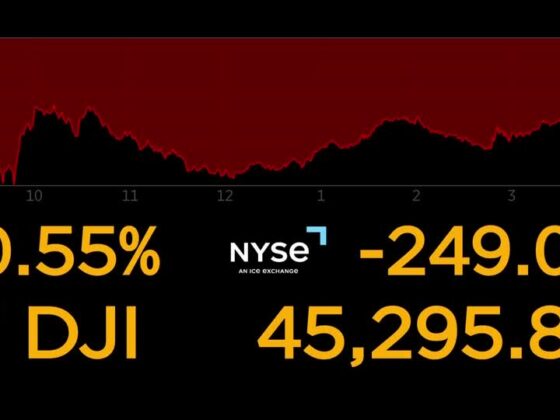

As of late August 2025, the U.S. stock market is experiencing a slight pullback from record highs, with major indices like the S&P 500 and Dow Jones Industrial Average showing minor declines after a strong rally. Despite this dip, there remains an ongoing interest in identifying stocks that may be undervalued amidst fluctuating tech sector performance and economic uncertainties such as inflation rates and potential changes in Federal Reserve policies. In such an environment, finding companies that are priced below their estimated worth can offer investors opportunities to capitalize on potential market corrections or growth prospects.

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Udemy (UDMY) |

$6.86 |

$13.24 |

48.2% |

|

SolarEdge Technologies (SEDG) |

$33.82 |

$67.55 |

49.9% |

|

Phibro Animal Health (PAHC) |

$37.07 |

$70.71 |

47.6% |

|

Peapack-Gladstone Financial (PGC) |

$29.01 |

$56.54 |

48.7% |

|

Northwest Bancshares (NWBI) |

$12.65 |

$24.41 |

48.2% |

|

Lyft (LYFT) |

$16.22 |

$31.03 |

47.7% |

|

Investar Holding (ISTR) |

$23.44 |

$45.84 |

48.9% |

|

Fiverr International (FVRR) |

$23.55 |

$45.46 |

48.2% |

|

Excelerate Energy (EE) |

$24.42 |

$46.63 |

47.6% |

|

Corsair Gaming (CRSR) |

$8.93 |

$17.80 |

49.8% |

We're going to check out a few of the best picks from our screener tool.

Overview: Vertex, Inc. offers enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries globally and has a market cap of approximately $4.12 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $710.51 million.

Estimated Discount To Fair Value: 31.2%

Vertex, Inc. is trading at US$25.82, significantly below its estimated fair value of US$37.51, suggesting it may be undervalued based on cash flows. Despite a recent net loss and lowered full-year earnings guidance due to extended sales cycles, Vertex's revenue is still forecast to grow annually by 12.5%, outpacing the broader U.S. market growth rate of 9.3%. The company's strategic enhancements in tax automation and integration with major platforms like Oracle could drive future profitability improvements.

Overview: Crocs, Inc. and its subsidiaries design, develop, manufacture, market, distribute, and sell casual lifestyle footwear and accessories under the Crocs and HEYDUDE brands for men, women, and children both in the United States and internationally with a market cap of approximately $4.76 billion.