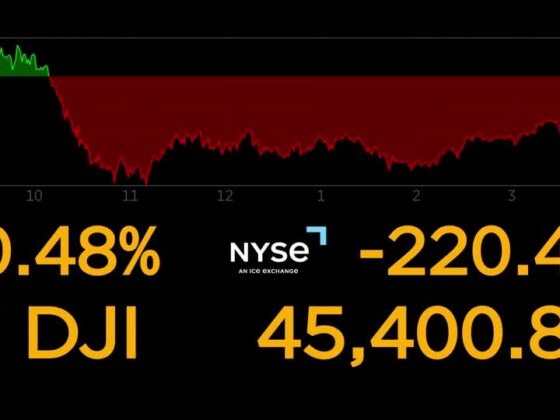

As the U.S. market navigates fluctuating labor data and anticipates potential interest rate cuts, investors are keeping a close eye on the performance of key indices like the S&P 500 and Dow Jones Industrial Average, which have recently shown resilience amidst economic uncertainties. In this dynamic environment, identifying promising stocks often involves looking beyond immediate market leaders to uncover lesser-known companies with strong fundamentals and growth potential—true hidden opportunities in today's investment landscape.

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

Southern Michigan Bancorp |

117.38% |

8.87% |

4.89% |

★★★★★★ |

|

Oakworth Capital |

87.50% |

15.82% |

9.79% |

★★★★★★ |

|

ASA Gold and Precious Metals |

NA |

12.79% |

-0.59% |

★★★★★★ |

|

First Northern Community Bancorp |

NA |

8.05% |

12.27% |

★★★★★★ |

|

Metalpha Technology Holding |

NA |

75.66% |

28.60% |

★★★★★★ |

|

Pure Cycle |

5.02% |

4.35% |

-2.25% |

★★★★★☆ |

|

Linkhome Holdings |

7.03% |

215.05% |

239.56% |

★★★★★☆ |

|

Gulf Island Fabrication |

20.48% |

3.25% |

43.31% |

★★★★★☆ |

|

Elron Ventures |

5.70% |

13.72% |

25.56% |

★★★★☆☆ |

|

Greenfire Resources |

35.48% |

-1.31% |

-25.79% |

★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Simply Wall St Value Rating: ★★★★★★

Overview: AudioCodes Ltd. offers advanced communications software, products, and productivity solutions for the digital workplace globally, with a market cap of $276.51 million.

Operations: AudioCodes generates revenue primarily from its communications equipment segment, which reported $243.25 million. The company has a market cap of $276.51 million.

AudioCodes, a nimble player in the communications sector, is leveraging its debt-free status to strategically focus on AI technology and partnerships like Cisco Webex Calling's Cloud Connect. Trading at 87.9% below its estimated fair value, it presents an intriguing opportunity despite recent challenges such as a significant earnings forecast decline of 87.5% annually over three years. The company repurchased shares worth $18.1 million this year and declared a $0.20 dividend per share for August 2025, indicating confidence in future prospects even as net income fell from $3.77 million to $0.306 million year-over-year for Q2 2025.

Simply Wall St Value Rating: ★★★★★★

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle-market businesses and individuals, with a market cap of $310.90 million.