegraph reported on Aug. 29.

Despite Avalanche’s growing institutional and governmental adoption, we “cannot at this point attribute this to the US Government adopting Avalanche for its GDP data,” said Nicolai Sondergaard, research analyst at the Nansen crypto intelligence platform.

The network’s increasing blockchain activity was mainly driven by decentralized finance (DeFi) traders, miner extractable value (MEV) trading bots and whales speculating on the next big memecoin launch, the analyst told Cointelegraph, adding:

“The transaction surge is driven by: 60% DeFi protocol activity (Trader Joe, Aave, Benqi), 25% Automated trading bots and MEV, and 10% Whale trading and memecoin speculation […].”

The research analyst said that the additional 5% of activity was attributed to blockchain gaming and non-fungible tokens (NFTs).

DeFi lending rises 72% on institutional interest, RWA collateral adoption

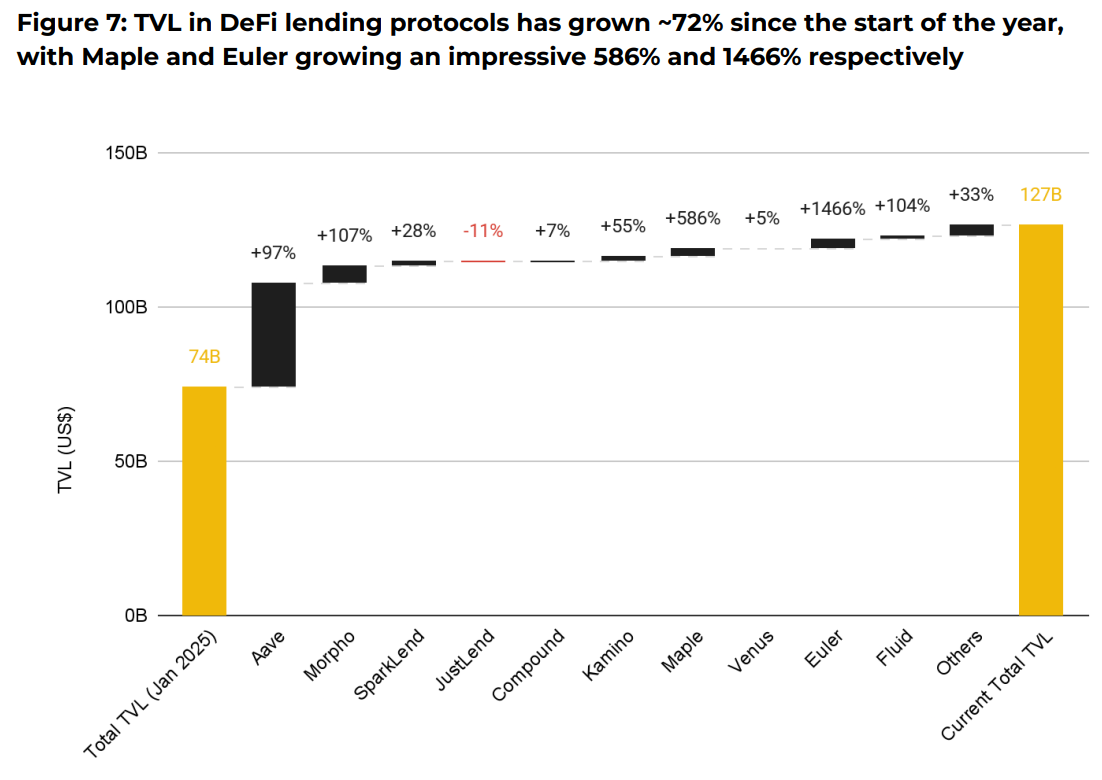

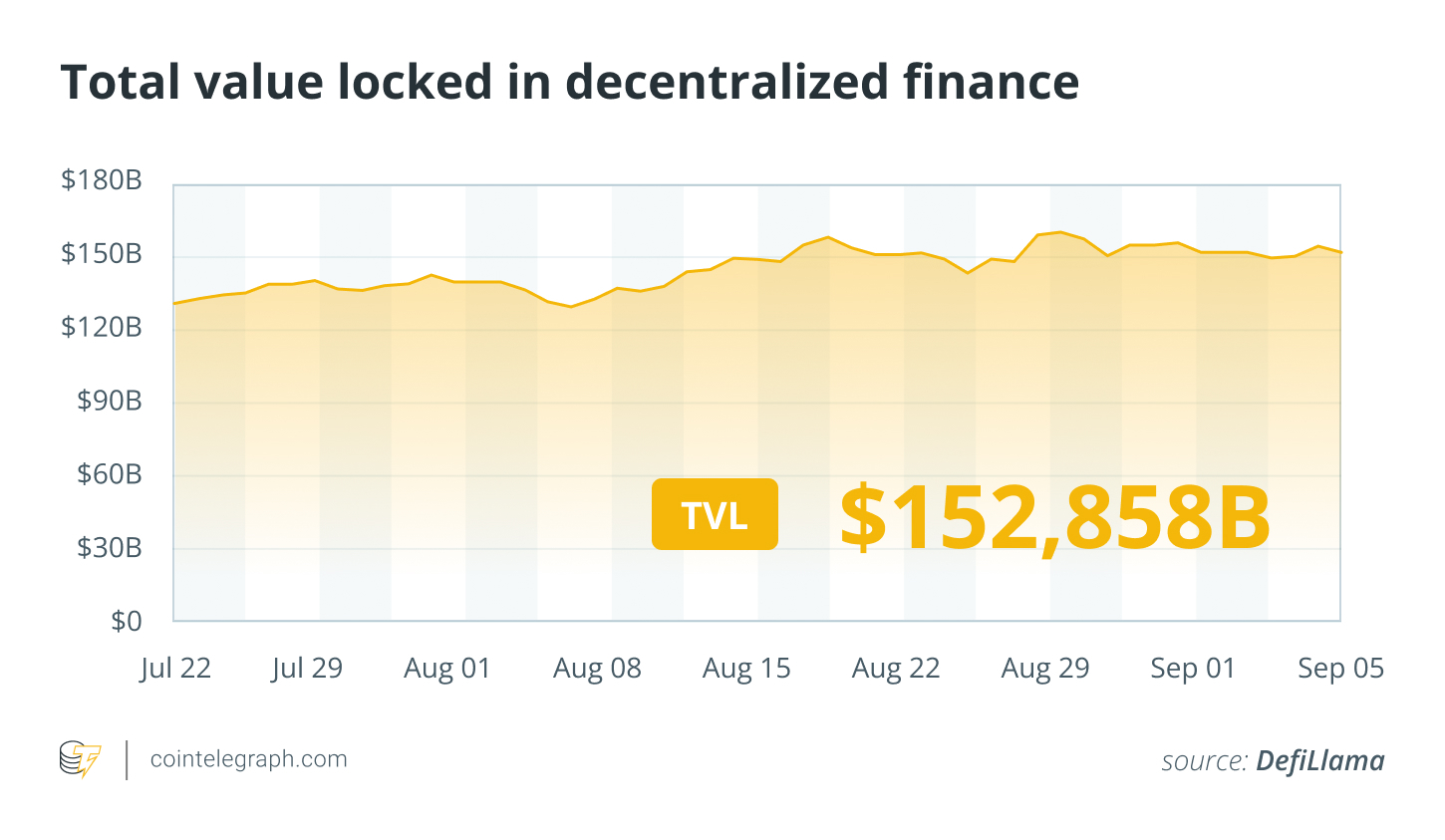

Decentralized lending protocols are surging in total value and set to capitalize on the growing institutional adoption of stablecoins and tokenized assets, according to Binance Research.

Decentralized finance (DeFi) lending protocols are automated systems that facilitate lending and borrowing for investors via smart contracts, eliminating the need for financial intermediaries like banks.

DeFi lending protocols have risen more than 72% year-to-date (YTD), from $53 billion at the beginning of 2025 to over $127 billion in cumulative total value locked (TVL) on Wednesday, according to Binance Research.

This explosive growth is attributed to DeFi lending protocols benefiting from accelerated institutional adoption of stablecoins and tokenized real-world assets (RWAs).

“As stablecoin and tokenized asset adoption accelerates, DeFi lending protocols are increasingly positioned to facilitate institutional participation,” wrote Binance Research in a Wednesday report shared exclusively with Cointelegraph.

A significant portion of this growth was attributed to Maple Finance and Euler, which saw 586% and 1,466% rises, respectively.

“As tokenized assets continue integrating into the mainstream financial system, we expect a new generation of onchain financial products to emerge, enabling more efficient, transparent, and accessible capital markets,” a Binance Research spokesperson told Cointelegraph, adding:

“DeFi lending protocols, in particular, offer a programmable and interoperable framework that makes them well-suited to facilitate greater institutional participation.”

This emerging dynamic is set to enhance DeFi liquidity and the broader crypto ecosystem by “bridging traditional finance and decentralized infrastructure,” added the spokesperson.

Mantle 2.0 to accelerate DeFi-CeFi convergence: Delphi Digital

Mantle 2.0, which aims to become the institutional “liquidity chain” for tokenized real-world assets, is championing a new business model that may accelerate the mutually beneficial convergence between the industry’s centralized and decentralized participants.

Mantle Network was initially launched as an Ethereum layer-2 (L2) scaling solution in 2021 under BitDAO, as the first L2 network launched by a decentralized autonomous organization (DAO).

In July 2023, BitDAO and Mantle Network consolidated into the Mantle brand and the Mantle (MNT) token.

The project is now entering a “new phase in its lifecycle,” dubbed Mantle 2.0. It is marked by Bybit executives being installed as key advisers and a new roadmap targeting the convergence of centralized finance (CeFi) and decentralized finance (DeFi), according to crypto research firm Delphi Digital’s Wednesday report.

Mantle 2.0 may champion a new business model for the cryptocurrency industry, encouraging more DAO-governed projects to merge with major centralized exchanges, combining the advantages of decentralized governance with the deep liquidity and mainstream user base of centralized trading venues.

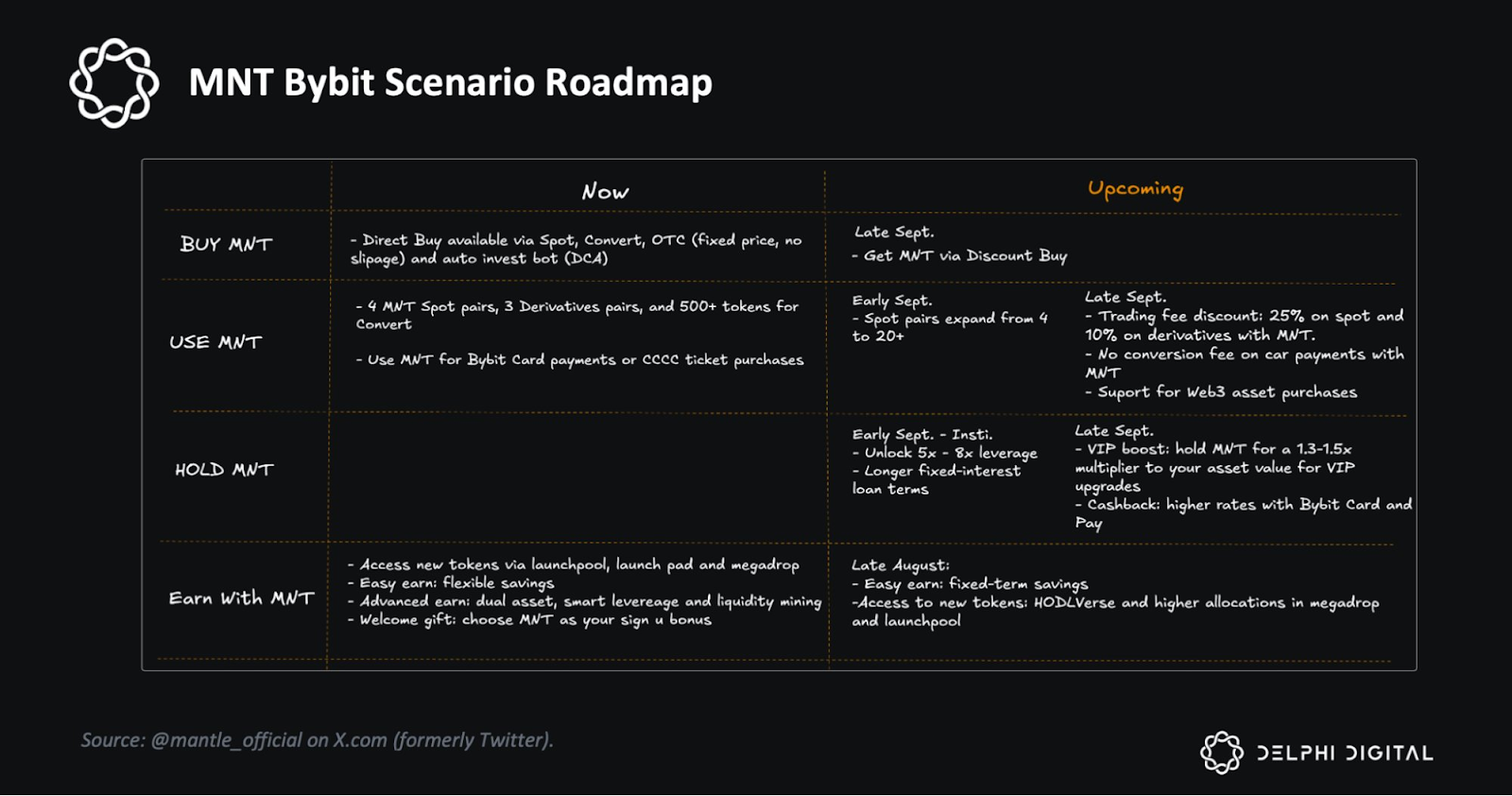

On Aug. 18, the Bybit exchange launched multiple exclusive campaigns and earn products for the MNT token.

On Aug. 29, Bybit exchange and Mantle revealed a combined roadmap, which awarded MNT holders lower slippage buys, more payment options within the Bybit ecosystem and other savings and staking products.

“Mantle is no longer just an L2 but the foundation of Bybit's ecosystem. This isn’t a simple partnership but a play for RWA dominance,” wrote Delphi Digital in a Wednesday X post, adding:

“This update shifts the Mantle token into a Bybit utility asset.”

“This anchors MNT’s value to Bybit's massive daily volume ($3-5B spot, $25B+ derivatives) over simple governance,” wrote the research firm, adding that we are seeing the emergence of a “new competitive landscape that merges TradFi infrastructure with DeFi rails.”

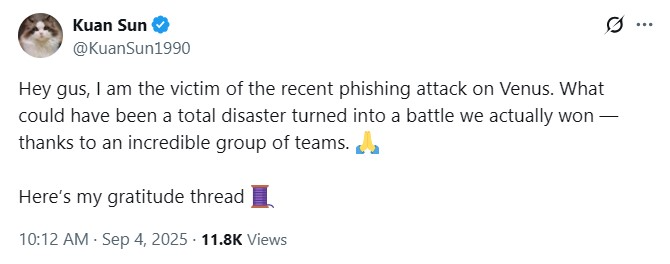

Venus Protocol recovers user’s $13.5 millon stolen in phishing attack

Decentralized finance (DeFi) lending platform Venus Protocol helped a user recover stolen crypto following a phishing attack tied to North Korea’s Lazarus Group.

On Thursday, Venus Protocol announced that it had helped a user recover $13.5 million in crypto after the phishing incident that occurred on Tuesday. At the time, Venus Protocol paused the platform as a precautionary measure and began investigating.

According to Venus, the pause halted further fund movement, while audits confirmed Venus’ smart contracts and front end were uncompromised.

An emergency governance vote allowed the forced liquidation of the attacker’s wallet, enabling stolen tokens to be seized and sent to a recovery address.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The meme token MemeCore (M) rose by over 236% as the week’s biggest winner in the top 100, followed by memecoin launchpad Pump.fun’s (PUMP) token, up over 41% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.